Foreign funds return strongly

After a prolonged absence, global investors are making a notable comeback in the Philippine markets. Since the start of the year, foreign funds have been actively increasing their stakes in Philippine stocks. According to data from the Philippine Stock Exchange (PSE), daily net foreign buying was positive in eight out of the first nine days of 2024.

Reversal from years past

The re-emergence of foreign funds is highly welcome. The daily average net buying inflow in the current year stands impressively at P446 million daily. This is a stark contrast to the preceding years, with daily average net selling outflows reaching P161 million and P127 million in 2022 and 2023, respectively.

Since 2018, foreign funds have consistently held a negative stance in the Philippine market. The climax of this selling spree occurred during the tumultuous COVID-19 period in 2020, with a peak net selling outflow reaching P614 million daily.

Source: PSE, Wealth Securities Research

Global broadening

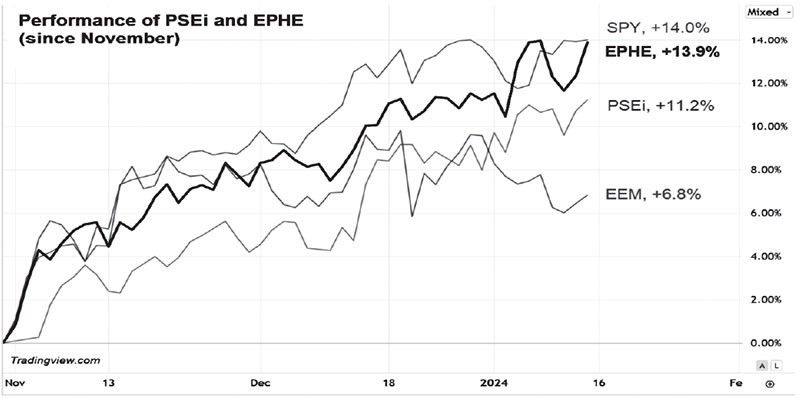

In our previous articles, we highlighted the broadening from mega-cap tech stocks to other sectors of the economy. This trend has been unfolding since November last year and is evident not only across sectors within the US markets, but also extends to other countries. Japan’s Nikkei 225 gained 15.2 percent and Europe’s STOXX 600 increased 7.3 percent since November. Countries that may have been overlooked in 2023, such as the Philippines and most ASEAN markets, are also catching up. This characteristic indicates a bull market dynamic, with the rally initiating from leading stocks like the Magnificent 7, followed by a broadening of upside participation across various sectors and stock markets worldwide.

Phl stocks mirror S&P 500’s surge

During this period, the PSE Index surged by 11.2 percent, closely trailing the MSCI Philippines ETF (EPHE), which has recorded a gain of 13.9 percent since November. Both performances mirrored the trajectory of the S&P 500, which has seen a 14 percent increase over the same period. Notably, Philippine stocks outperformed the MSCI Emerging Markets ETF (EEM) which registered a more modest gain of 6.8 percent.

Stocks thrive in ‘soft-landing’

A positive outlook for stocks in 2024 is expected under a “soft landing” scenario where inflation is declining, interest rates are lowered by the Fed, and the economy slows down but avoids a recession. This favorable situation will likely lead many emerging market central banks, such as the Bangko Sentral ng Pilipinas (BSP), to implement monetary policy easing. Such measures will positively impact on stocks, aligning with the broader trend of economic recovery.

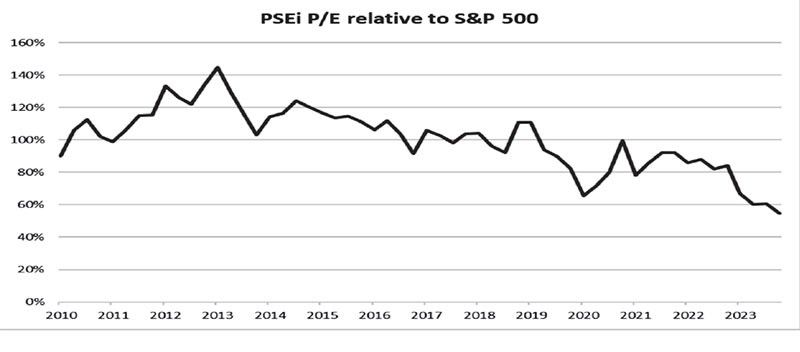

Low valuation suggests healthy upside

In recent years, emerging markets, including the Philippine market, have experienced a significant undervaluation compared to the US stock market. Currently, the PSE Index is valued at 12 times earnings vs. S&P 500’s 22 times. Between 2010 and 2016, the PSE Index consistently commanded a premium over the S&P 500. But today, it trades at a hefty 45 percent discount. The PSE index also trades at a discount compared to the region’s 14.2 times earnings.

Despite the recent surge in the PSE Index, its relatively low valuation indicates a significant upside. This offers opportunities for investors to capitalize on the ongoing market rally and potentially gain significant returns.

Source: Bloomberg, Wealth Securities Research

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending