‘Philippines one of fastest-growing economies in Asia’

MANILA, Philippines — The Marcos administration has made 2024 a banner year for economic achievements and has once again successfully positioned the Philippines as among the fastest-growing economies in Asia despite global challenges such as geopolitical tensions.

“2024 is a year of triumph for the Filipino people. In the face of unprecedented challenges, we have emerged stronger. I assure you that from here on, things will get better — because you have a government that works very hard to ensure that all Filipinos reap the rewards of strong economic growth through more comfortable lives and more high-quality jobs,” Finance Secretary Ralph Recto said.

Within the first 100 days of Recto’s leadership, the Development Budget Coordination Committee (DBCC) proactively recalibrated the government’s medium-term targets to adapt to both domestic and global realities and ensure that these goals reflect the needs of the Filipino people.

Under the refined MediumTerm Fiscal Program, the country’s deficit and debt are projected to gradually reduce, while ensuring that the government can finance the long-term investments needed to create more jobs, increase incomes, and decrease poverty.

Guided by the said program, the Philippines is on track to achieve a growth-enhancing fiscal consolidation, bringing multiple economic feats in 2024.

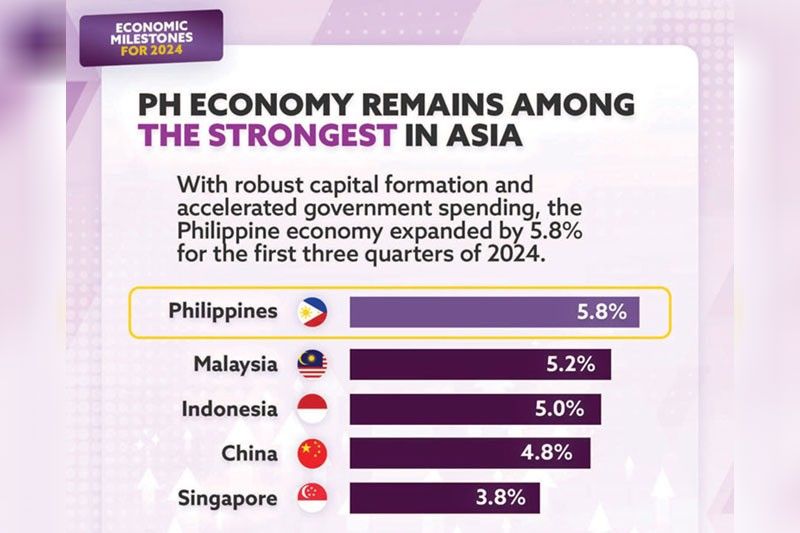

With robust capital formation and accelerated government spending, the Philippine economy expanded by 5.8 percent for the first three quarters of 2024 and remains among the fastest-growing economies in Asia, outpacing Malaysia’s 5.2 percent, Indonesia’s five percent, China’s 4.8 percent and Singapore’s 3.8 percent.

The economy has already doubled its size since 2013 in terms of nominal gross domestic product (GDP). By 2032, the Department of Finance (DOF)’s projections show that it can grow by another two-fold.

The country’s economic team remains optimistic about meeting the growth target of six to 6.5 percent for 2024. Growth assumptions for 2025 to 2028 have been given a wider band of six to eight percent, underpinned by transformative structural reforms and the resilience to navigate evolving domestic and global challenges.

2024 revenue goal surpassed

Total revenue collection for 2024 is expected to increase to P4.42 trillion by the end of the year, surpassing the full-year target of P4.27 trillion. As a percentage of GDP, the emerging revenues will climb to 16.7 percent, the highest in the last 27 years or since 1997.

The DOF was able to marshall more resources to fund the nation’s 2024 budget without the need to impose new taxes on the people through more aggressive privatization of public assets; higher dividend contributions of government-owned and -controlled corporations by raising their remittance share to 75 percent from 50 percent of their earnings; and sweep of idle, unused, and excess funds of GOCCs.

The Bureau of Internal Revenue (BIR) and the Bureau of Customs (BOC) likewise improved their revenue administration efficiency by ensuring ease of paying taxes and accelerating their respective digitalization programs.

