ADB: Domestic demand to fuel growth this year

MANILA, Philippines — The country’s economic growth this year and next year is expected to be driven by domestic demand, according to the Asian Development Bank (ADB).

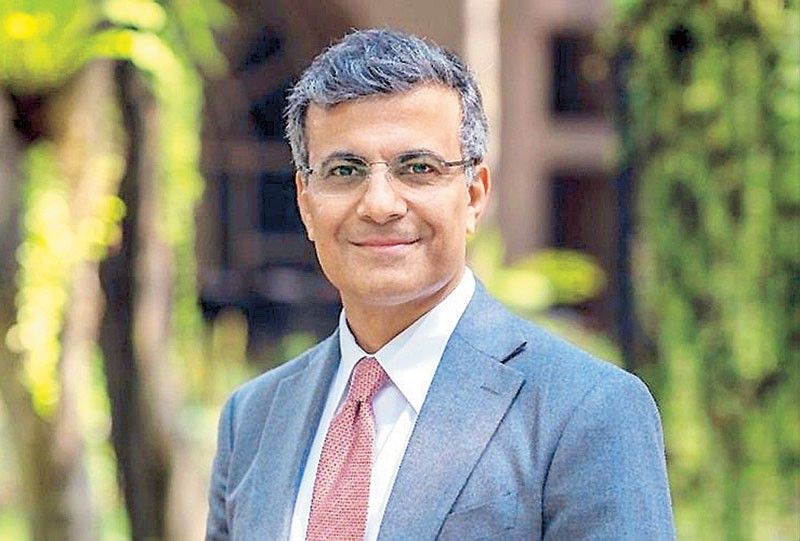

In an email, ADB Philippines country manager Pavit Ramachandran said broad-based domestic demand will be the key growth driver of the country’s economic growth this year and in 2025.

The ADB’s Asian Development Outlook July report released last week showed that the multilateral lender retained its growth forecasts for the Philippines for this year and 2025.

For this year, the ADB expects the Philippines’ gross domestic product (GDP) to grow by six percent, which is the low end of the government’s six to seven percent target.

The ADB expects the Philippine economy to expand at a faster pace of 6.2 percent next year, but below the government’s 6.5 to 7.5 percent GDP growth goal for 2025.

The economy posted a 5.7-percent growth in the first quarter, slower than the 6.4 percent expansion in the same period last year, but faster than the 5.5 percent growth in the fourth quarter of 2023.

“Low unemployment rate and steady remittances from overseas workers will continue to boost household consumption,” Ramachandran said.

He also cited investment as a driver of growth for this year and 2025.

“The acceleration in public infrastructure investment, with high multipliers, will continue to lift growth,” he said.

Public infrastructure spending, which was at 5.8 percent of GDP in 2023, is intended to be sustained at five to six percent of GDP for the medium term.

Ramachandran said reforms aimed at attracting investments into the country are also supporting private investment.

The ADB said both household consumption and investment will be supported by moderating inflation and monetary easing.

The multilateral lender expects inflation in the Philippines to average 3.8 percent this year and ease to 3.4 percent next year.

Last June, inflation eased to 3.7 percent, its lowest level in four months due to slower increases in transport and energy prices.

Average inflation in the first semester was at 3.5 percent, within the two to four percent target band of the Bangko Sentral ng Pilipinas (BSP).

“We expect BSP to cut policy rates from the second half of 2024 in a phased manner, while ensuring inflation remains anchored within its target of two to four percent,” Ramachandran said.

Last month, the BSP kept the benchmark interest rate at 6.5 percent, a 17-year high.

Aside from consumption and investment, Ramachandran said services are expected to remain buoyant including tourism, trade and business process outsourcing.

“Brisk construction and manufacturing will also contribute to growth,” he said.

- Latest

- Trending