SM Prime: 30 years of growth and good

MANILA, Philippines — In a span of 30 years, SM Prime Holdings (PSE: SMPH) has become a dominant force in the Philippine property sector, driven by its iconic SM malls and the market-leading developments of SM Development Corporation (SMDC).

Tracing its origins back to a small shoe store founded by Henry Sy Sr. in downtown Manila, SMPH has grown into one of the most valuable firms in the country and a leading integrated property developer in Southeast Asia.

Beyond its impressive scale, SM Prime stands as a bellwether for the Philippines—its progression following the same arc as the nation’s economic and social advancement.

Turning headwinds into headway

In the 1990s, the Philippines posted an average real GDP growth rate of 2.8% per year, owing to political instability, natural disasters and the Asian Financial Crisis.

During the same period, average lending interest rate was over 19%, reflecting the broader economic challenges faced by the country.

Against this backdrop, the SM Group founded and listed SMPH in July 1994 to organize and expand its chain of shopping malls. At the time, it only had four in its portfolio: SM North EDSA, SM City Sta. Mesa, SM Megamall and SM City Cebu.

After raising nearly P6 billion from the capital market, SM Prime aggressively expanded its mall network, cementing its position as the country’s largest mall operator and securing a spot in the Philippine Stock Exchange Index (PSEi) since October 1994.

Reorganizing for growth

Entering its second decade as a listed company, SM Prime led a transformative consolidation that altered the course of its growth trajectory.

Through a series of well-executed transactions, the SM Group unified its sprawling real estate interests under SM Prime, effectively turning the mall operator into a property conglomerate.

The entire process, from announcement to final regulatory approval, took less than five months. Its speed and ingenuity earned SM Prime the "Most Innovative Deal" award from the financial publication Alpha Southeast Asia.

Post-consolidation, SMPH’s market capitalization surged 133% to P950 billion by the close of 2023, up from approximately P408 billion in 2013.

Setting records

Since its reorganization, SM Prime has consistently pushed boundaries in value generation.

In 2017, the property titan made history as the first company on the PSE to reach a P1 trillion market capitalization, closing at P1.01 trillion on June 9.

SM Prime also crossed key milestones in revenue recognition, surpassing the P104 billion mark in 2018 and recording P128 billion in 2023, its highest to date.

Over the last 10 years, its annual net income has expanded by 146% from P16 billion to a record high of P40 billion in 2023, the highest among its listed peers.

The company is poised to break another profit record in 2024, with first-half earnings surging 13% to P22 billion, up from P19 billion a year earlier.

Beyond profitability

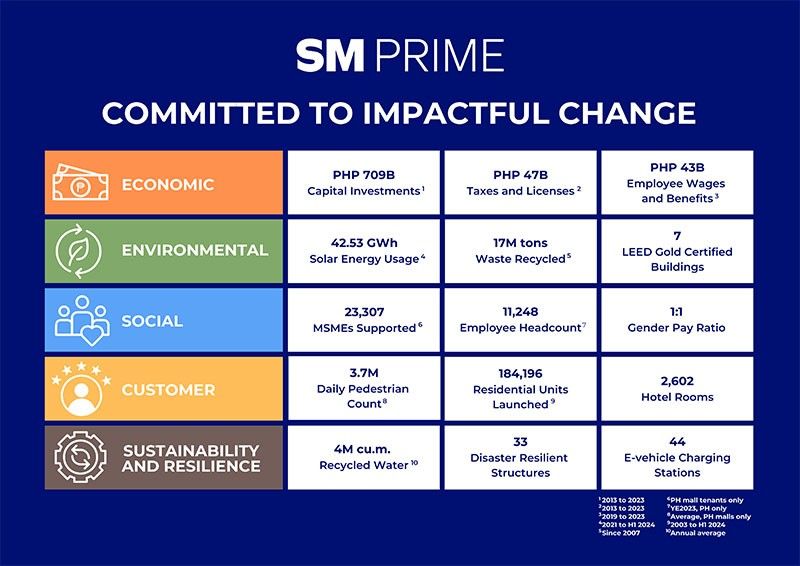

SM Prime's growth transcends financial metrics and shareholder returns. It has been a catalyst for national progress—creating jobs, contributing tax revenues, building communities and advancing sustainable urbanization across the Philippines.

“As SM Prime marks its 30th anniversary, our focus remains on innovation and sustainability. With the strong foundation we’ve built, we believe our best projects are still to come,” said SM Prime President Jeffrey Lim.

“We have integrated project developments in our five-year pipeline, which we expect will drive the company to a new level of growth,” he added.

Editor’s Note: This press release from SM is published by the Advertising Content Team that is independent from our Editorial Newsroom.

- Latest