GCash x PSE initiative will test non-GCash infrastructure

I received several private notes from Barkadans about the GCash/PSE tie-up story that provided interesting insight into the potential commercial and technical aspects of the deal.

One note agreed in principle with the dissenting opinion of Joseph Roxas, president of Eagle Equities Inc., that GCash’s estimate of being able to provide the PSE with up to 9 million traders within 5 years was likely inaccurate.

The reader said that the total addressable market is actually closer to about 5% of GCash’s 67 million users, so roughly about 3.35 million, once the userbase is filtered for sufficient disposable income, interest in investing, and willingness to try something new.

A few analysts mentioned that they question the discoverability of the GCash-to-PSE link, based on how cluttered and “everything” GCash’s user interface is already.

This was also a common refrain from non-analyst GCash users that wrote in to give their views.

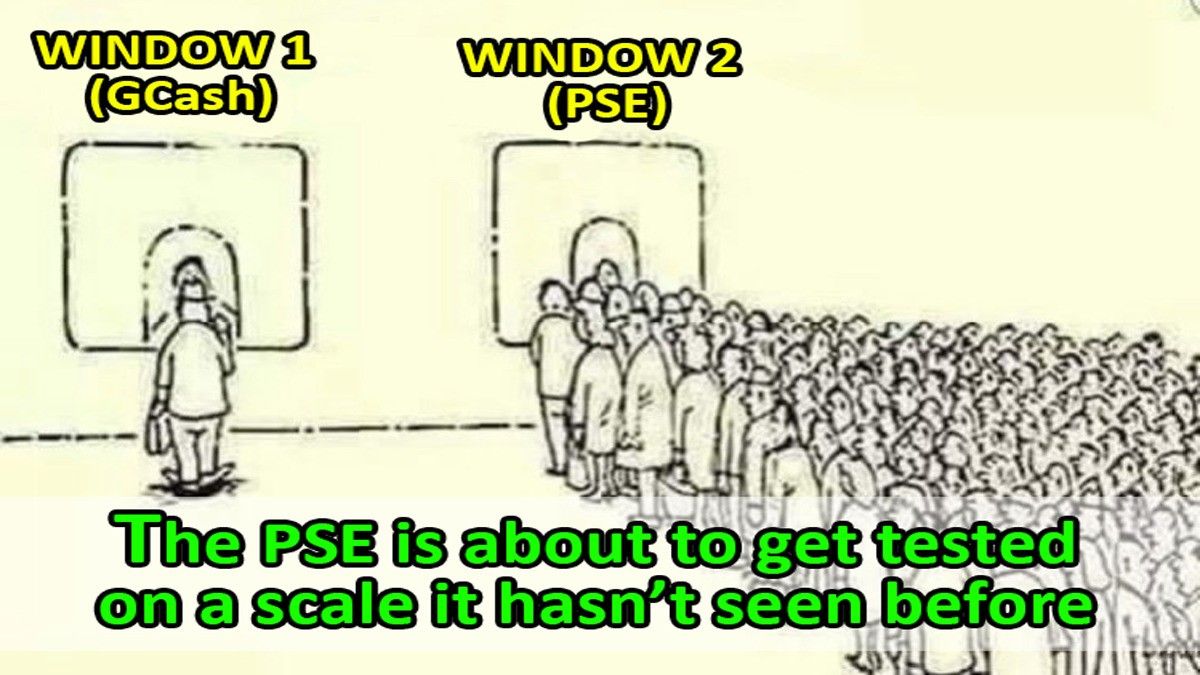

Yet another reader with technical experience wrote in to say that GCash’s infrastructure is battle-tested to handle tens of thousands of users sending large batches of small transactions in a short period of time, but “hoped” that the PSE and AB Capital components of the system were similarly tested at such a scale.

This reader said that any step in the process belonging to the PSE or AB Capital that remains manual, that isn’t automated, will result in “large” and “painful” bottlenecks.

MB BOTTOM-LINE

I want everyone to remember that this is all just speculation and opinion at this point.

Until the parties provide more information about the nuts and bolts of the system that will support this massive change, we’re just not going to have a solid idea of what to expect on Day 1 when the “Invest” option appears in the GCash app.

If even the conservative estimates are true, that 3.35 million GCash users will become PSE investors over 5 years, that’s still 670,000 new investors coming online through AB Capital’s system each year, which is around 30% larger than the number of accounts in COL Financial’s [COL 3.47 0.29%] entire system.

That’s nearly half of all PSE accounts, added to the PSE ecosystem, through one broker link, each year, every year. I’m not saying this to be cynical. I think the tie-up will be transformative for the PSE in terms of market inclusion.

But I think that when you deal at this kind of scale, all sorts of little things that didn’t matter when they were happening just 10 or 20 times per day start to matter when they’re now happening 10 to 20 times per second.

And that kind of readiness is hard to develop, even with advanced testing.

I’m confident that GCash is ready, but are the PSE and AB Capital?

I’ve reached out to both to learn more, and I hope to be able to relay what I find out to you all very soon.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest