FDI inflows down 18% in 4 months

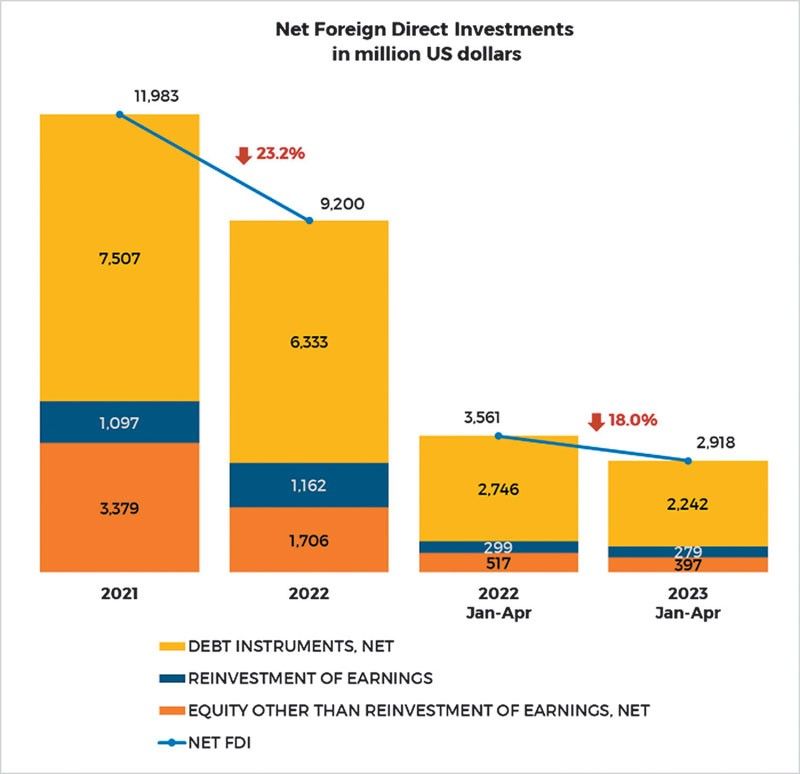

MANILA, Philippines — The inflow of foreign direct investments declined by 18 percent to $2.92 billion in the first four months from $3.56 billion in the same period last year due to concerns over slowing economic growth and relatively high inflation globally.

Latest data released by the Bangko Sentral ng Pilipinas (BSP) showed that investments in debt instruments, consisting mainly of intercompany borrowing between foreign direct investors and their subsidiaries or affiliates in the Philippines, decreased by 18.3 percent to $2.24 billion from January to April compared to $2.75 billion in the same period last year.

Likewise, total reinvestment of earnings slipped by 6.6 percent to $279 million during the four-month period from $299 million in the same period last year.

On the other hand, equity other than reinvestment of earnings dipped by 23 percent to $397 million from $517 million.

Equity infusions from Japan, Singapore and the United States slipped by 7.1 percent to $535 million from $576 million. The inflows were channeled into manufacturing, real estate as well as financial and insurance.

On the other hand, equity withdrawals surged by 132 percent to $137 million in the first four months of the year from $59 million a year ago.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp., said the slower net FDI in previous months may have to do with higher inflation, as well as global interest rates that tend to weigh on investments.

As the US Federal Reserve continues to raise rates to significantly bring down elevated inflation, Ricafort said this has increased the risk of recession in the world’s largest economy.

For April alone, the BSP said the net FDI inflow declined by 14.1 percent to $876 million from $1.02 billion in the same month last year.

“The decline in FDI may be attributed to concerns over slowing economic growth and relatively high inflation levels globally,” the BSP said.

Investments in debt instruments declined by 7.7 percent to $663 million in April from $719 million in the same month last year, while reinvestment of earnings fell by 19.4 percent to $77 million from $95 million.

Likewise, equity infusion from Japan, the US and Singapore decreased by 7.1 percent to $158 million from $224 million, while outflows went up by 24.4 percent to $22 million from $18 million.

China Bank chief economist Domini Velasquez said the muted FDI inflow could largely be traced to a slowdown in the global economy and risk-averse sentiment of investors.

“A global recovery next year should help bolster investor interest,” Velasquez said.

She added that hard earn structural reforms such as laws and rules liberalizing industries should help boost FDI in the medium term.

According to Velasquez, there is still demand based on investments approved by both the Board of Investments (BOI) and the Philippine Economic Zone Authority (PEZA).

For the coming months, Ricafort said net FDIs could pick up further amid easing trend in inflation and in global commodity prices that reduce the cost of FDIs as well as the eventual easing of interest rates especially into 2024.

After raising key policy rates by 425 basis points, the BSP extended its prudent pause as it kept interest rates untouched during the back-to-back rate-setting meetings in May and June due to the inflation downtrend and robust gross domestic product (GDP) growth in the first quarter.

Inflation cooled to 5.4 percent in June from 6.1 percent in May and averaged 7.2 percent in the first half, still above the central bank’s two to four percent target range.

The BSP could consider cutting interest rates once inflation eases back to within the two to four percent target range by the fourth quarter of this year.

In 2022, the Philippines managed to exceed its FDI inflow target of $8.5 billion despite the 23 percent plunge in net inflow to $9.2 billion from an all-time high of $11.98 billion in 2021.

The BSP sees the net inflow of FDIs decreasing to $9 billion this year before rising to $11 billion next year.

- Latest

- Trending