Philippine Airlines Q2 profit: P2.6B (down 67%)

Philippine Airlines [PAL 5.20 ?1.2%; 12% avgVol] [link] reported a Q2 net income of P2.6 billion, down 67% y/y from its Q2/23 net income of P7.9 billion, and down 43% q/q from its Q1/24 net income of P4.6 billion. Q2 revenue was P45.1 billion (down 0.2% y/y). H1 revenue was P90.9 billion (up 4% y/y) on 7.91 million passengers (up 12.5% y/y). PAL’s consolidated operating expenses increased by 15% to P10.45 billion, which PAL attributed to an 11.43% increase in flights. Flight expenses increased 13% as a downstream consequence of PAL’s increased flying schedule, with fuel consumption up 7% and maintenance up 16%. In an associated press release, PAL referred to its Q2 and H1 results as “on track in its transformative growth strategy” to make PAL “more efficient” while also being its “only full-service airline” and the airline with the “biggest network.” PAL’s stock is up 0.4% year-to-date, is flat over the trailing 12 months, and is down 13% from its March 2020 COVID-crash low. The stock price has been in a downtrend since March 2012 when shares peaked at around P18.00/share.

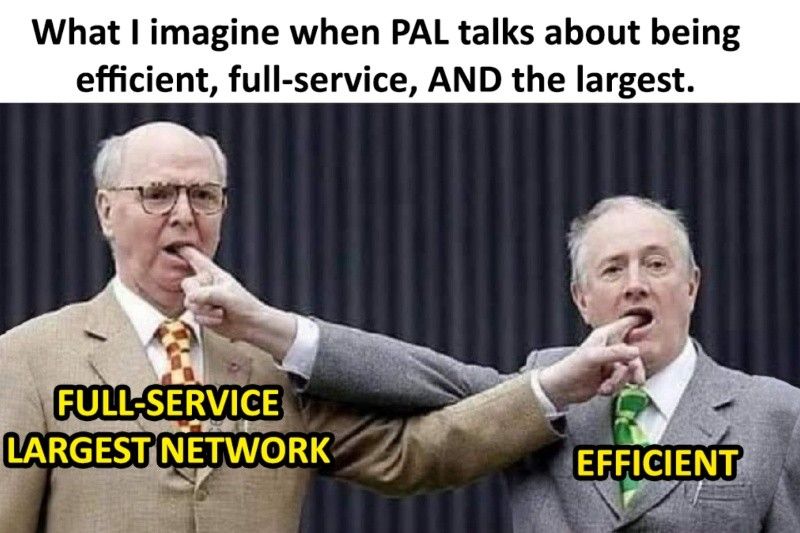

MB BOTTOM-LINE: PAL’s Achilles' heel has always been efficiency, and while the new group has been doing much better than the old group since the airline emerged from bankruptcy, some of the airline’s old ways of thinking appear to be seeping back into management’s commentary. The President and COO of PAL, Lucio Tan III (LT3), said that their growth strategy is to be efficient, but also full-service, and also the largest. Not all of these points are in conflict per se, but they can certainly be in tension depending on how this growth strategy is executed. Did PAL learn vital lessons from the pandemic and its unsurprising bankruptcy? The initial returns were promising from a business perspective, but shareholders have yet to be rewarded. How quickly will the parasites reattach themselves to the income stream? Will hubris and legacy concerns pilot major decisions, or data and cutthroat strategy? This is the first result that has given me flashbacks.

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

- Latest