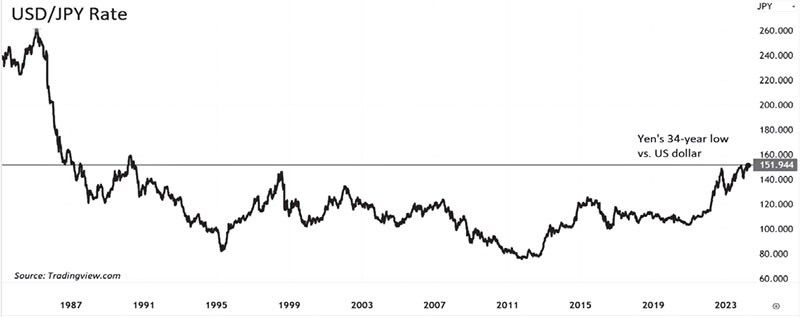

Yen hits 34-year low

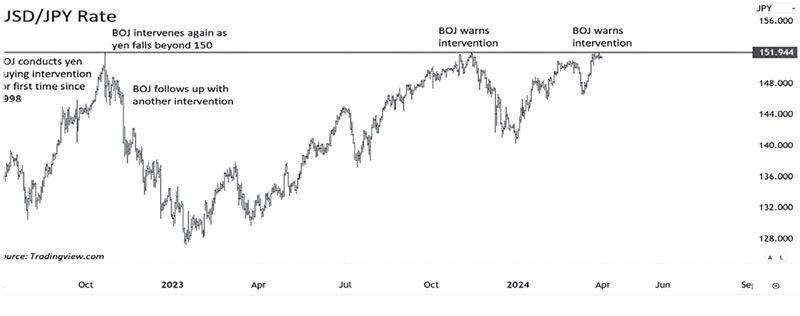

Last week, the Japanese yen hit a 34-year low of 151.97. This surpassed the 151.95 level in October 2022 that previously triggered Japan’s market intervention. Now, the Bank of Japan (BOJ) finds itself with limited options. It is just resorting to purchasing the currency to prop it up after a historic policy shift failed to change the yen’s trajectory. The lack of clear signals on further near-term policy tightening combined with the BOJ’s stance on keeping financial conditions loose has intensified the downward pressure on the yen.

BOJ shifts away from negative rates

The BOJ made significant moves on March 19. It terminated the negative interest rate policy (NIRP), abandoned the yield curve control (YCC) strategy, halted purchases of exchange traded funds (ETFs) and stopped buying japan real estate investment trusts (J-REITS). However, these measures did not lead to the desired strengthening of the yen.

Weak yen persists despite policy changes

Despite initiating steps toward monetary policy normalization, the BOJ indicated that it “anticipates that accommodative financial conditions will be maintained for the time being.” It also pledged to act against a rapid rise in JGB yields. These statements contributed to the yen’s continued decline.

Note that Japan narrowly evaded a recession at the end of last year. It posted a modest 0.4 percent expansion, while consumer spending saw a slight dip of 0.3 percent. These figures hint at underlying economic fragility due to inflationary pressures. This situation prompted the BOJ to exercise prudence in its monetary normalization efforts.

Interest rate differential drives yen’s decline

The yen’s slide persists as Japan’s new rate of 0 percent to 0.1 percent remains the world’s lowest, even after recent policy adjustments. This is why the market remains comfortable using the yen as a funding currency, especially given the elevated US Fed funds rates of 5.25 percent to 5.5 percent. The significant interest rate differential has favored US assets and strengthened the US dollar. Strong US corporate earnings, robust macroeconomic numbers and the AI-led stock market bulls have all contributed to the strength of the US dollar and consequently to the yen’s ongoing decline.

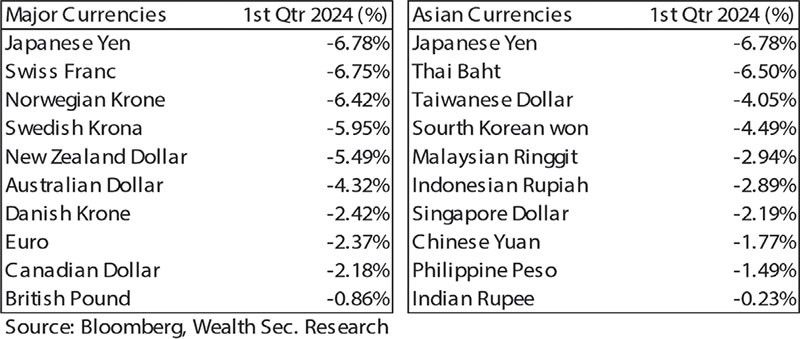

In the first quarter of 2024, the yen remained the worst-performing major and Asian currency, experiencing a substantial 6.78 percent decline.

Policymakers on close watch

In response to escalating volatility in the yen, Japan’s key monetary authorities that included the BOJ, Finance Ministry, and Financial Services Agency held an emergency meeting last Wednesday. This signaled their readiness to intervene against disorderly and speculative currency movements. Finance Minister Shun’ichi Suzuki emphasized the potential for “decisive steps” against yen weakness, echoing sentiments seen during Japan’s

October 2022 market intervention.

Critical yen support-level at 152

The chart above underscores the significance of the 152-per-dollar level as a major support level for the Japanese yen. This level marks the pivotal point where Japanese authorities successfully intervened in October 2022, triggering a significant reversal in the dollar-yen rate. Market participants are again anticipating a potential intervention by the BOJ at this level. According to Bloomberg, hedge funds have placed billions of dollars in FX options bets maturing in April, with substantial potential gains if this crucial support at 152 to 153 range holds.

Technical analysis points to the 152-level as crucial. If this level is breached, USDJPY may target 155, followed by 160. On the other hand, successful intervention by the BOJ to defend the 152 level could lead to a reversal, with USDJPY potentially correcting to 146 or even reaching 141.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending