Maharlika faces risk of fund misuse — Singapore-based think tank

MANILA, Philippines — A Singapore-based think tank raised red flags on the controversial Maharlika Investment Fund (MIF) due to the risk of its potential misuse of funds and lack of accountability.

A 79-page report by the Asean+3 Macroeconomic Research Office (Amro+3) released on November 27 pointed out that Maharlika has not clearly defined its role in infrastructure development which could lead to misuse of funds despite having a “strong legal framework” and a “potential to be successfully managed.”

“The authorities should clearly define its role in infrastructure investment with appropriate governance stipulated to avoid misuse of funds. The MIF should be run by professionals and the board should comprise independent directors,” the report said.

Despite not having a complete nine-member board of directors, Finance Secretary Benjamin Diokno said on Tuesday that the administration is confident that the MIF will be fully operational before the end of the year.

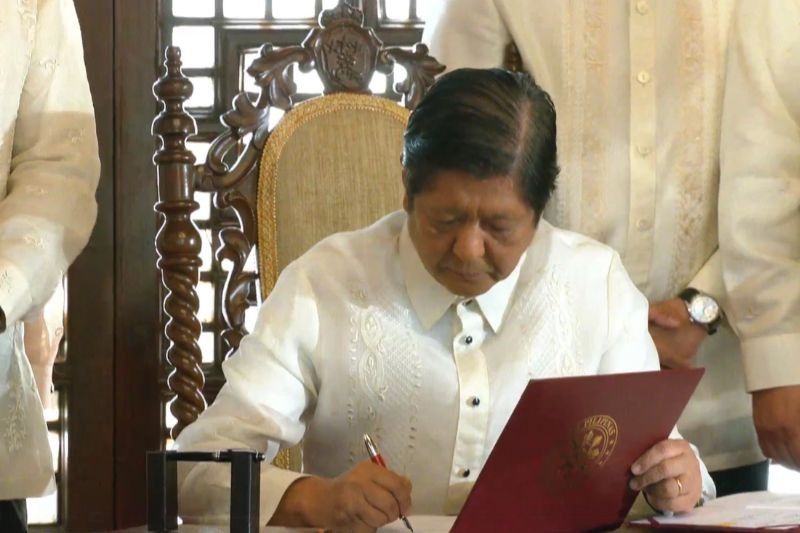

Among the board of directors of the Maharlika Investment Corp. (MIC) are three independent directors from the private sector which must be submitted by the MIC’s advisory board to President Ferdinand Marcos Jr.

At present, MIC President and Chief Executive Officer (CEO) Rafael Consing Jr. stands as the sole presidential appointment on the board. His actions, particularly the revision of MIF’s implementing rules and regulations, have drawn scrutiny from critics due to the removal of educational qualifications required for his position.

Others have highlighted his connection to past fraud cases, a factor that disqualifies an individual from board membership in MIF. Nevertheless, Consing clarified that the cases he was associated with have already been resolved and cleared.

As a former governor of the Bangko Sentral ng Pilipinas (BSP), Diokno currently serves as a member of the MIC's board of directors, holding the position of chairman in his ex-officio capacity as the finance secretary.

The remaining board of director positions consist of two regular directors appointed by Marcos, along with the CEOs of the Landbank of the Philippines (LBP) and the Development Bank of the Philippines (DBP).

The think tank also highlighted the potential conflicts arising from different objectives within the MIF, which could pose challenges in certain investment scenarios.

“Given the MIF has to ensure long-term value and promote socio-economic development, there could be a risk that the different goals might be at odds with each other in some investments, for instance, there could be a trade-off between the rate of return and the public good nature of certain projects,” the think tank said.

In a press briefing on November 15, Consing said the priority for the MIF will be some projects approved by the National Economic and Development Authority board.

AMRO, established in February 2016, is an international body tasked with performing regional macroeconomic oversight. It monitors, evaluates, and reports on economic and financial situations and forecasts within the ASEAN+3 region, comprising the 10 member states of the Association of Southeast Asian Nations (ASEAN), along with China, Japan and South Korea.

Not a sovereign wealth fund

Amro+3 also noted that the MIF leans more towards being a "national investment" fund rather than a sovereign wealth fund.

Citing examples from other countries that have sovereign funds, the think tank explained that a sovereign fund typically invests surplus revenue from natural resources like oil, similar to the United Arab Emirates, or fiscal surpluses, akin to Singapore’s Government Investment Corp.

“The MIF is a national investment fund mainly investing within the country to support national development strategies, similar to the Indonesia Investment Authority, and Temasek Holdings,” the thinktank said.

Indonesia Investment Authority and Temasek Holding have a similar mandate to the MIF which invests in local infrastructure for the economy’s development.

According to the Department of Finance, the goal of the MIF is to “promote sustainable economic development by making strategic and profitable investments in key sectors” to be done “through public-private partnerships and co-investments.”

They also pointed out the benefits that can be expected from the MIF:

- Enhancing investment capital: the MIF is poised to serve as a long-term source of investment capital that will foster economic growth and job creation.

- Promoting infrastructure development: the MIF can be used to finance various infrastructure projects, such as roads, bridges, and airports, improving connectivity and enhancing the country’s attractiveness to investors.

- Boosting foreign investment: by attracting foreign investment, the MIF can draw in fresh capital and technology.

Financial positions of contributing gov't institutions

The think tank also emphasized that the MIF's capital size might impact the standing of certain government financial institutions, noting that the capital is "relatively small" compared to the investible funds it oversees.

“The contributions to the MIF’s capital from government financial institutions (GFIs) are relatively small compared with the size of their investible funds, there could be some impact on the institutions’ financial position in the event of losses,” Amro+3 said.

The MIF, expected to have a capitalization of P500 billion, currently holds a capital derived from P50 billion from LBP and P25 billion from the DBP, both remitted last September.

In October, the two state-run banks asked the BSP for regulatory relief to keep up with the required capital adequacy ratio (CAR). This came after purported weakening due to the remittance of the initial capital for the fund.

However, the LandBank said that it is above the BSP’s required 10% CAR just a day after Marcos granted the bank an exemption from remitting its legally mandated annual net earnings for 2022.

In a press conference on November 15, Consing assured that the two-state run banks do not need to withdraw their remitted capital as it will be used to “generate returns.”

“When you put in a seat capital for a company you’re not thinking about how I am going be exiting (but) you want to be able to generate returns out of it. And that’s exactly how are we doing it,” he said.

A part of the MIF's initial capitalization, amounting to P50 billion, will stem from the national government. This will include a portion of the dividends (100%) from the BSP remitted to the national government during the first and second fiscal years following the MIF's commencement. The BSP contribution is yet to be remitted.

The BSP’s earnings plunged by 71% in eight months to P22.91 billion from January to August compared with last year’s P78.82 billion. Last June, Diokno reassured that the contribution from BSP to the MIF would not compromise the bank's stability.

The report on the Philippines, encompassing notes regarding the MIF, resulted from AMRO's latest yearly consultation mission. This mission occurred during a visit spanning from August 29 to September 8.

“Amro recognizes the authorities’ ambition to step up investments in infrastructure, long-term development, and sustainable growth,” the think tank said.

“However, at the operational level, it is essential for the authorities to closely monitor the MIF and its management body, the Maharlika Investment Corp., to ensure that the objectives are achieved, the country’s long-term development needs are met, and the governing law is strictly adhered to,” it added. — with reports from Elijah Felice Rosales, Lawrence Agcaoili, and Cristina Chi.

- Latest

- Trending