USA vs the World 2.0

Trump’s victory has rattled global financial markets. It created a stark contrast between surging US assets and struggling world markets. As US stocks quickly climbed to record highs and US Treasuries rose, the rest of the world was weighed down by weakening currencies and underperforming equities.This mirrored the conditions of 2018 during the height of US-China trade war in Trump’s first term which we discussed in our article USA vs. the World on Sept. 3, 2018.

As Trump prepares his return to the Oval Office on Jan. 20, markets are once again pricing in America’s return to protectionist and isolationist policies–this time with even greater intensity.

Global de-risking and deleveraging take hold

Global investors are undertaking a massive portfolio de-risking and deleveraging. Even traditional safe-haven assets like gold are losing appeal in favor of US dollar, US equities and Treasury securities. The winners have been narrowly focused on Trump-associated trades, with Bitcoin surging, Tesla shares rallying and banking stocks gaining momentum. Meanwhile, losers include stocks and currencies from major US trading partners like Europe and China, emerging markets and sectors such as renewables and healthcare, which will face headwinds from Trump’s policies.

Xi Jinping’s worst nightmare is back

Trump’s return presents Xi Jinping with his worst-case scenario. Already battling a fragile property sector, waning consumer confidence and slowing economy, China’s leader now faces an American president-elect promising punitive 60 percent tariffs. Trump’s Cabinet choices stacked with China hawks like Marco Rubio as secretary of state and Mike Walts as national security adviser signal an even more confrontational approach to Beijing than during his first term.

America’s self-sufficiency advantage

Trump’s return could not have come at a more opportune time for the USA. China’s economy is currently weak, while the US stands advantageously positioned as the world’s most self-sufficient major economy. With its massive domestic market, abundant energy resources, agricultural dominance and acommanding lead in AI technology and chip manufacturing, the US is far less dependent on global trade than its competitors.

America First policy

Trump’s Make America Great Again doctrine marks a clear shift away from globalization and focuses on bringing back American manufacturing and reversing trade deficits. Trump also plans mass deportation targeting 11 million illegal immigrants. This would disrupt labor-intensive US sectors and affect remittance dependent nations like Mexico and the Philippines. Whether this policy is good or bad for the US in the long-term is debatable. However, what is clear is that the rest of the world is being forced to adapt, with each country left to fend for itself.

Dollar reigns supreme

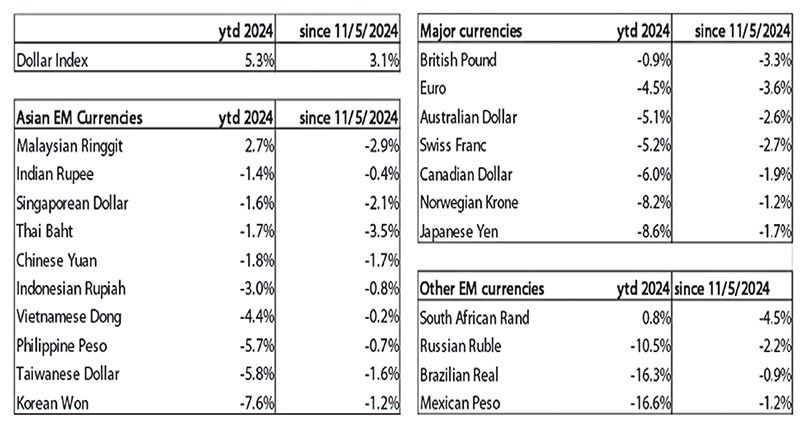

The US dollar has strengthened significantly against most global currencies. In Asia, the Japanese yen and Korean won are down by 8.6 percent and 7.6 percent year-to-date. The Thai baht has emerged as the weakest Asian currency since Nov. 5, while the Philippine peso tested its all-time low at the 59-level last Thursday. Latin American currencies fared even worse, with the Mexican peso and Brazilian real plummeting by 16.6 percent and 16.3 percent year-to-date, respectively.

Trump lifted US stocks, the rest faltered

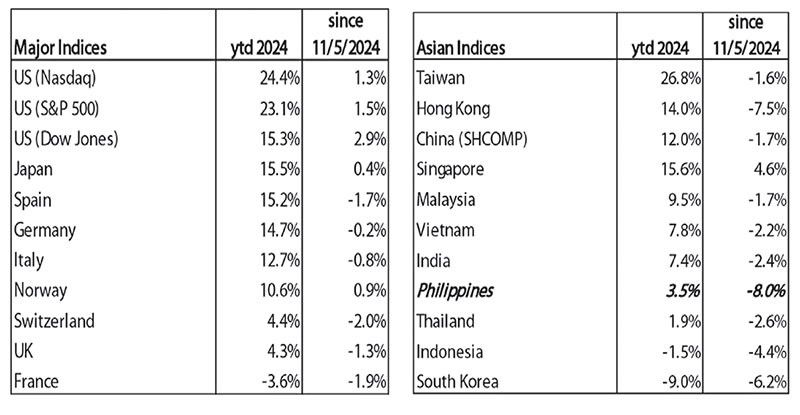

US stock markets have hit fresh highs, with the Nasdaq up by 1.3 percent since Nov. 5 (up by 24.4 percent year-to-date) and the S&P 500 adding by 1.5 percent (up by 23.1 percent year-to-date). Asian markets struggled and went the opposite direction. The Philippine Stock Exchange Index (PSEi) plunged by eight percent following Trump’s election, hitting a low of 6,557 last Thursday before recovering slightly to 6,676 on Friday. Bloomberg showed the PSEi had the worst performance among 92 global stock indices after Trump’s victory. Korea’s KOSPI also dropped by 6.2 percent since Nov. 5, bringing its year-to-date decline to nine percent and hitting a one-year low.

America’s Trump Card

As markets anticipate Trump’s return to the White House, global investors are rethinking their strategies. US assets have become both a safe haven and a growth bet, while the rest of the world faces the challenges of adapting to a more aggressive America First policy. Is the era of globalization and global coordination over, replaced by an every-nation-for-itself reality where America holds all the cards?

Everybody loses?

However, the appointment of hardcore hardliners to key cabinet positions sparked a sharp US market reversal Thursday and Friday. The question now haunting investors: Will America’s trump card turn out to be a self-destructive play where global markets, including US stocks, all end up losing?

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending