Tight range for trading this week

MANILA, Philippines — The local stock market is seen trading within a tight range with a slight downward bias this week as investors wait for fresh catalysts.

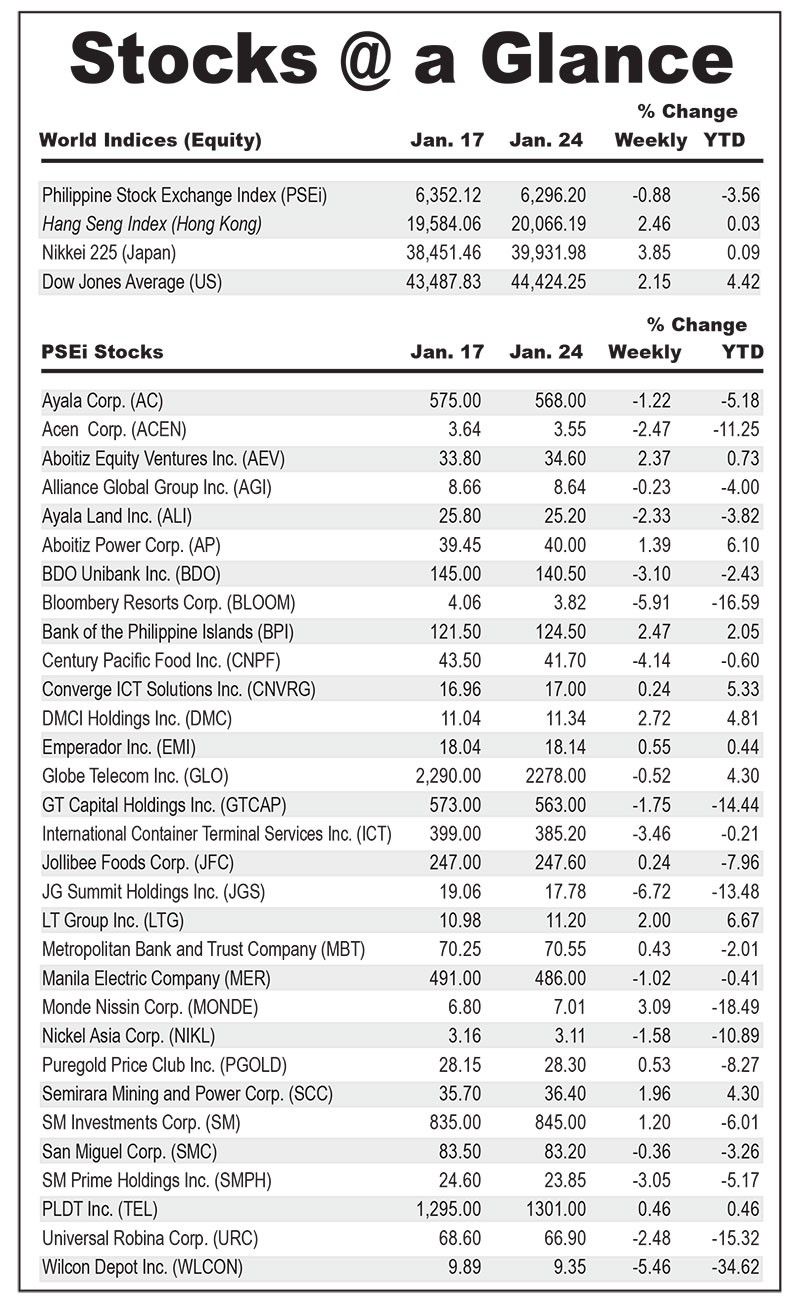

The benchmark Philippine Stock Exchange index finished in red territory last Friday at 6,296.20, or 0.88 percent lower week-on-week.

“The local market is already on a three-week decline as bearish sentiment continues to linger, driven by worries over the US’ planned protectionist policies and the possibility of the Philippines not hitting its 2024 economic growth target,” Philstocks Financial research manager Japhet Tantiangco said.

He said that chartwise, the market is still having a difficult time getting past its 10-day exponential moving average.

But with the market at attractive levels, some bargain hunting may be seen in this week’s trading, he added.

“However, we do not expect a strong rally yet as investors continue to wait for catalysts,” Tantiangco said.

For this week, First Metro Investment Corp. head of research Cristina Ulang said investors would be on the lookout for the Bangko Sentral ng Pilipinas inflation guidance for the month of January.

“Market will remain bearish, wary of the upcoming data out in early February,” she said.

Sun Life Investment Management and Trust Corp. president Michael Enriquez, for his part, said range-bound trading is expected this week given the Chinese holiday. Chinese New Year will be celebrated on Jan. 29.

“Newsworthy is the index rebalancing announcement where AREIT and China Banking Corp will replace Nickel Asia and Wilcon Depot,” he said.

The changes in the indexes will be effected on Feb. 3, 2025.

Major support is seen at 6,150, while major resistance is at 6,400.

- Latest

- Trending