Asian Financial Forum ushers cooperation between Hong Kong investors and Philippine startups, businesses

HONG KONG — Just in time for the Chinese New Year, Hong Kong’s Asian Financial Forum (AFF) concluded with a positive outlook last January 12, heralding more business opportunities and investments for Southeast Asian markets, the Philippines included.

“Southeast Asia and Asia is a key focus that we are showcasing in our conferences,” Hong Kong Trade Development Council (HKTDC) Executive Director Patrick Lau said in a press conference at the sidelines of the two-day conference.

HKTDC and the Hong Kong government organize AFF annually. This year, it returned to a physical venue, in its home, the Hong Kong Convention and Exhibition Center, and gathered over 7,000 attendees, online and on ground.

It also featured 160 prominent speakers—from global business leaders to policymakers, financial and wealth management experts, entrepreneurs, tech giants and economists—who shared their views during plenary sessions, policy dialogues and panel sessions.

Finance Secretary Benjamin Diokno was one of them and spoke during a plenary session on the global economy, along with his counterparts from Hong Kong and other countries, as well as and other high-ranking officials from global banks.

According to Lau, AFF is also a great platform for Hong Kong investors to meet and partner with new potential projects and businesses.

“Asian Financial Forum is not just a forum for speakers to come and tell us new insights and new ideas, but even more importantly or at least equally important, is for the participants to also bring their projects and ideas to exchange during the forum,” Lau shared.

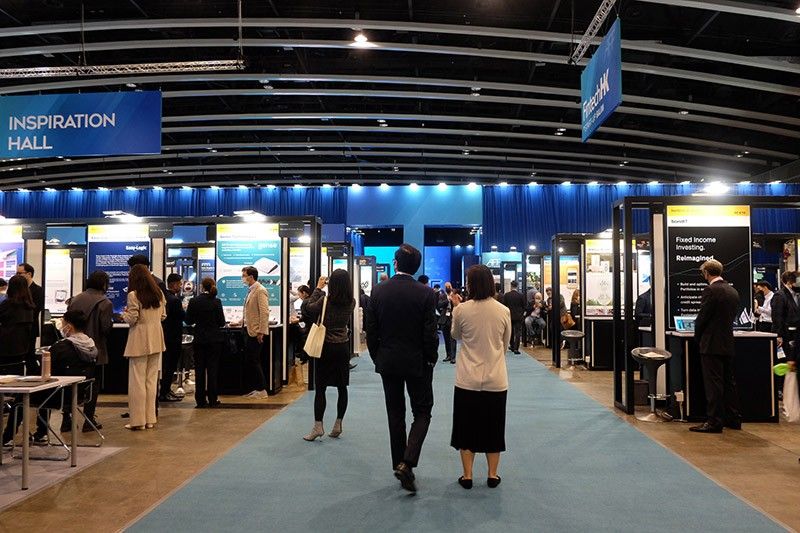

The forum, on its 16th edition, once staged an exhibition zone where over 120 startups and companies showcased their innovations and business opportunities. Last of its component was the Deal Flow Matchmaking Session, which successfully matched over 600 businesses this year.

These networking and deal-making events are the perfect venues for Philippine entrepreneurs and startups to meet foreign investors and partners. In fact, Filipinos have always been favored in the past AFFs.

“At AFF in particular, I know that Filipino projects are being put into our investment database where we are finding business partners and investors for them,” Lau told Philstar.com during a Q&A.

“It’s also both ways because Filipino participants want to showcase their projects and meet potential other investors. But in fact, investors they are very much interested in Southeast Asia market. They in fact want to meet Filipinos project owners, business partners as well. That is why our business-matching, our connection is so easy.”

Attending the two-day AFF, Jove Tapiador, president of Rural Bank of Silay City Inc. and co-founder of Fintech Philippines Association, agreed to this.

“There can be potential collaborations similar to that of Singapore and Philippines, same with Hong Kong and Philippines and we can learn from each other. Going around, I’ve talked to them and they are interested in the Southeast Asian market. Philippines is interesting because it’s a large market, English speaking and near Hong Kong,” he said in an exclusive interview with Philstar.com.

For fintech startups in particular, Tapiador encouraged them to diversify capital sourcing from Hong Kong and Chinese investors alike.

“What we would encourage is to create a strong startup ecosystem in the Philippines. And it should be diverse, even capital sourcing should be diverse. When you say that Hong Kong investors are interested in the country, they should be welcomed,” he said.

He knew for certain that Chinese entrepreneurs are already investing in Philippine companies, even citing the likes of tech giants Alibaba and Tencent.

“This kind of economic relationship should be encouraged because it is symbiotic. There’s capital to be deployed in emerging economies such as the Philippines [while] there’s market opportunity outside the Philippines especially in Hong Kong and China,” Tapiador noted.

During his time at the forum, he had met and talked with fintech leaders and fintech startup founders, and observed that Hong Kong’s homegrown startups have a strong technical acumen in AI, machine-learning and payment systems. On non-fintech side, startups on healthcare are also emerging.

With Hong Kong’s relaxation of borders, for foreign countries and most recently, for China, Lau is confident that more individuals and organizations would explore new businesses at the international finance center.

“People anticipate this year still to be a difficult economy. The opportunities are clearly in Asia. . . People would want to come back to Hong Kong to meet potential investors, buyers and business partners from the Mainland China and from rest of Asia in particular, and then from the rest of the world,” Lau said.

- Latest