Banks tag mandated loans, dirty money, infotech risks among major challenges

MANILA, Philippines — Philippines banks have tagged mandatory credits, anti-money laundering, and information technology (IT) risk management as the most challenging areas in terms of compliance.

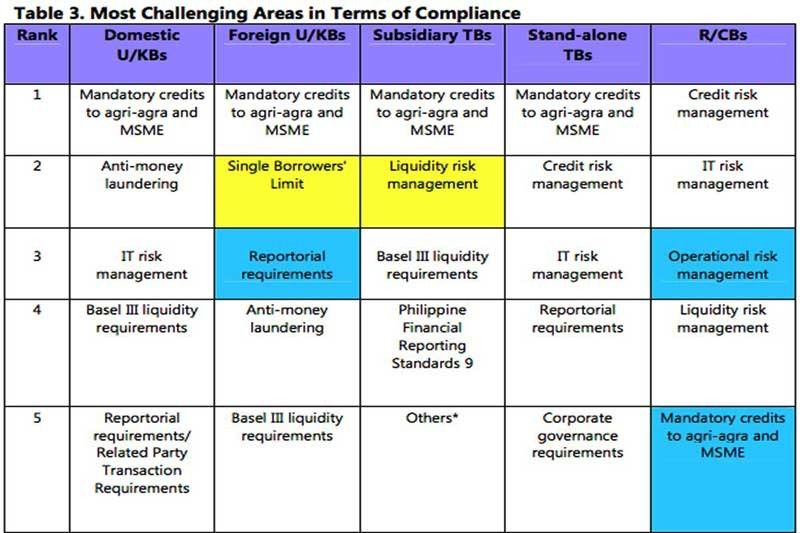

Based on the Banking Sector Outlook Survey (BSOS) for the second semester 2018, bank presidents and chief executive officers enumerated five areas that they find challenging in terms of compliance.

Survey results showed big and mid-sized banks ranked compliance with the mandatory credits to Agri-agra under Republic Act 10000 and Micro, Small and Medium Enterprises (MSME) under RA 6977, otherwise known as the Magna Carta for SMEs, at the top of the list.

Results showed 77.1 percent of the respondents still find difficulty in complying with the Agri-Agra Law as the banking system’s 13.1 percent compliance ratio for other agricultural credit was slightly below the required 15 percent, while compliance ratio for agrarian reform credit stood at 1.2 percent versus the required 10 percent.

Moreover, 41 percent of respondents reveal that compliance with the regulations on anti-money laundering remains a challenge. In the same manner, most of the respondents also view that IT risk management, credit risk management and reportorial requirements as challenging areas in terms of compliance with the BSP’s existing rules and regulations.

The BSP said all the banking group respondents mentioned that compliance with mandatory credits to agri-agra at 25 percent and MSMEs at 10 percent as the most challenging area in terms of compliance, except for rural and commercial banks.

“Notably, there is a shift in the ranking of the most challenging areas by some banking groups. For instance, liquidity risk management ranks number 2 for the subsidiary thrift banks in the second semester, from number 5 in the previous semester,” it added.

Meanwhile, bank presidents also identified the top five risks to their operations including institutional risk, financial market risk, macroeconomic risk and technology risk.

Big and mid-sized banks also tagged global and domestic geopolitical risk as risk to their operation as well as cybersecurity threat and regulatory or compliance risk as the main risk under institutional risks.

- Latest