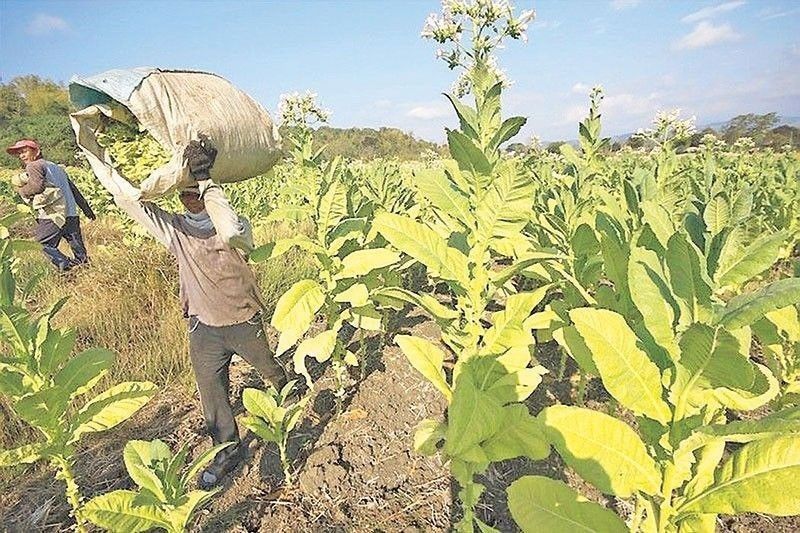

Special report: Tobacco farmers pin hopes on 60-year-old fund

(Third of a series)

MANILA, Philippines — Imagine how many projects can be financed with nearly P140 billion. Unfortunately, a fund of that amount can’t easily be touched, not even by its supposed beneficiaries.

At a time when the government is busy defending the impounding of idle funds of state-run corporations, hundreds of billions of pesos have been sleeping for decades that otherwise could have financed an important yet controversial sector.

Such is the case of the Tobacco Fund under Republic Act 4155, which aims to promote and strengthen the Virginia tobacco industry. The law was enacted in June 1964 to encourage the production of the most dominant tobacco type in the country.

Long before the Rice Competitiveness Enhancement Fund and the Coconut Farmers and Industry Trust Fund were created, the Tobacco Fund was already there – increasing every year but never used.

As of March 21, the tobacco fund under the special account in the general fund for the National Tobacco Administration (NTA) stood at P107.26 billion. The Bureau of Internal Revenue (BIR) has also accumulated P32 billion in its supposed share.

It was the Sin Tax Reform Act of 2012 that increased the fund, with higher excise taxes imposed on tobacco products to discourage people from getting into the habit of smoking and to encourage smokers to quit.

Five years before the Sin Tax law, data showed that tobacco excise revenues ranged from P23 billion to P32 billion per year. This took a sharp turn and more than doubled to P71.61 billion in 2013, just one year after the law took effect.

It further grew to P82.34 billion in 2014, rose to P99.5 billion in 2015 before slightly declining to P95.05 billion in 2016. A consistent increase, however, was noted again starting in 2017 until 2021 when excise taxes ballooned to P176.46 billion.

A nine percent decline to P160.3 billion was recorded in 2022 before dropping further by 16 percent to P134.87 billion in 2023 amid Filipinos’ reduced consumption of “sin” products as prices of essential goods increased. Last year, tobacco excise tax accounted for 46 percent of total excise tax collection.

For 2024, tobacco excise tax is estimated at P152.04 billion, up 13 percent.

As of the first semester, the BIR had collected only P58.65 billion from the sin product, or roughly 38 percent of the target.

The BIR is reeling from the illicit trade of tobacco in the country, which is among the reasons why the agency is missing its collection target for excise products. This is exacerbated by the transition to vape products, which remains difficult for the agency to regulate.

Amid these challenges, the BIR is looking at the Tobacco Fund to help in its operations and collection goals.

Longing for funding

Just like the NTA, the BIR also has failed to access the Tobacco Fund since its inception in the ‘60s. While the BIR’s parked funds at P32 billion are smaller, no single disbursement has been given either for enforcement or improvement of its detection mechanisms.

Since last year, the agency has been lobbying for at least a portion to be released to improve apprehension activities against illicit tobacco products — a major problem hindering its revenue collection goals, said BIR assistant commissioner Jethro Sabariaga.

In 2023, BIR asked for P600 million from the fund, less than two percent of the total P32 billion. This would have been used for the purchase of vehicles for its field operations, laboratory and monitoring equipment, and for its tracking system. As activities shift to importation, this could also aid in the enforcement of imported articles.

Unfortunately, not a single centavo was handed out to the BIR.

“With the enormity of the numbers at P32 billion, why are we not capacitating the agencies? The fact that nothing is being released or used—there lies the problem,” Sabariaga told The STAR.

Under the law, the fund was designed to help enhance the efficiency of government agencies while assisting farmers in improving their livelihood.

“Nation-building and enhanced regulation go hand in hand,” said economist Julieta Delos Reyes of the University of the Philippines - Los Baños.

“By addressing the illicit tobacco trade, we are not only protecting our citizens but also strengthening our economy and ensuring a prosperous future for generations to come,” she also said.

It is not the first time that concerned agencies such as the NTA and the BIR, as well as local government units, have called for the release of the Tobacco Fund.

During the Aquino administration, former BIR commissioner Kim Henares supposedly lobbied to tap the fund but to no avail.

Unresolved ‘mystery’

It remains a mystery for Sabariaga why the government, under the past eight administrations, has not addressed the matter, especially at times when the industry faced a plethora of challenges such as rampant smuggling and the growing popularity of alternative tobacco products coupled with farmers’ woes of lack of capital and technical support.

Sabariaga can only guess: It’s a highly political matter.

“That’s the official statement that you can see from history. The fact that it’s been there for so long, nothing has been spent. That’s political,” he said.

Tobacco belongs to what the BIR calls the “three products that do harm” alongside alcohol and sugar-sweetened beverages. Taxes for these sin products were raised to fund the Universal Health Care Law that would supposedly give every Filipino access to more comprehensive health care services.

Oddly enough, the country wanted to bring down tobacco use prevalence by increasing taxes, and yet the government is also expecting higher revenues from the sin products.

Once you cut down on tobacco production and usage, where do you now get the resources to fund rising medical costs?

Sadly, Sabariaga said the Philippines has long been half-hearted on this matter. Politically and behaviorally, the country is a fence-sitter who cannot make up its mind and instead sticks to being neutral on an issue.

“The government should really take a hard stance on being a regulator. The shameful tag that we are getting is that we are a ‘cuddler’ of this industry because we are half-hearted. Because, admittedly, we are a poor country and we need the revenues,” Sabariaga said.

- Latest

- Trending