Philippine peso strengthens

MANILA, Philippines — The Philippine peso strengthened by 1.19 percent to 56.415 last week as the currency touched its strongest level in five months against the US dollar.

The peso’s rebound defied earlier expectations, which had predicted weakness on bets that the Bangko Sentral ng Pilipinas (BSP) would cut rates before the Federal Reserve.

The peso’s strength was caused by US dollar weakness against most currencies. Lower US inflation and slower economic growth suggest that interest rates may start coming down. Additionally, the unwinding of carry trades and the broadening of stock market gains to other sectors and other countries have further contributed to the dollar weakness.

BSP cuts rates amid lower inflation risks

The BSP lowered its benchmark interest rate by 25 basis points to 6.25 percent at its August policy meeting, a move that had long been signaled by the central bank. Governor Remolona emphasized that the inflation outlook was skewed to the downside for 2024 and 2025, prompting the rate cut. This decision aligns with Remolona’s statements in recent months, which have been preparing markets for potential easing.

Dollar weakness fuels peso’s strength

A key driver of the peso’s strength is the broad weakening of the US dollar against most currencies. Cooling US inflation, which has decelerated for four straight months, and lower US interest rates have diminished the dollar’s appeal.

This has narrowed interest rate differentials against major currencies like the yen, and the euro triggered a significant rebalancing in the forex markets.

Carry trade unwinding propels yen, euro gains

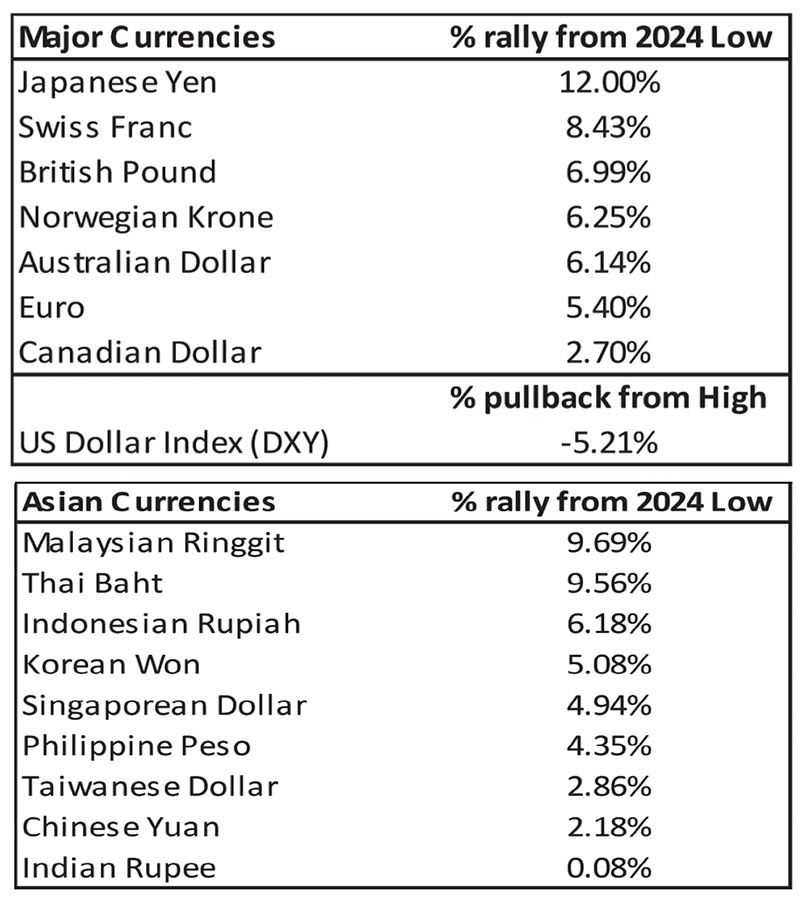

Market anticipation of the Fed’s first rate cut has triggered a significant unwinding of carry trades. One popular carry trade involves shorting the Japanese yen while buying US Treasuries and US stocks. This shift has led to notable appreciation in the Japanese yen, Swiss franc, British pound and the euro as well as other major currencies over the past two months.

Asian currencies have also benefited from this broad weakening of the US dollar, with the Malaysian ringgit and Thai baht leading the gains. The Philippine peso has likewise strengthened, rallying 4.35 percent from its low earlier this year.

PSEi rallies on broadening bull market

While the peso has strengthened alongside Asian peers, the Philippine Stock Exchange Index (PSEi) has surged by 13 percent from its June low. The PSEi closed at 6,961.96 last week – near the upper end of its two-year range. This reflects a broadening global bull market that is extending to diverse sectors and emerging markets like the Philippines. The broadening has resulted in flows coming into other sectors and countries, with the Philippine peso and stock market being clear beneficiaries.

Powell: ‘The time has come’

Last Friday, Fed Chair Jerome Powell affirmed expectations of upcoming rate cuts in his Jackson Hole speech, stating “the time has come for policy to adjust.”

This has made a September rate cut a certainty, with markets now pricing in a one-third chance of a 50-bp cut and a two-thirds chance of a 2-bp cut. Notably, officials from the ECB and Bank of England also signaled they’re set to lower rates in the coming months, heralding the end of a high-interest rate era.

The peso’s newfound stability provides the BSP with increased policy flexibility, allowing it to focus on economic growth without the constant concern of currency volatility. While challenges remain, the shift marks a turning point. Investors are now watching how the central bank leverages this improved landscape, with its next moves potentially setting the tone for both domestic policy and foreign investment flows.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending