FDI inflow down 20 percent in 1st half

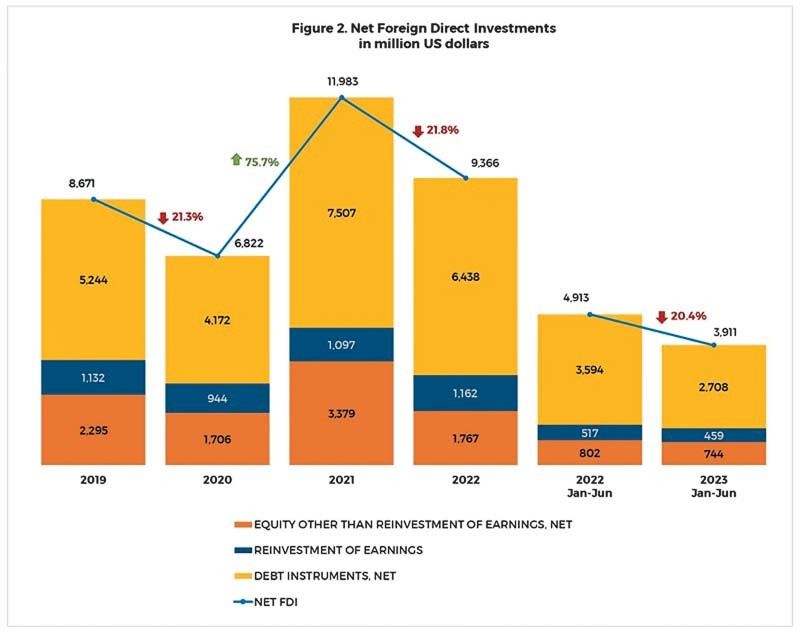

MANILA, Philippines — The inflow of foreign direct investments (FDIs) declined by 20.4 percent to $3.91 billion in the first half from $4.91 billion in the same period last year after hitting a five-month low in June, according to the Bangko Sentral ng Pilipinas (BSP).

The BSP said the slowdown in FDI inflow in the first semester could be attributed “largely to investor concerns over weak growth prospects amid persistent global uncertainties.”

Investments in debt instruments consisting mainly of inter-company borrowing between foreign direct investors and their subsidiaries or affiliates in the Philippines fell by 25 percent to $2.71 billion from January to June compared to $3.59 billion in the same period last year.

Total reinvestment of earnings decreased by 11.2 percent to $459 million during the six-month period from $517 million in the same period last year.

Equity other than reinvestment of earnings, likewise, slipped by 7.3 percent to $744 million from $802 million.

Equity infusions from Japan, Germany, the US, and Singapore rose by 3.5 percent to $923 million from $892 million. The inflows were channeled into manufacturing with 54 percent, real estate with 15 percent, as well as financial and insurance with 10 percent.

The BSP reported that withdrawals more than doubled to $180 million in the first half from $89 million in the same period last year.

For June alone, the net inflow of FDIs slipped by 3.9 percent to $484 million, the lowest since the $465 million registered in January from $503 million in the same month last year.

Investments in debt instrument increased by 11 percent to $283 million in June from $255 million a year ago, while reinvestments of earnings plunged by 26.8 percent to $89 million from $122 million.

Equity infusions primarily from Japan, the US, and Singapore that were channeled to manufacturing, real estate, as well as information and communication declined by eight percent to $132 million from $143 million, while withdrawals grew by 20 percent to $21 million from $17 million.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp., said FDIs may have been weighed by elevated inflation and higher interest rates that increased borrowing costs thereby reducing inflows in recent months.

Ricafort said uncertainties on the US debt ceiling, which was eventually resolved after the signing into law of the higher US debt ceiling by US President Biden last June 3, as well as some earlier uncertainties after some US mid-sized and regional bank failures since March added to market volatility and investor uncertainty.

For the coming months, Ricafort said increased business and economic activities as well as extended pause amid easing trend in inflation would further encourage more FDIs into the Philippines.

He also said the recent signing of the Philippines-South Korea free trade agreement (FTA) and the country’s membership into the Regional Comprehensive Economic Partnership (RCEP) are expected to boost trade, FDIs, employment and overall economic growth.

In 2022, the Philippines managed to exceed its FDI inflow target of $8.5 billion despite the 23.2 percent plunge in net inflow to $9.2 billion from an all-time high of $11.98 billion in 2021.

The BSP lowered its projections for the net inflow of FDIs to $9 billion from $11 billion this year and to $11 billion from $12 billion next year.

- Latest

- Trending