SEIPI pushes for restoration of PEZA autonomy

Under create more

MANILA, Philippines — The Semiconductor and Electronics Industries in the Philippines Foundation Inc. (SEIPI) is pushing for the restoration of the autonomy of the Philippine Economic Zone Authority (PEZA) under the bill seeking to amend the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act to encourage investments in the sector.

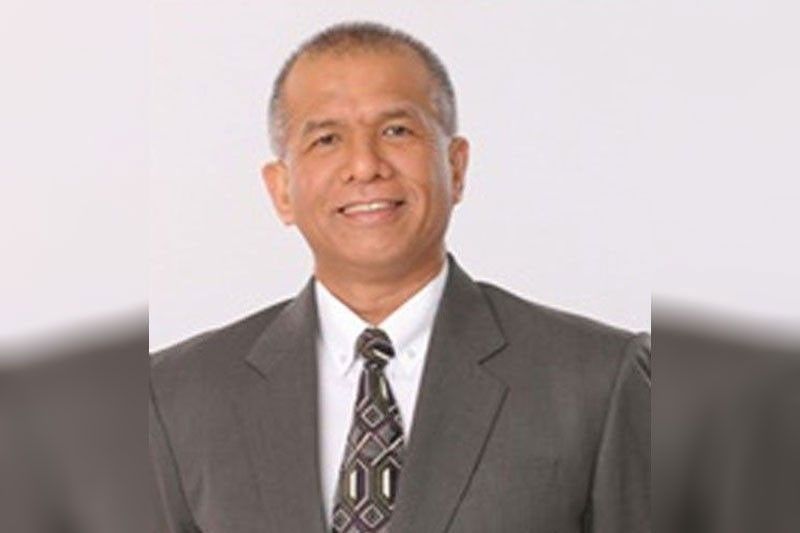

SEIPI president Dan Lachica told reporters on the sidelines of the Tatak Pinoy Act Forum yesterday that the group welcomes the initiative to amend the CREATE Act, which was approved into law under the previous administration to rationalize the incentives system for investors.

He said the implementation of the CREATE Act has led to the country losing potential investments in the electronics industry.

“There were many lost opportunities in terms of investment in new products,” he said, noting that some investments for new products in the electronics industry initially eyed to be made in the Philippines, went to neighboring countries due to the changes in the incentives system.

He said one company looking to expand in the Philippines opted to bring its $1.6-billion investment to Vietnam instead because of the move to rationalize incentives here.

Without new investments in new products, he said the industry is stuck with legacy products, which affects its growth performance.

With moves to amend the CREATE Act through the CREATE to Maximize Opportunities for Reinvigorating the Economy (MORE) bill, he said the group wants the proposed changes to include bringing back the autonomy of the PEZA to approve incentives for projects in ecozones.

Under the CREATE measure, projects seeking incentives with investments above P1 billion have to go through the Fiscal Incentives Review Board (FIRB), while those below the threshold are approved by investment promotion agencies (IPAs) like the PEZA.

Last Feb.2, the FIRB issued a resolution, which increased the investment capital threshold of projects seeking incentives to be approved by IPAs to up to P15 billion.

Lachica said the SEIPI also wants the value-added tax on constructive exports to be removed and the five percent tax on gross income earned restored under the CREATE MORE.

Despite signs of improving performance based on the latest exports data, he said the group is projecting a 10 percent contraction in electronics exports this year because of soft demand.

Data from the Philippine Statistics Authority showed that electronics exports rose by 12.7 percent to $17.64 billion in the January to May period this year from $15.65 billion in the same period last year.

“Because of our product mix in the Philippines, compounded by the inventory correction, we’re hoping we can just reach our 2023 levels,” Lachica said.

Last year, the country’s electronic exports reached $41.91 billion.

Trade Secretary Alfredo Pascual said in the same event that the Tatak Pinoy Act is expected to boost electronic exports.

Under the Tatak Pinoy Act, a multi-year Pinoy Strategy will be crafted to outline the plan and action for the regions, provinces, cities and municipalities to expand and diversify productive capabilities and offer sophisticated products and services, as well as compete in the global market.

“Under Tatak Pinoy, semiconductors and electronics are at the top of the priorities as they constitute 62 percent of our exports,” Pascual said.

He said one of the major initiatives under Tatak Pinoy is to conduct a feasibility study on establishing a lab-scale wafer fabrication facility in the Philippines to support research and development prototyping, intellectual property development in semiconductor technology and experimentation with new materials and manufacturing processes.

- Latest

- Trending