Landbank strong, well capitalized after P50 billion Maharlika infusion

MANILA, Philippines — State-run Land Bank of the Philippines maintained it remains strong and adequately capitalized even after freeing up P50 billion for the Maharlika Investment Fund (MIF).

In a statement yesterday, Landbank said it “remains strong, adequately capitalized, and compliant with regulatory requirements of the Bangko Sentral ng Pilipinas (BSP).”

This comes after Landbank and the Development Bank of the Philippines sought regulatory relief from the BSP for their contributions to Maharlika.

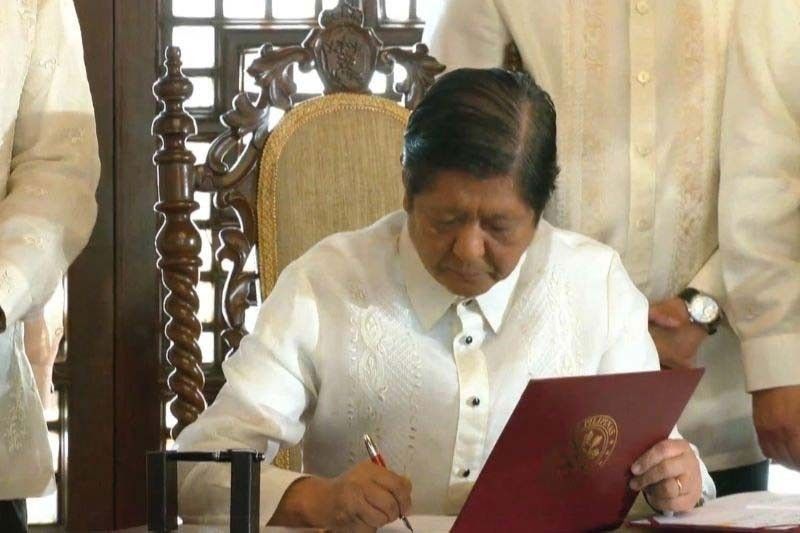

A few days later, President Marcos issued an executive order slashing Landbank’s dividend rate to zero from 50 percent upon the recommendation of the Department of Finance.

Under Executive Order 43, the move targets to “support the capital position of Landbank, maintain its compliance with BSP regulations on capital adequacy requirements, and expand its role in the economic recovery of industries adversely affected by the pandemic, in the interest of national economy and general welfare.”

“Even with the P50 billion seed capital to the MIF, the bank will meet its CAR (capital adequacy ratio) requirements,” Landbank said.

It should be noted that the BSP tracks the CAR and common equity tier 1 (CET 1) ratio of banks to ensure that they are capable of absorbing a reasonable amount of financial risks and still comply with statutory capital levels.

Both capital ratios are essential as it indicates a bank’s financial strength and how well it can weather financial challenges.

A higher CAR also means a bank is more financially stable and secure.

As of the first semester, Landbank’s CAR is at 16.61 percent, well above the 10 percent minimum requirement of the BSP.

On the other hand, its CET 1 stood at 15.73 percent which was also compliant with the 10.25 percent requirement.

As of end-June, Landbank’s total assets reached P3 trillion, up eight percent year-on-year, while net income settled at P20.9 billion on the bank of loans and investments earnings.

Outstanding loans to agriculture and rural development was at P713.8 billion, equivalent to almost 70 percent of its total portfolio of P1.04 trillion.

- Latest

- Trending