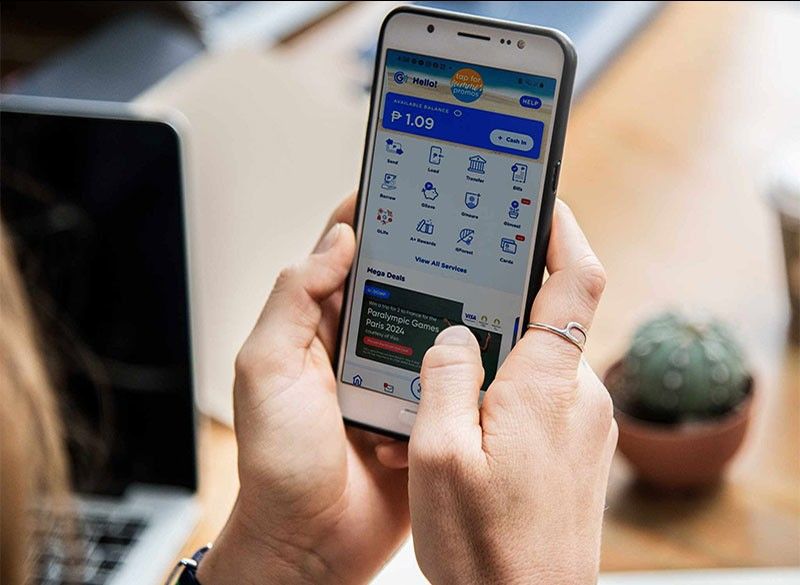

GCash widens global reach

MANILA, Philippines — Overseas Filipino workers (OFWs) may connect their GCash accounts with foreign banks by the second quarter of the year, expanding the financial services they can access in the e-wallet.

GCash International general manager Paul Albano told reporters the app would onboard banks in the US and Europe as part of its strategy to expand abroad.

This means OFWs in the US and Europe may soon top up money into their GCash accounts through their financial deposits with American and European banks.

“By the second quarter, in the US, Europe and the UK, they (OFWs) can do bank cash in. That means their bank accounts in the US—for example, Chase, J.P. Morgan, Bank of America—can be used to cash in into their GCash accounts,” Albano said.

However, Albano reminded OFWs that GCash transacts in peso wherever it is accessed. As such, OFWs have to depend on the conversion rate of their banks abroad when transferring money into their e-wallet accounts.

On top of this, OFWs can load money into their GCash accounts through remittance centers like Ria Money Transfer and Western Union.

GCash is currently available in 13 countries and territories: Australia, Canada, Germany, Hong Kong, Italy, Japan, Qatar, South Korea, Spain, Taiwan, United Arab Emirates, UK and the US.

By April, the e-wallet will also launch in Kuwait, Saudi Arabia and Singapore, as it pushes all the buttons in persuading OFWs to download the app.

In February, GCash secured approval from the Bangko Sentral ng Pilipinas to introduce its financial services in the 16 markets listed above. GCash is spreading its wings abroad to capture a portion of the $33.5 billion market for OFW remittances.

Aside from this, GCash wants OFWs to use the app in settling the bills of their families, ensuring that their hard-earned money is spent the right way. Similarly, the e-wallet hopes to offer OFWs a suite of investment opportunities to save money for the future.

Albano admitted that GCash is keen on adding new markets to its network, but plans to focus its attention first in promoting the app in its recent expansions.

- Latest

- Trending