AgriNurture’s Q3 net income implodes (on paper)

AgriNurture [ANI 6.7 unch] [link] Q3 profit was down 98% y/y to just P31 million (Q3/21 was P1.54 billion). 9M profit down 87% to P88 million. ANI is an agri-business, owned by Antonio Tiu, that exports fresh produce and processed food such as coconut, mango, banana, pineapple, and plant based meat to Hong Kong and China.

The company also distributes produce and other products locally. ANI’s trade with Hong Kong and China was significantly hampered by the lockdown and mobility restrictions in China during Q1 due to the “challenge in the logistics in China”, but the main issue is the massive one-off gain that ANI recognized in Q3/21 on fair market revaluation of its properties.

MB BOTTOM-LINE

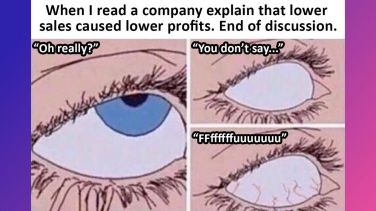

Let’s just completely ignore the whole property revaluation thing that injected a metric buttload of paper gains into just a single quarter yesteryear; ANI’s export business with China is down 22%, and its domestic business is down even further (-57%). It would be great for a trading company to provide more context on what happened, especially when the results produce ugly headline numbers and ugly fundamental business numbers.

Just saying that logistics are “challenging” in China doesn’t really say much to existing shareholders and potential shareholders about how the ANI management team hopes to weather the complex COVID situation in China, and insulate itself against future quarters that could be impacted by similar problems. (Don’t look now, but COVID concerns are rising once again in China.) Has ANI sought to diversify its client base to lessen its jurisdictional risk? We don’t know.

The Management Discussion section is basically a page long (with suspicious double-spacing between paragraphs), and if you really sift out the facts (this is what happened) from the analysis (why it happened and what we’re going to do about it), you’re left with probably one or two very basic sentences.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest