Japan is cheap

Many of my friends and family members have been going to Japan lately. They are all agog saying that their trips to Japan are so cheap. The reason for this is the steep depreciation of the Japanese yen. This makes everything from the Michelin-starred meals to luxury cosmetics a steal for tourists. But while visitors are reveling in the bargain bonanza, Japanese finance officials, importers and international investors are grappling with the repercussions of this historic currency weakness.

Yen plunges to 38-year low

The yen has plunged to levels not seen since 1986 against the US dollar. The USDJPY rate reached an intraday high of 161.28 against the US dollar last Friday before closing at 160.88. The yen’s staggering 12.5 percent decline year-to-date is the steepest among Asian currencies.

BOJ-Fed policy divergence drives yen plunge

This freefall has been fueled by the stark divergence in monetary policy between the Bank of Japan (BOJ) and the Federal Reserve. While the BOJ maintains ultra-loose monetary policy to spur economic recovery, the Fed’s aggressive tightening to combat inflation has made US assets and the US dollar significantly more attractive.

Tourists gain, importers suffer

While the depreciating yen may be drawing tourists to Japan with promises of affordable travel, it is also creating a challenging economic landscape for the world’s third-largest economy. Importers are feeling the pinch as the cost of raw materials and goods from overseas skyrockets. This in turn fuels inflationary pressures that could erode consumer purchasing power and dampen domestic demand.

Investors face currency losses

The impact on international investors is equally significant. While Japanese stocks have seen gains due to robust economic performance, these profits have been largely negated by the yen’s sharp decline. This currency risk presents a significant challenge for foreign investors, who are now forced to grapple with the eroding value of their yen-denominated assets.

USDJPY rate hits critical 160-level

The USDJPY chart is currently above the critical 160-level. Technical analysis suggests that a significant break above this level could trigger further selling pressure, potentially pushing the currency pair toward its next resistance level at 177.

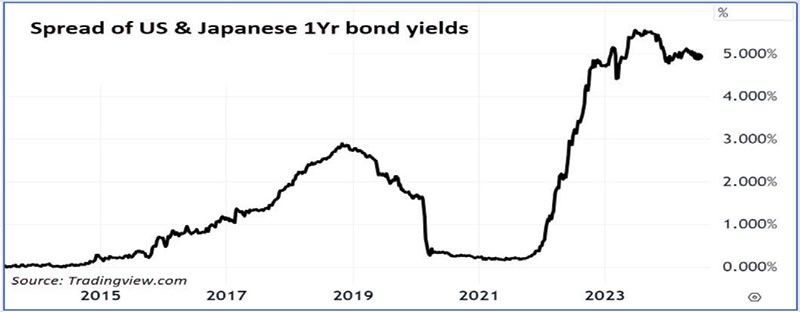

Carry trade fuels yen’s downward spiral

This divergent monetary policy has widened the spread between US and Japanese bond yields, creating a lucrative opportunity for the yen carry trade. Investors are borrowing cheaply in yen to invest in higher yielding assets, further accelerating the yen’s slide. This strategy has delivered impressive returns of 17 percent over the past year, reaping the benefits of the wide interest rate differential and profiting from the yen’s depreciation.

Yen’s weakness casts a shadow over regional currencies

The yen’s slump also threatens to destabilize the broader Asian currency landscape. The Bloomberg Asian dollar index is already at its lowest level since November 2022. Further yen weakness could trigger a domino effect, sending other regional currencies tumbling as investors seek the relative safety of the US dollar.

BOJ’s delicate balancing act

The Bank of Japan faces a challenging dilemma: balancing the need for economic stimulus with the risks of a free falling currency. Warnings and actual intervention in currency markets by Japanese officials appear to have temporarily stemmed the yen’s slide. Ultimately, the Fed lowering its policy rates and the BOJ shifting towards tighter monetary policy will be crucial in determining the USDJPY narrative. This will have far-reaching implications across global currency markets.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700or email [email protected].

- Latest

- Trending