AboitizPower plans to tap new funding for early coal retirement

MANILA, Philippines — Aboitiz Power Corp. plans to tap low cost and long-term funding geared towards early coal retirement and reinvestment of proceeds to enable renewable energy.

“ETM (energy transition mechanism) is basically a sustainability-linked loan. So basically you try and access concessional capital, donor capital. People will try to lend you lower than market rates but you have to make commitments,” AboitizPower chief financial officer Juan Alejandro Aboitiz said.

“What they want to see in exchange for that discount is commitment to either like reduce emissions over a certain period of time or decommission your plants by some point in time. So those are things we’re studying,” he said.

AboitizPower president and CEO Emmanuel Rubio said the company is discussing options with financial institutions like the Asian Development Bank and the International Finance Corp. to look into ETMs.

“The way we’re approaching it is we’re not nominating specific plants, but capacities in periodic sequence because we believe the country still needs stable, reliable, and affordable electricity,” he said.

Aside from strengthening its environmental, social, and corporate governance practices, AboitizPower earlier said it is working to increase its understanding of ETMs and carbon offset markets to ensure that the company does not only manage risks, but also position itself well to maximize related opportunities.

ACEN Corp, the Ayala Group’s listed energy platform. announced in November last year the full completion of the world’s first ETM transaction, which will enable the early retirement of the 246-megawatt (MW) South Luzon Thermal Energy Corp. coal plant and its transition to cleaner technology.

The Department of Energy (DOE) is encouraging a voluntary early and orderly decommissioning or repurposing of existing coal-fired power plants in line with the country’s energy transition program.

It said a voluntary early and orderly decommissioning or repurposing of existing coal-fired power plants would be done while securing a stable supply and addressing the climate emergency by ramping up renewable energy to 50 percent share by 2040.

“In all of these, adequate and timely access to climate financing is crucial for the Philippines to equitably and effectively pursue its energy transition,” the DOE said.

On AboitizPower’s end, while it is pushing for the growth of renewable energy, it also acknowledges that other types of technology are still needed, specifically thermal baseload power which remains to be the cheapest source of electricity at present.

AboitizPower’s thermal business group currently manages and operates the thermal power generation assets of AboitizPower. Its coal and oil assets provide much needed baseload power to the Philippine grid.

“We still will be relying on thermal facilities like coal and liquefied natural gas (LNG). Both for coal and LNG, there is an issue with regard to variability of the cost of fuel which brings into the table the option of nuclear,” Rubio said.

AboitizPower expects nuclear energy to be a major part of the country’s energy mix, with the company seeing the technology as a potential source of reliable and clean baseload power for the country.

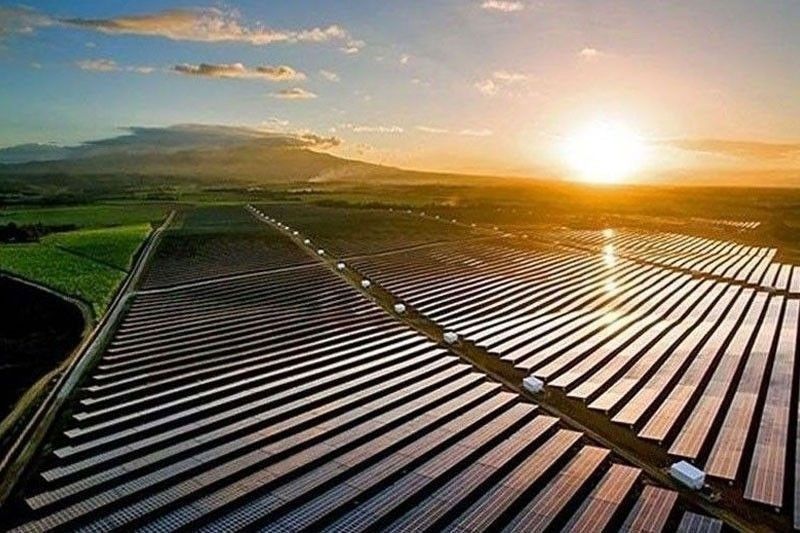

At present, AboitizPower is targeting a total of 4,600 MW of clean energy and a 50:50 balance between its renewable and thermal capacities by 2030.

Together with its partners, it currently has the largest and most diversified renewable energy platform in the Philippines in terms of installed capacity under its operational control.

- Latest

- Trending