OFW remittances up 2.6% in September

MANILA, Philippines — Remittances from overseas Filipino workers (OFWs) increased at a slower pace of 2.6 percent in September from 2.8 percent in August amid the economic slowdown in some host countries, according to the Bangko Sentral ng Pilipinas (BSP).

Data released by the BSP showed that personal remittances reached $3.23 billion in September, $81 million higher than the $3.15 billon recorded in the same period last year.

Of the total amount, cash remittances coursed through banks amounted to $2.91 billion, $647 million higher than last year’s $2.84 billion.

China Bank chief economist Domini Velasquez said remittances from other major sources such as Germany and Japan may have weakened as their economies stalled.

Velasquez said that a slower wage growth in the United Kingdom may have also affected the earnings of OFWs.

“Remittances rose in September, albeit at a slightly slower rate as the surge in consumer prices may have encouraged OFWs to send money home,” she said.

According to Velasquez, remittances may have also experienced a boost from the strong economic growth seen in the US, the main source of remittances.

“Moving forward, we expect remittances to recover on the back of the easing inflation in host economies. However, the cooling labor market and the tensions in the Middle East will be downside risks to the upcoming remittances figures,” she said.

From January to September, the sum of net compensation of employees, personal transfers, and capital transfers between households grew by 2.8 percent to $27.24 billion versus last year’s $26.49 billion.

During the nine-month period, cash remittances also increased by 2.8 percent to $24.49 billion from $23.82 billion.

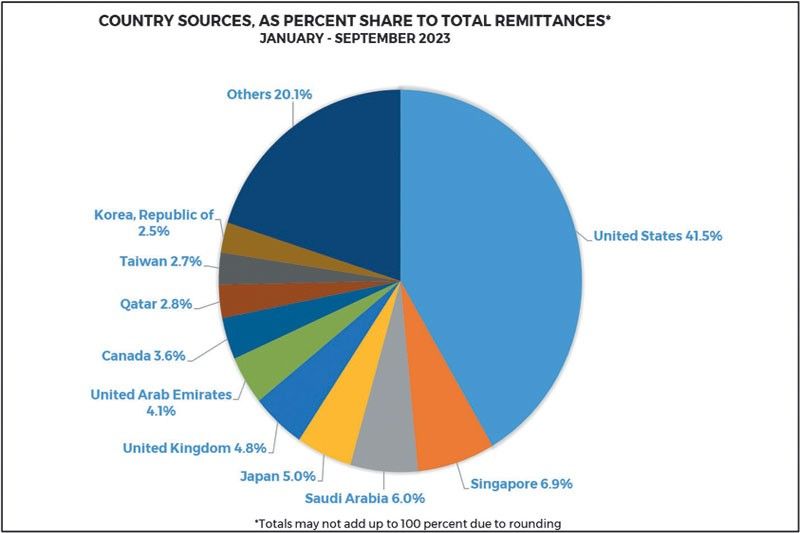

“The growth in cash remittances from the US, Saudi Arabia and Singapore contributed mainly to the increase in remittances in the first three quarters of 2023,” the BSP said.

Data showed that the US had the highest share of overall remittances with 41.5 percent, followed by Singapore with 6.9 percent, Saudi Arabia with six percent, Japan with five percent, United Kingdom with 4.8 percent, United Arab Emirates with 4.1 percent and Canada with 3.6 percent.

ING Bank senior economist Nicholas Mapa said OFW remittances continue to chug along, expanding by 2.6 percent in line with market expectations.

“Remittances continue to be a sizable and consistent source of foreign currency while also providing a nice lift to household spending via peso purchasing power once converted by beneficiaries,” Mapa said.

The economist from the Dutch financial giant expects remittances to continue to grow over the course of 2023 and into 2024.

The BSP missed its four percent growth target for the second straight year as remittances increased by only 3.6 percent in 2022. Personal remittances hit an all-time high of $36.14 billion last year, of which cash remittances hit a record high of $32.54 billion.

For 2023, the BSP lowered the target for both personal and cash remittances to three percent from four percent.

- Latest

- Trending