Synergy Grid & Development Phils files for P28.9-B follow-on offering

Synergy Grid & Development Phils [SGP 395.80] has applied with the SEC to sell 1,053,500,000 common shares (plus 101,000,000 over-allotment shares) at between P15 and P25 per share, to raise up to P28.86 billion. SGP said that it would use the proceeds to purchase additional primary stock from its subsidiary National Grid Corporation of the Philippines (NGCP), so that NGCP could use the money to fund its capex requirements. SGP acquired a 60% indirect interest in NGCP when it entered into a share-swap deal with Henry Sy Jr’s OneTaipan Holdings Inc. and Robert Coyiuto Jr.’s Pacifica21, which resulted in the shareholders of OneTaipan and Pacifica21 acquiring SGP shares, and SGP acquiring shares in OneTaipan and PacifiCa21 (which both own parts of NGCP).

MB BOTTOM-LINE

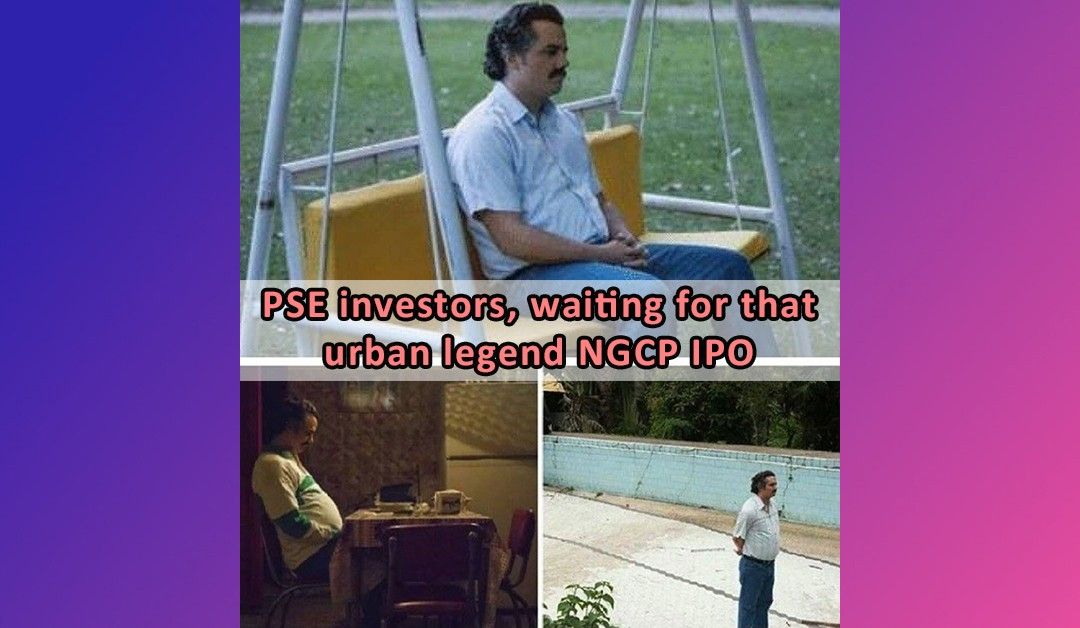

The market is still waiting for its opportunity to own a direct slice of the hugely-profitable NGCP, which has thrown off P187.8 billion in dividends in just 10 years to Henry Sy Jr, Robert Coyiuto Jr., and State Grid International Development Ltd. of China. The terms of NGCP’s congressional franchise required it to sell at least 20% of its shares to the public by 2019, and the Energy Regulation Commission (ERC) directed NGCP to conduct the sale by September 10 of this year.

Allowing the public to buy a minority stake in an entity that owns a majority stake in NGCP is not the same as allowing the public to buy a minority stake in NGCP directly, as the layers of corporate control could be used to obscure the dividends from the public. It’s possible that SGP’s owners have a good faith intention to share these profits with the public in the spirit of the agreement that forms the basis of NGCP’s franchise, but the ownership group’s decade-long delay and continued breach of the IPO requirement don’t give me a lot of confidence in that.

NGCP’s ownership group has, to this point, been very uncommunicative with its plans, but perhaps the group was only waiting for the moving pieces to fall into place for this FOO to better explain how it intends to meet the requirements of its franchise. The clock is ticking.

--

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest