Quick look at the week ahead

US news is dominating the weekend headlines.

The surprising jobs report (the US economy added 263k jobs in November; the market expected to lose 200k) and data suggesting that hourly pay is up 5.1% y/y signals that the US economy is not cooling off as the US Federal Reserve hoped it would after its aggressive interest rate increases.

Analysts there are expecting the US Federal Reserve to raise rates by 50 basis points (bp) to 4.25% in the next rate meeting in two weeks, with expectations that the Fed will need to raise rates by another 75 bp or so during the first half of 2023.

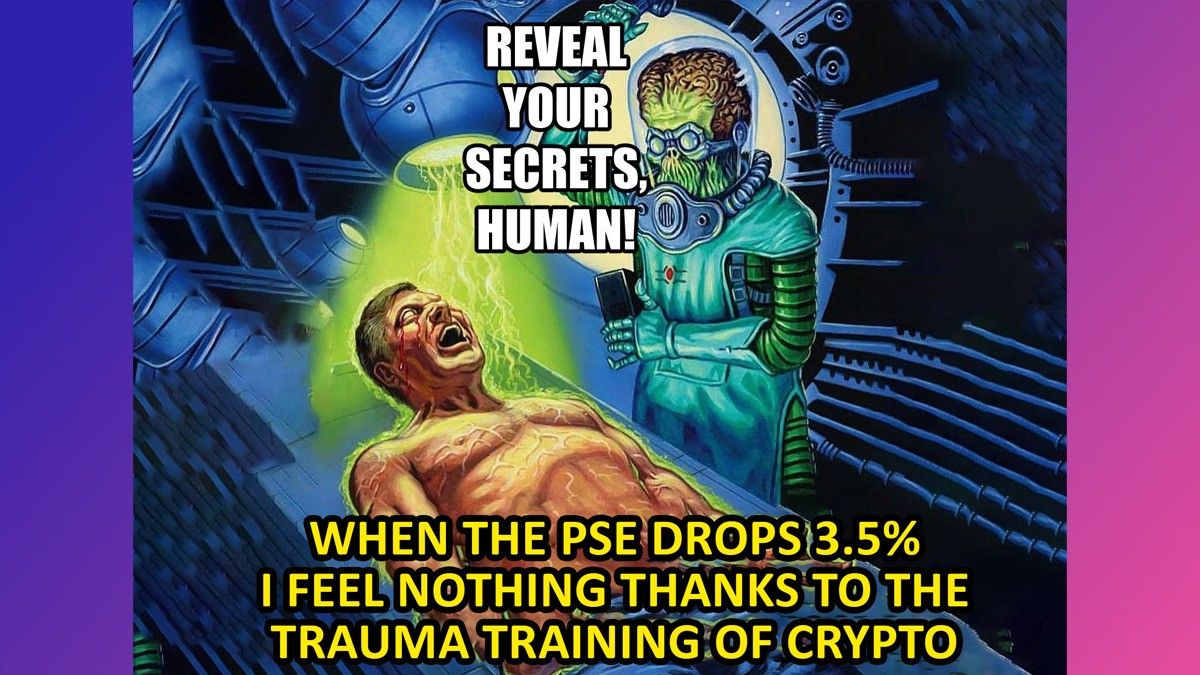

On the PSE, we’ve got a moderately interesting week ahead, starting with Raslag [ASLAG 1.7 1.1%] having 75% of its shares come out of mandatory 180-day lockup this morning.

Given the ownership group’s voracious appetite for buying its own stock since the IPO, and that the IPO is currently still under water, I don’t anticipate ASLAG holders will have any additional selling pressure, but it’s always worth a look.

This morning will also mark the end of the (very quiet) PREIT IPO offer period. On Friday we have the Citicore Energy REIT [CREIT 2.3 0.4%] record date for its Q3 dividend, which will payout on January 5.

MB BOTTOM-LINE

I’m curious to hear if any potential PREIT buyers have been turned away by brokers!

I’ve honestly heard next to nothing about this IPO from anyone, so I don’t have a very good feel (one way or the other) as to whether or not the newest Villar IPO will achieve “oversubscribed” status.

When allocations start being made, I’ll put out a poll and try to fill in some of these blanks, and as usual, I’ll put the data together and put it out for everyone to see before PREIT’s IPO on December 15.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest