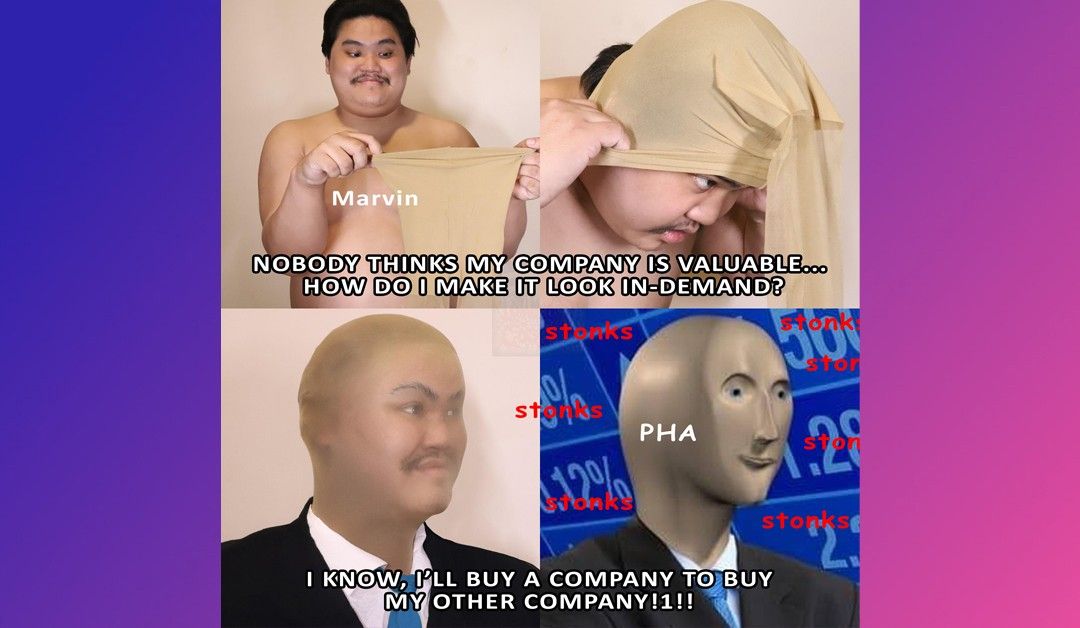

PHA to buy 33% of SquidPay for P561 million

Premiere Horizon Alliance [PHA 0.62 susp], owned by Marvin Dela Cruz and his Investor Group (Marvin & Friends), voted to pay P561 million to acquire 33% of SquidPay, which is a company that is also owned by Marvin & Friends, for P561 million. Not much is new here, since the PHA board already voted to approve the acquisition of “at least 33% of SquidPay” (looks like it was more like “exactly 33%” in the end); the biggest update comes in the amount that Marvin & Friends decided to pay themselves for SquidPay’s shares.

PHA’s disclosure was oddly preoccupied with SquidPay’s valuation, noting that PHA’s acquisition gives SquidPay a P1.7 billion “pre-money” valuation, and that this valuation is “within the range of values” that KPMG provided to SquidPay in a recent valuation report. PHA will only be required to provide comprehensive financial reporting on SquidPay if it owns more than 50% of SquidPay’s stock, so this minority stake is not sufficient to force/allow PHA to integrate SquidPay’s financials into its quarterly and annual earnings reports. PHA was suspended by the PSE under the “Substantial Acquisitions” rule, and will remain suspended until it provides comprehensive disclosure of the transaction.

MB BOTTOM-LINE

The disclosure said that PHA will be buying 264 million “existing” common shares from Marvin & Friends directly, so based on that description of the transaction, the P561 million paid for those shares would go to Marvin & Friends and not to SquidPay. I’m not sure, then, why the disclosure specified that SquidPay would have a “pre-money” valuation of P1.7 billion, considering PHA’s investment doesn’t inject any money into the SquidPay company and only enriches Marvin & Friends.

For a little background, to show the difference between “pre-money” and “post-money” valuations and why it is kind of weird that they referred to the valuation as “pre-money” in this context, allow me a quick example. Say that PHA and SquidPay agree, based on an external valuation, that the company (without any investment) is worth P1.7 billion. If PHA decides to pay P561 million to SquidPay for primary (new) shares of SquidPay, then it’s really important to indicate whether the P1.7 billion valuation is what the company is worth BEFORE the P561 million is given to the company, or after. If the P1.7 billion is a “pre-money” valuation, and PHA then gives SquidPay P561 million, then the company is then worth P2.26 billion “post-money”; if the P1.7 billion is the “post-money” valuation, and PHA gave SquidPay P561 million as part of the deal, then we could infer the pre-money valuation of P1.14 billion. Except that here, PHA doesn’t give any money to SquidPay at all. The only transfer of money is from PHA to Marvin & Friends. So, while paying P561 million for 33% of the company gives SquidPay an implied company-wide valuation of P1.68 billion, it doesn’t make any sense to refer to this valuation as “pre-money” because... there’s no money.

I mean, there’s P561 million for Marvin & Friends, but SquidPay itself gets nothing. Unless PHA and SquidPay are reporting this transaction within the greater context of another yet-to-be-disclosed transaction with an investor that’s planning to put money into SquidPay directly. I don’t get why the disclosure would refer to SquidPay’s valuation this way. Unless it’s just because they wanted it to sound cooler, because, objectively, it does. It just doesn’t make sense.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest