Dollar defies downgrades

The dollar confounded investors by strengthening after Fitch cut the US credit rating and Moody’s downgraded several US banks. Expectations were for the move to undermine the greenback. Instead, it extended its gains as yields on US Treasuries jumped post-downgrade. Ironically, the US dollar’s surge started Aug. 1, the day Fitch downgraded the US credit rating.

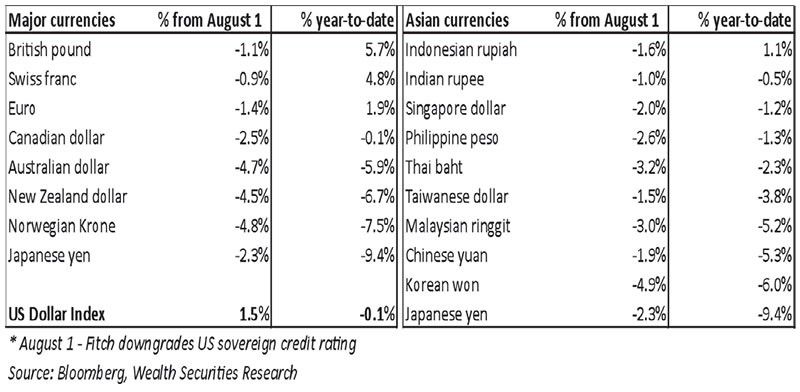

Asian currencies plummet

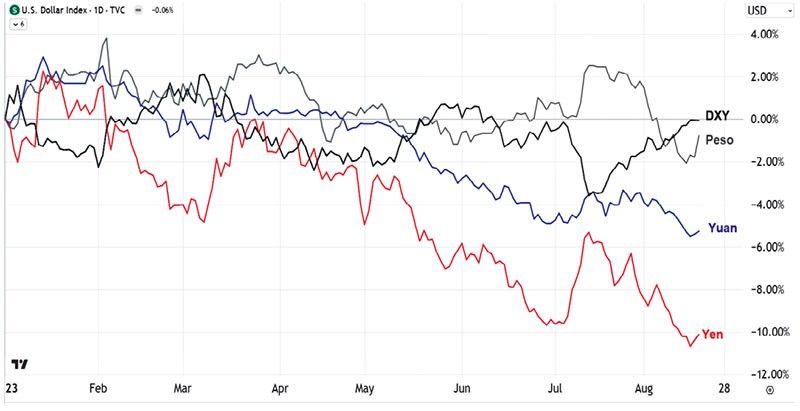

Year-to-date, the US dollar index (DXY) barely moved. This is masked by the euro and British pound’s strength, which together constitute 80 percent of the gauge. However, against Asian currencies, the dollar showed extreme strength. The Chinese yuan, Japanese yen, and South Korean won recently plunged to new lows for the year while the Philippine peso declined alongside regional currencies as Fed tightening and growth concerns battered Asian currencies.

Source: Trading.com

Higher yields underpin greenback gains

The Fitch downgrade pushed US Treasury yields higher as long-term yields are now at decade highs. The 30-year yield advanced to 4.426 percent, its highest since 2011. Both the five-year and 10-year US Treasury yields rose last week to near their 2022 highs.

Hawkish July FOMC minutes hinted at more hikes. This helped drive a sixth day of rising yields. Lured by higher yields, investors poured $127 billion into Treasury funds this year. Inflows to these funds are on pace to hit an annual record according to fund tracker EPFR Global.

Five percent world

Global bond yields are rising as investors recognize ultra-low rates may be gone for good. Bank of America warned the pre-2008 crisis “five percent world” could return. Blackrock and PIMCO said stubborn inflation could keep upward pressure on long-term rates.

This caused global stock markets to plunge. From Aug. 1 to 18, the benchmark S&P 500 Index dropped 4.6 percent and the MSCI All-Country Weighted Index (AWCI) fell 5.7 percent. In the same period, the MSCI Emerging Market Index and the Philippine Stock Exchange Index declined 8.5 percent and 4.6 percent, respectively.

Yuan sinks to 15-month low on gloomy China data

China’s dismal economic data weighed on the yuan and regional currencies. The yuan slid to a 15-month low against the US dollar last week, bringing its year-to-date decline to 5.3 percent. July data showed China’s banking sector loans at 14-year lows, exports dropping the most since 2020, consumer and producer prices falling, and youth unemployment soaring. The PBOC tried slowing the yuan’s decline by setting stronger fixings and adjusting overseas borrowing rules. Chinese authorities told state-owned banks to step up its intervention as the yuan fell toward the 7.35 level last week.

Deepening crisis in China property

Strains persist as liquidity concerns plague top property developer Country Garden, which missed bond payments. Meanwhile, struggling rival China Evergrande filed for bankruptcy protection in the US, highlighting China’s deepening property crisis. Adding to the financial turmoil, one of China’s largest private wealth managers Zhongrong International Trust Co. delayed payments on some trust products.

Match the Fed or risk currency slides

Regional currencies remain under pressure as investors price in a more hawkish Fed. This presents a dilemma for policymakers across Asia. Match the Fed’s rate hikes and face slowing growth, otherwise risk further currency slides. Note that the spread of 10-year US Treasuries over 10-year China government bond is now at 169 basis points, the highest since 2007. With the dollar strengthening, Asian monetary officials are carefully weighing the risks of falling behind the Fed tightening pace.

Remolona’s hawkish stance

While the BSP did not raise rates, BSP Governor Eli Remolona made hawkish statements. In an interview with CNBC last week, he said that the central bank would be ready to tighten further if needed. He added that the BSP has room to raise rates without sacrificing economic growth. Remolona also stated that the BSP is likely to keep policy rates steady at 6.25 percent and maintain its hawkish stance until Fed signals the start of easing cycle. His hawkish statements helped stabilize the peso.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit http://www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending