2023 mid-year report

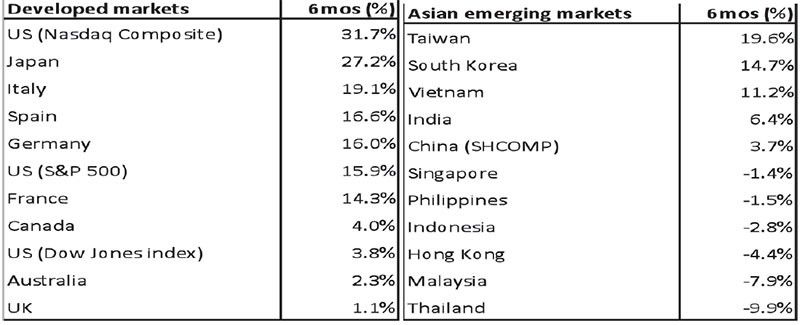

In stark contrast to the performance last year, developed market equities delivered strong gains during the first half of this year. The confluence of AI-driven enthusiasm, lower inflation, better-than-anticipated corporate profits, resilient US economic growth, and improved sentiment has fueled the impressive gains posted this year.

Best H1 in 40 years

Leading the charge is the tech-heavy Nasdaq Composite, which posted its best Jan. 1 to June 30 return since 1983. The Nasdaq index surged by a staggering 31.7 percent. The S&P 500 registered its strongest performance since 2019 with a solid 15.2 percent return.

European equities have not been left behind in this impressive stock market rally. This is bolstered by the recent retreat in energy prices and signs of economic resilience. Europe’s Stoxx 50 index, widely regarded as a key benchmark for European markets, has surged by a substantial 16 percent. This marks its most significant first half return since 1998.

While China and a significant portion of Southeast Asia have struggled to participate in this ongoing rally, Taiwan and South Korea emerged as standout performers with gains of 19.6 percent and 14.7 percent, respectively. These two countries benefited from the exceptional performance of their semiconductor and technology sectors that are riding the wave of expanding AI applications.

Source: Bloomberg

The Magnificent Seven

Investor enthusiasm surrounding investments in generative artificial intelligence software has been crucial in driving the rally this year. At the forefront of this extraordinary performance are the so-called “Magnificent Seven,” a group of mega-cap growth stocks that have played an instrumental role in propelling the market forward. This distinguished iconic list consists of Microsoft, Nvidia, Tesla, Meta, Apple, Amazon, and Alphabet.

Microsoft ignites AI race

Microsoft propelled the AI race into higher gear with a substantial $10 billion investment in OpenAI, strategically positioning itself to dominate the burgeoning early AI market. Microsoft aims to leverage the capabilities of ChatGPT, OpenAI’s advance language model. This strategic move has generated significant investor enthusiasm, driving Microsoft shares to soar by an impressive 42 percent in the first half of this year.

Nvidia’s phenomenal growth

Nvidia experienced a spectacular 189.5 percent surge in its stock price in the first half of the year. This meteoric rise can be primarily attributed to the soaring demand for Nvidia’s chips which play a vital role in training advanced programs like OpenAI’s ChatGPT. As the interest in AI applications continues to escalate, Nvidia finds itself among the elite group of trillion-dollar companies.

Tech giants join the AI revolution

Joining the AI revolution, other tech giants have embarked on their own AI initiatives. Meta Platforms, formerly known as Facebook, has experienced a notable stock price increase of 138.5 percent, while Tesla, Amazon, Apple and Alphabet have seen respective gains of 112.5 percent, 55.2 percent, 49.3 percent, and 35.7 percent. These companies are integrating AI tools and technologies into their products and services, recognizing the immense potential and transformative power of artificial intelligence.

Apple hits $3 trillion

Apple has made history as the first company to breach the astounding $3 trillion market capitalization threshold. The tech giant’s shares soared to unprecedented heights, reaching a new record price of $193.97 per share last Friday. Remarkably, the stock now stands six percent above its previous high of $182.94, which was achieved during the peak of January 2022.

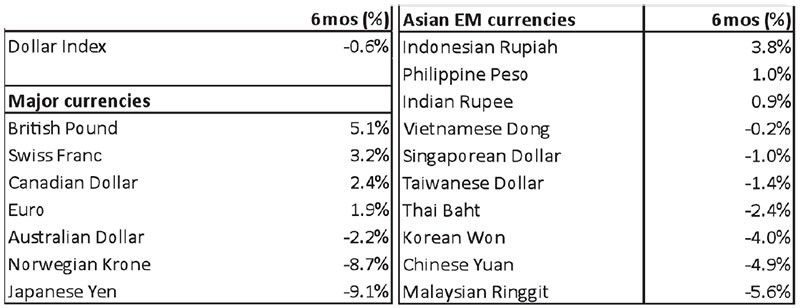

Divergent currency performance

Throughout the first half of this year, the US dollar index has largely remained range bound. After weakening by as much as 10 percent from a 20-year high in September 2022, the index has been consolidating between the 100 and 106 range. Amid this consolidation, major currencies have shown diverse performances. The British pound, Swiss franc, Canadian dollar, and the euro has shown stability and strength, respectively gaining 5.1 percent, 3.2 percent, 2.4 percent and 1.9 percent against the US dollar. In contrast, the Norwegian krone and the Aussie dollar moved in the opposite direction, losing 8.7 percent and 2.2 percent.

Source: Bloomberg

Weak yen, steady peso

The Japanese yen and the Chinese yuan have weakened considerably. The yen has declined 9.1 percent as the Bank of Japan maintains an accommodative monetary policy stance. The yuan has depreciated by 4.9 percent as the Bank of China initiates a stimulus package to revive its economy. Despite all the volatility in the currency markets, the Philippine peso performed remarkably well compared to its peers. It gained one percent against the US dollar in the first half of this year.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending