DMCI Holdings FY21 “core” net income surges 164% y/y

FY21 “core” net income of P17.4 billion, a record for DMCI Holdings [DMC 9.23 2.84%], up 164% from FY20 profit of P6.6 billion.

DMC said that it attributes the “spectacular growth” to higher commodity prices, higher electricity rates, and “construction accomplishments”.

With one-off gains (2021 CREATE Law tax benefits) and losses (2020 sales cancellations) included, DMC actually posted a 214% increase in total net income.

DMC said that it believes we are “at the start of a commodities supercycle”, where “supercycle” is generally considered a sustained period of increasing commodities demand, usually lasting up to a decade or more.

DMC has exposure to coal through Semirara Mining and Power [SCC 33.65 1.32%] (up 360%), nickel through DMCI Mining (up 150%), housing and real estate through DMCI Homes (up 127%), bulk electricity through DMCI Power (up 8%), and water through Maynilad (flat).

MB BOTTOM-LINE

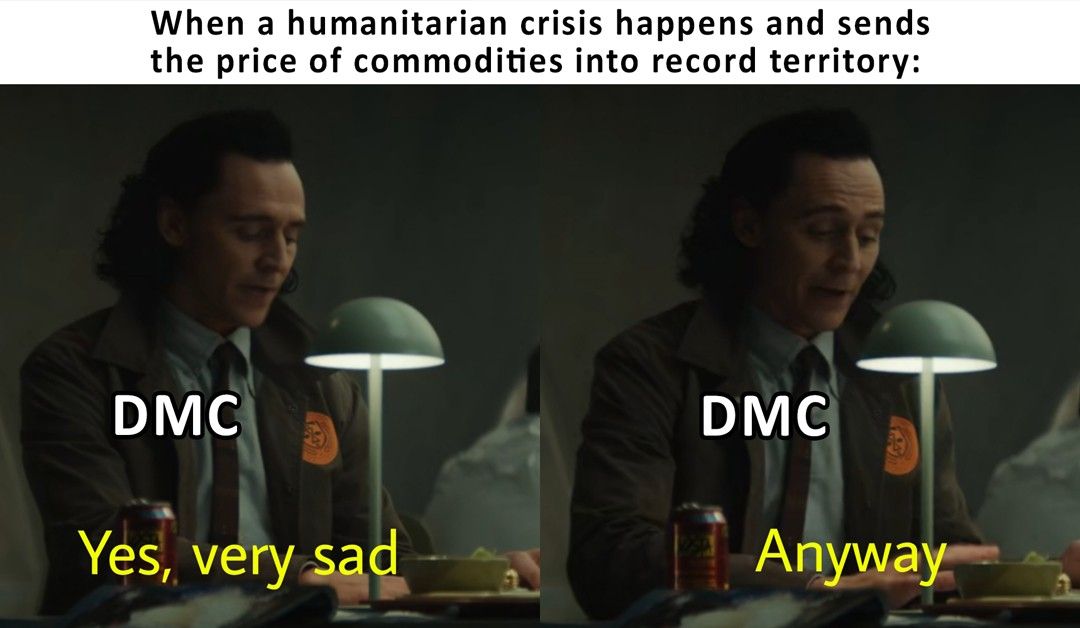

This was only the teaser, so we’ll have to wait for the full report to really dig in, but it’s hard to argue with DMC’s positioning in the commodities market considering what has been happening.

I mean, the worst that you can say about DMC at this point is maybe something like, “well, uh, maybe the shocking, record-high commodity prices won’t last like a super long time?”, but that’s not a very satisfying critique.

I think as a shareholder I’d want the DMC team and the Consunji Family to maximize this moment in the sun, both for the immediate future and the long-term, by keeping productivity high (mines open, plants operating) and making whatever investments need to be made to keep the party going for the rest of this supercycle.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest