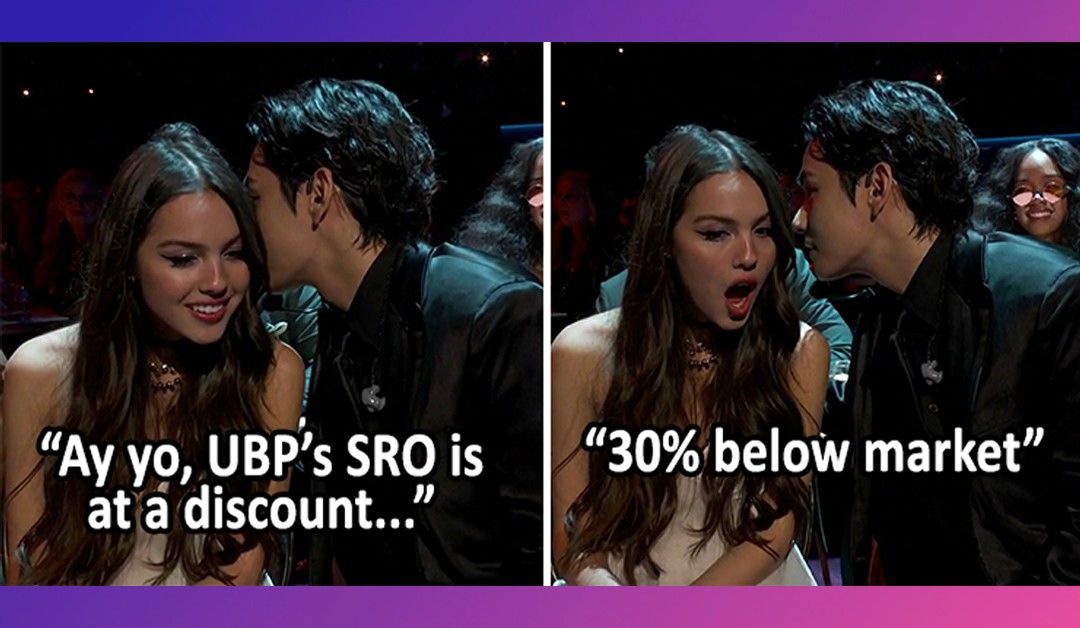

UnionBank sets SRO price at 30% discount to market

UnionBank [UBP 101.50 ?2.22%] [link] disclosed yesterday that it would sell 617,188,705 shares at P64.81/share, with an entitlement ratio of 1:2.4707, to raise P40 billion. UBP is the banking arm of the Aboitiz Family; the proceeds of this equity raise will be applied to fund the bank’s massive purchase of the Citigroup PH assets. The pricing is at the lower-middle of the range (P64.55 to P73.78) that UBP provided earlier.

The Ex-Date is April 6 (today, as of this writing), so only those that already hold the shares before today will be able to participate in the SRO.

Any shares purchased today, and from now on, will be “ex” (without) the right to participate in the SRO.

MB BOTTOM-LINE

I almost nailed my prediction of the entitlement ratio, but I shouldn’t get too much credit since UBP signaled the maximum value of the raise and the relatively tight price range of the offering.

A 1:2.4707 ratio means that existing shareholders have the option (but not the obligation) to purchase 1 SRO share for ?64.81/share, for every 2.4707 UBP shares that they owned on the day before the Ex-Date.

This will be a dilutive transaction for existing shareholders that don’t participate, but not incredibly so.

Based off of UBP’s closing price yesterday of P101.50, I’d expect the “new” price of UBP with all of the cheaper SRO shares included would be something close to P90.92/share.

This is a pretty nice arbitrage opportunity for anyone that takes advantage of it, as the difference between the SRO price and the market price of UBP post-listing to be well worth the trouble of making the purchase.

Those eligible to purchase SRO shares will be able to make their purchase during the offer period, which will run from April 25 through May 6.

Anyone that wants to purchase more than their entitlement should contact their broker, as it’s possible to purchase additional shares in the second round of the SRO from the leftover allocations that did not get taken-up in the first round.

You need to know how many shares you want to buy ahead of time, though, and pay for those shares ahead of time as well.

I’ve never attempted to go over my allocation in an SRO before, so anyone interested in doing this should definitely contact their broker for more information.

The procedure on how to do this could also vary from broker to broker.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest