The bloodbath continues for CEB

Cebu Pacific [CEB 45.30 0.44%]'s Q2/21 net loss of P6.5 billion, up 19% from Q2/20 net loss of P7.9 billion, and up 11% from Q1/21 net loss of P7.3 billion. With reference to CEB’s performance in the first half of 2021 as compared to the first half of 2020, passenger revenues were down 82% and ancillary revenues were down 71%, while cargo revenues were actually up 27% thanks to the uptick in chartered cargo flights. Operating expenses were down by 23%, due to reduced operations (less fuel, less payroll), but still amounted to P18.6 billion for the period (which is basically the problem).

MB BOTTOM-LINE

Yikes. Like most of its international airline contemporaries, CEB lost (again) a very significant amount of money in Q2. It was able to trim those losses somewhat as compared to Q1 and as compared to the initial lockdown, but CEB (and the industry as a whole) will continue to bleed freely until the international travel engine is restarted in a significant way. While CEB raised over P12 billion through the sale of those convertible preferred shares, and an additional P12 billion through selling convertible bonds to IFC and an American private equity firm, that only buys one year of losses at CEB’s current burn rate.

At this rate, the proceeds from both sales will be exhausted by CEB’s losses before the end of Q2 in 2022. Considering that we’re back in lockdown, our vaccination rate is barely in double-digits, and the industry’s traditionally slow recovery from passenger volume losses due to contagious diseases, it just doesn’t seem likely that CEB will be in a better place 6 months from now.

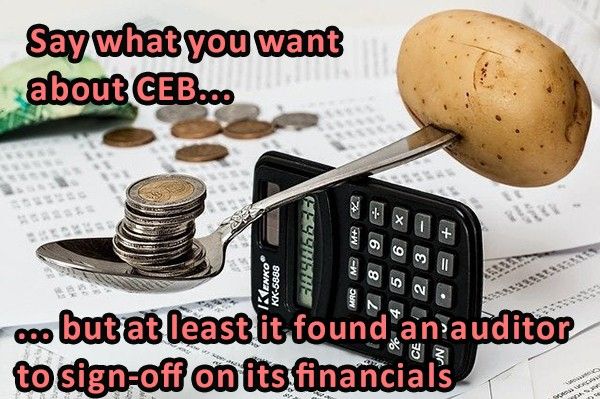

I wish we had the benefit of comparing CEB’s experience with its main rival, Philippine Airlines [PAL 6.05 0.00%], but... that stock has been untradable for two months since it failed (repeatedly) to submit audited financial statements for Q1. CEB’s stock is down 50% relative to its pre-COVID level and is down almost 20% from its June peak price of P54/share. There’s a lot of blood on the runway, but no reason to think that CEB’s going to stop adding to the carnage any time soon.

--

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

- Latest