For the first 10 months of the year, the DOF has already collected P3.77 trillion in total revenues — a 16.8-percent increase over the same period last year.

Tax collections rose by 11.4 percent to P3.23 trillion from January to October, while non-tax revenues surged by 64.9 percent to P539.4 billion.

As a result, the revenue effort for the first three quarters of the year improved to 17.5 percent of GDP, up from 16.4 percent in the same period last year.

Meanwhile, the fiscal deficit represents a manageable 5.1 percent of GDP for the first three quarters of 2024, lower than 5.7 percent in the same period last year.

The country’s debt also remains manageable at 61.3 percent of GDP as of the third quarter, with the majority, or around 68 percent of the portfolio sourced from the country’s robust domestic market.

Rating upgrades secured

The country’s fiscal discipline and prudent debt management have earned the Marcos

administration its first-ever credit rating upgrade of A- from R&I and an upgrade of outlook to positive from S&P in 2024. This means that the government and the private sector will continue to benefit from wider access to cheaper and more costeffective borrowing costs.

The economic managers’ “Road to A” strategy as well as its strict adherence to the Medium-Term Fiscal Program will ensure more credit rating upgrades within the Marcos administration’s term.

With its prudent and transparent debt management, the Philippines scored the highest in debt transparency at 12.5 out of 13 against the 50 countries surveyed by the Institute of International Finance (IIF)’s 2024 in 2024.

Unemployment rate drops

The sustained strength of the country’s labor market was evident in 2024 as the yearto-date unemployment rate dropped to four percent — well below the full-year target range of 4.4 to 4.7 percent.

With this, the total number of Filipinos employed rose to 48.6 million from January to October 2024.

Wage and salary workers, or those involved in formal and stable jobs, continued to make up the largest share of employed persons in the country at 63.8 percent.

Along with the strong labor market, the Philippines achieved an unprecedented gross national income (GNI) per capita of $4,335 or P241,165 in 2023 as more and better economic opportunities are available for Filipinos.

GNI per capita measures the economic output per citizen, including both domestic and international earnings. A higher GNI per capita means greater economic prosperity and an increased standard of living.

This puts the Philippines on track to achieve an upper-middle-income status next year, which the World Bank defines as countries having GNI per capita ranging between $4,516 and $14,005 for 2025.

Prices remain stable

The country’s year-to-date inflation rate of 3.2 percent has stayed firmly within the DBCC’s assumption of 3.1 to 3.3 percent, reflecting the government’s effective interventions to ease supply pressures for key food items, especially rice.

In particular, rice inflation has continued its downtrend to 5.1 percent in November from 22.5 percent in June as a result of the implementation of Executive Order (EO) No. 62 in July 2024, which lowered import tariffs on rice.

The continued drop in rice prices, including the setup of more Kadiwa stores nationwide, has benefitted the bottom 30 percent of households as headline inflation for the said group declined to 2.9 percent in November from 5.8 percent in July.

The overall inflation rate is expected to average 3.1 to 3.3 percent this year, significantly lower than six percent in 2023.

This favorable domestic inflation outlook allowed the Bangko Sentral ng Pilipinas (BSP) to be the first in ASEAN to start its monetary policy easing, cutting policy interest rates by a cumulative 50 basis points and slashing reserve requirements across all financial intermediaries by 250 bps to boost growth.

Lifted out of poverty

All the strategic growth-enhancing initiatives undertaken by the Marcos administration are aimed at achieving the most important number, which is cutting poverty incidence to a single digit or nine percent by 2028.

In 2023, the administration successfully reduced poverty incidence among Filipino individuals to 15.5 percent from 18.1 percent in 2021, and the pre-pandemic rate of 16.7 percent in 2018. This means that 2.4 million Filipinos were lifted out of poverty from 2021 to 2023.

The figure is lower than the government’s target of 16.0% and 16.4% for the year, putting it on track to hit its goal of lifting eight million more Filipinos out of the poverty line by 2028.

A recent Macro Poverty Outlook for the Philippines released by the World Bank projected that the country could cut its poverty incidence to 9.3 percent in 2026 — two years ahead of the 2028 target with the continuous improvement in the labor market and the easing of the inflation rate.

- Latest

- Trending