Rainy days and markets

The Carpenters’ melancholic hit “Rainy Days and Mondays” seemed appropriate last week in the financial markets. As the song laments, “Hanging around, nothing to do but frown, rainy days and Mondays always get me down.” Filipino investors might find themselves nodding in agreement.

Super Typhoon Carina entered the Philippine area of responsibility (PAR) last Monday, bringing rain that by Wednesday had become a deluge rivaling the worst in recent memory. Similarly, the financial markets opened the week with their own storm, as the sell-off in Megatech and AI-related stocks intensified.

Reminiscent of Ondoy

Carina’s wrath echoed past Philippine disasters. The typhoon caused severe and widespread flooding in Metro Manila and surrounding areas, mirroring the devastation of Typhoon Ondoy in 2009 (see Epic flood, the effect on stocks, Sept. 28, 2009). Both Ondoy and Carina brought extensive damage, with thousands stranded and countless homes flooded. While Ondoy dumped a comparable amount of rainfall in a shorter period, leading to catastrophic flash floods, Carina’s prolonged deluge also caused widespread destruction. PAGASA data reveals that Carina’s total rainfall surpassed that of Ondoy.

Just like in past calamities, the Philippine Stock Exchange closed last Wednesday. Taiwan’s stock exchange shut down for two days after Carina (international name: Gaemi) pummeled the country.

Tech sector’s perfect storm

While Carina battered the Philippines with real rain and floods, a different kind of storm was brewing in the financial markets. As discussed in last week’s article, the tech sector has been caught in a perfect storm. We said that “Soaring valuations, economic data hinting at lower interest rates, geopolitical tensions, trade wars, tariff threats, tech glitches and the Trump assassination attempt all converged, creating a perfect storm” (see When it rains, it pours, July 22).

What began as a gentle drizzle of profit-taking on tech has escalated into a full-blown typhoon. The so-called Magnificent Seven tech giants have been hit particularly hard, with Tesla and Alphabet leading the decline, shedding eight percent and six percent for the week, respectively. AI leader Nvidia fell by four percent for the week and at one point had dropped as much as 25 percent from its June 24 peak.

The great rotation

The “great rotation” from tech safe havens to riskier assets continues two weeks after we first noted the trend (see The cut is near, July 15). This shift, anticipating the Federal Reserve’s first rate cut after its recent tightening cycle, typically benefits interest-rate-sensitive stocks, value stocks and the more cyclical areas of the market.

Small-caps outshine tech

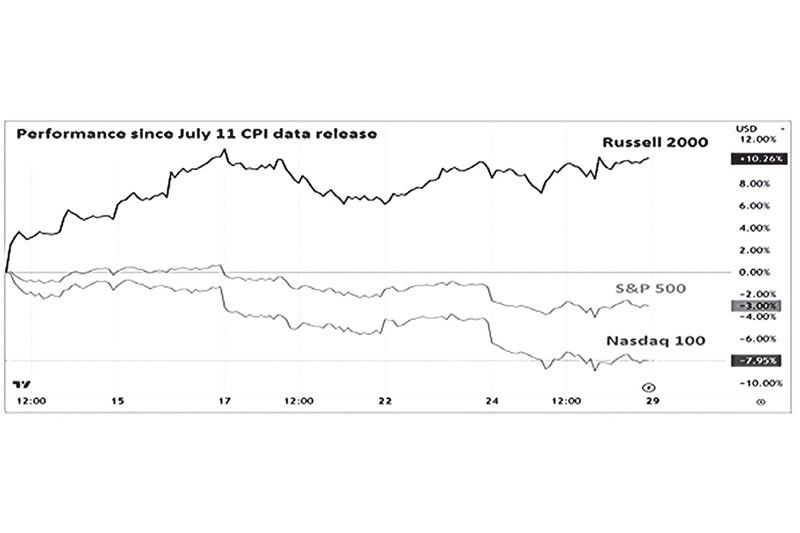

Small-cap stocks, represented by the Russell 2000 index, have outperformed tech stocks for the third consecutive week. The Russell 2000 has surged over 10 percent since the July 11 release of US CPI data. The data indicated cooling inflation and fueled bets that the Fed will cut interest rates sooner than expected. This outperformance is evident when compared to the tech-heavy Nasdaq 100, which fell by eight percent, and the broader-based S&P 500 index, which declined by three percent over the same period.

The long-neglected Philippine stock market, considered a value play, also outperformed the Nasdaq 100. The Philippine Stock Exchange Index (PSEi) has gained 1.8 percent since July 11 and 9.2 percent from its low in June.

A contrarian’s perspective

Steve Eisman, the investor popularized in “The Big Short,” offers a contrarian view. “This is a psychological rotation, not a fundamental deterioration,” Eisman told CNBC’s Fast Money last week. His perspective suggests rotations are always violent, but tech fundamentals have not changed that much.

Navigating the storm

Market volatility is expected to persist as the tech sector recalibrates and investors reassess their positions. Apple and Microsoft are set to report earnings this week which is adding more volatility to the market. The upcoming FOMC interest rate decision and July jobs report are also likely to contribute to market fluctuations, significantly influencing investor sentiment and market direction.

Resilience and long-term vision

In this volatile environment, investors should reassess their risk tolerance and maintain diversified portfolios. Stay alert for potential buying opportunities, particularly in high-quality AI and Megatech stocks that have been oversold. Despite current headwinds, the tech sector’s fundamental strengths and long-term potential remain intact.

Just as Filipinos have shown resilience in the face of natural disasters, astute investors can navigate this market turbulence by staying informed and maintaining a long-term outlook. Prudence paired with strategic opportunism will be key to weathering this financial storm.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending