Alternergy eyes P4 billion from green notes issue

MANILA, Philippines — Renewable energy firm Alternergy Holdings Corp. is tapping the green notes market to raise as much as P4 billion to support the development of its renewable energy projects.

Alternergy has appointed BDO Capital & Investment Corp. as the lead arranger for the fixed rate green corporate notes issuance.

The capital raising activity is intended for the development of the renewable power projects which the company won under the Green Energy Auction 2 (GEA 2) program of the Department of Energy.

Alternergy said its board has authorized management to discuss and negotiate on the terms of the notes.

The final terms and issuance of the notes will be subject to the approval of the company’s board.

“We are pleased to work with BDO Capital to support our capital raising initiative. Our green corporate notes will be used primarily to fund the construction of the Tanay and Alabat wind projects and other renewable projects in line with our overall strategy to expand our funding sources to include non-bank financial institutions,” Alternergy president Gerry Magbanua said.

Magbanua said BDO Capital, as mandated lead arranger, is tasked to tap insurance companies, pension funds corporate bank lenders and other primary institutional lenders to support the development of Alternergy’s triple play portfolio of renewable projects.

“With the board approval, Alternergy and BDO Capital are set to launch the fundraising with target financial closing by the first quarter of 2024,” Magbanua said.

“Over the past weeks, our Alternergy team has been conducting pre-marketing presentations with a core group of institutional investors, and we are encouraged by the positive feedback towards our track record and pioneering expertise in renewable project development,” he said.

A third-party certifier has also been tapped by Alternergy to allow the green labelling of its proposed corporate notes under the green bond framework.

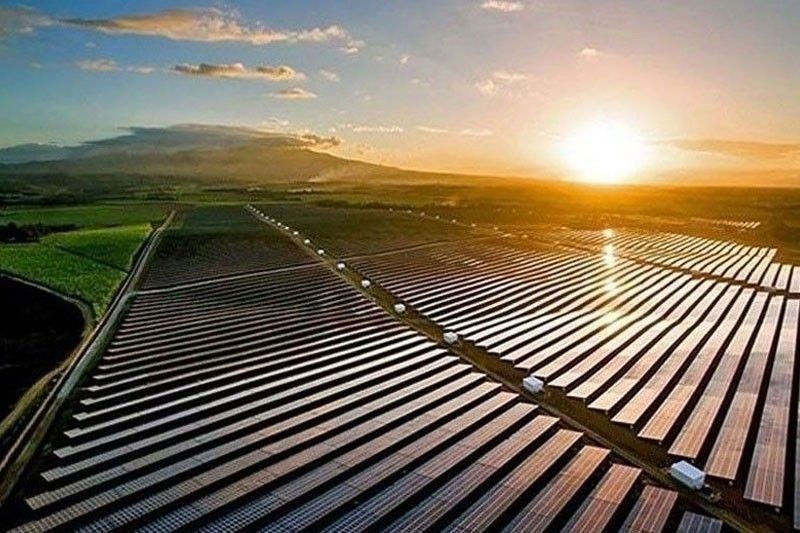

Alternergy has a portfolio of project companies engaged in different renewable energy projects, particularly wind, run-of-river hydro, solar farm and commercial rooftop, battery storage and offshore wind projects.

The company has been building up its capital backbone to fund its portfolio of renewable projects.

In early October, Alternergy stockholders approved the reclassification of a portion of its preferred shares into three series of non-voting perpetual preferred shares.

In November, Alternergy inked a private placement with the Government Service Insurance System covering P1.45 billion worth of preferred perpetual shares.

The company likewise tapped three investment banks – BPI Capital, RCBC Capital and SB Capital – as lead arrangers to raise P12 billion non-recourse project finance for the Tanay and Alabat wind power projects.

- Latest

- Trending