Inflation heats up to 2.9% in December

MANILA, Philippines — Inflation rose for the third straight month in December, driven by the faster uptick in housing and transport costs, but average inflation for 2024 remained within the government’s two to four percent target.

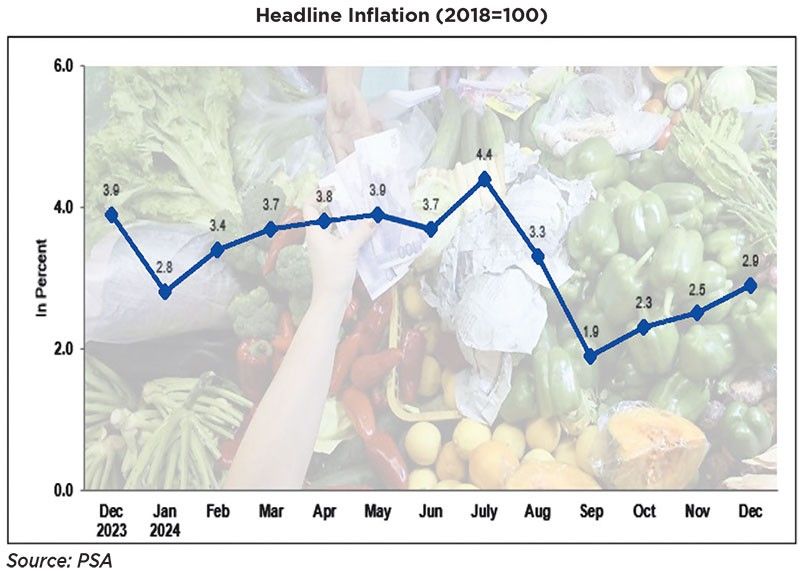

National Statistician Dennis Mapa said in a press conference yesterday that headline inflation – the rate of increase in average prices of consumer goods and services – accelerated to 2.9 percent in December from November’s 2.5 percent.

Last month’s inflation print, however, was lower than the 3.9 percent posted in December 2023.

The December inflation print is also within the 2.3 to 3.1 percent forecast range of the Bangko Sentral ng Pilipinas (BSP) for the month.

Mapa attributed the uptrend in December inflation mainly to the faster increase in housing, water, electricity, gas and other fuels at 2.9 percent during the month from 1.9 percent in November.

Also cited as a main driver to the higher inflation in December was the transport commodity group, which posted a 0.9-percent increase during the month from a 1.2-percent decline in November.

Inflation for food and non-alcoholic beverages, which typically drives the uptrend in overall inflation, remained at 3.4 percent in December from the previous month.

From 5.1 percent in November, rice inflation slowed to 0.8 percent in December, the lowest level since January 2022.

For full-year 2024, inflation averaged 3.2 percent, lower than the six percent average in 2023. It was also within the government’s two to four percent target range.

The downtrend in average inflation for 2024 was primarily due to the lower average increase in food and non-alcoholic beverages at 4.4 percent last year from 7.9 percent in 2023.

Also contributing to the downtrend was the lower average inflation of housing, water, electricity, gas and other fuels at 1.7 percent last year from 4.9 percent in 2023.

Other commodity groups also registered lower average inflation in 2024 compared to 2023, except for education services, which posted higher inflation of 4.3 percent last year from 3.6 percent in 2023.

“The 3.2 percent average inflation rate in 2024 is a significant improvement from the six percent figure in 2023. Despite the risks we encountered throughout the year, our combined efforts to temper inflation have largely been successful. We will build upon this momentum as we commit to keep the inflation rate within our target range in 2025,” National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan said.

At its meeting last month, the Development Budget Coordination Committee announced that the government had retained its annual inflation target of two to four percent for this year up to 2028.

In terms of what to expect in January, Mapa said the outlook for inflation is mixed, with prices of some goods like rice expected to slow down and others to go up.

“We have an expectation that the inflation for rice will be negative in January,” he said.

He said vegetable prices, however, continue to increase.

Amid climate risks, the NEDA said the government would continue to implement measures to ensure water and food security.

“In pursuit of price stability, the BSP maintains a calibrated approach to its monetary policy easing while the relevant agencies continue to pursue measures to ensure adequate food supply and affordable prices,” Balisacan said.

These measures include the expansion of the coverage of the Department of Social Welfare and Development’s projects such as the Local Adaptation to Water Access and Breaking Insufficiency through Nutritious Harvest for the Impoverished to 323 cities and municipalities across 67 provinces this year.

“As we enter 2025, we remain optimistic about curbing inflation through strategic, timely and proactive measures. At the same time, we are intensifying efforts to improve productivity, encourage innovation and build resilience toward ensuring food security and protecting consumers’ purchasing power,” Balisacan said.

The BSP, for its part, has reaffirmed its commitment to a less restrictive monetary policy stance.

“On balance, the within-target inflation outlook and well-anchored inflation expectations continue to support the BSP’s shift toward less restrictive monetary policy,” the central bank said.

However, monetary authorities will continue to monitor emerging upside risks to inflation such as geopolitical factors.

The balance of risks to the inflation outlook also remains toward the upside due to possible upward adjustments in transport fares and electricity rates. But the impact of lower import tariffs on rice continues to be the main downside risk to inflation.

On the other hand, the BSP said that domestic demand would likely remain firm, but subdued.

“Private domestic spending is expected to be supported by easing inflation and improving labor market conditions. However, downside risks in the external environment could materialize and temper economic activity and market sentiment,” the central bank said. — Keisha Ta-asan

- Latest

- Trending