'Sluggish investments, exports to hamper Philippine growth’

MANILA, Philippines — Achieving economic growth of above 6.5 percent will be challenging this year amid subdued investment activity due to high interest rates and a weaker external sector, according to global research firm BMI Country Risk & Industry Research.

In a report, BMI said that while it is still possible for the Philippine economy to grow by 6.2 percent this year, downside risks are dominating the outlook.

“The economy will find it hard to breach the upper half of the six to seven percent growth target which the government has set. Headwinds stemming from restrictive financial conditions alongside a weaker external sector will keep a lid on growth,” it said.

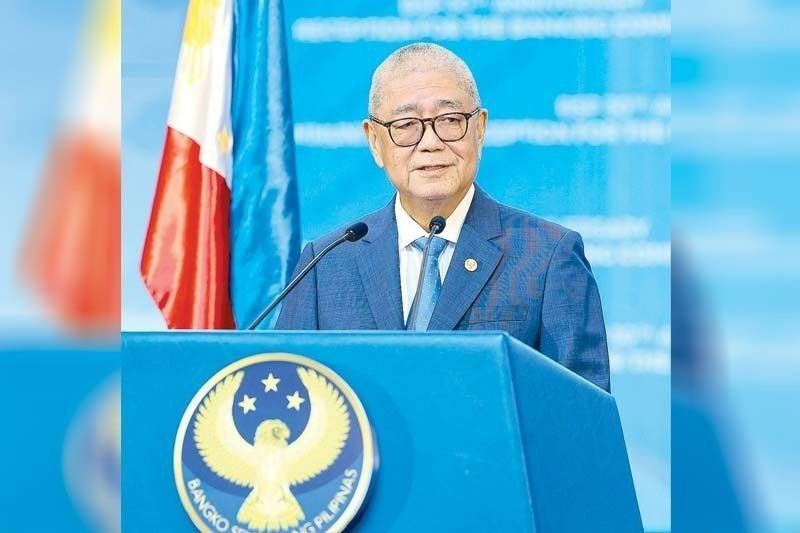

BMI said investment activity would stay muted amid a high interest rate environment. This was after the Bangko Sentral ng Pilipinas (BSP) hiked its key rate by 450 basis points to 6.5 percent from May 2022 to October 2023, the highest in 17 years.

BSP Governor Eli Remolona Jr. recently hinted at a possible rate cut in August amid easing inflationary pressures. BMI, however, said policy easing next month may be unlikely at a time when the peso has been weakening against the dollar.

“The peso has weakened considerably, becoming one of the poorest performing currencies in the region, with only the Japanese yen faring worse. The constant repricing of US interest rates expectations has weighed on many emerging market currencies, including the peso,” it said.

Thus, the BSP is only expected to cut rates in October, right after the US Federal Reserve starts its own monetary loosening cycle in September.

“However, the lagged impact of policy easing means that its impact will likely only be felt in 2025. Indeed, business sentiment toward the economy has notably diminished,” the research firm said.

The external sector will also provide less support for the Philippine economy over the coming quarters as several of the country’s major trading partners are due for an economic slowdown after showing robust growth in the first quarter, according to BMI.

“We believe that growth in mainland China has reached its peak and will diminish in the following quarters. The strong start to the year for the US economy is also expected to succumb to the pressures of tight monetary policy and a less supportive fiscal backdrop,” it said.

On the other hand, receding price pressures and lower inflation would offer some respite to household incomes and support private consumption, the research firm said.

In a separate analysis, BMI said it has maintained its 2024 year-end forecast of P56.50 to $1 as interest rate cuts from the US Fed may cause the peso to rebound against the dollar.

“We think that the peso will reverse its losses in the fourth quarter once the US Federal Reserve begins its monetary loosening cycle in September,” the research firm said.

BMI said the peso could strengthen by about four percent from the current spot rate of 58.70 to $1.

For 2025, the peso is expected to strengthen to 55 to $1 as the Fed is expected to cut borrowing costs by 200 basis points. “If the BSP were to go ahead with monetary loosening in August, this would exacerbate weakness in the peso, potentially breaching the 59 to $1,” BMI said.

- Latest

- Trending