Sugar and rice: Key drivers of Phl inflation

Food expenditure is a significant portion of Filipino family budgets. A family spends an average of around 40 percent on food, a large part of which is spent on rice. As a result, changes in food prices substantially impact household budgets and overall inflation in the country. In the Philippines, the prices of key imports like sugar and rice significantly influence inflation levels. Despite the decline in oil prices, rising food inflation and elevated prices for sugar and rice have driven overall inflation in the past year. This article delves into the current trends in the sugar and rice markets, shedding light on their prevailing dynamics.

Resilient sugar and rice prices

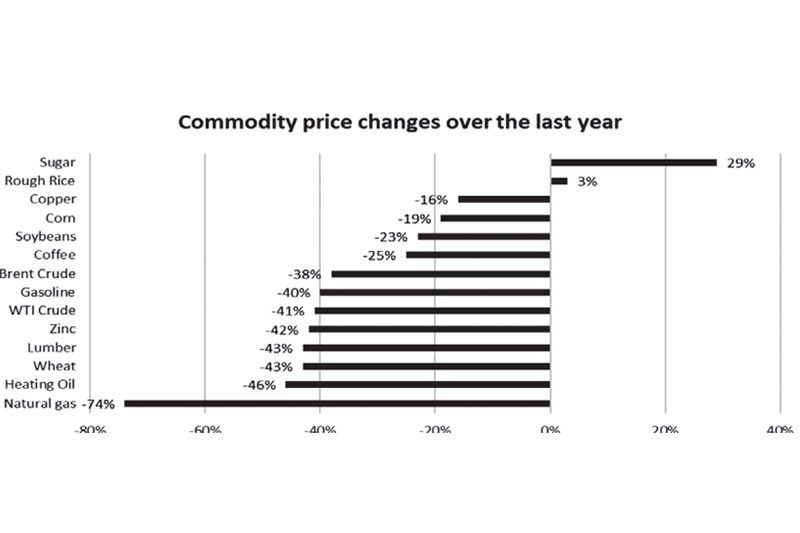

Over the past year, prices have been on a downward trend for most commodities. While prices across various sectors experienced significant declines, sugar and unhusked rice demonstrated resilience. Year-on-year, rice is up three percent and sugar is up 29 percent.

Source: Bloomberg, Wealth Securities Research

Unprecedented sugar surge

Driven by mounting concerns surrounding El Nino weather patterns and its implications for global supply, sugar prices soared to levels not seen in over a decade last April The severe heatwaves and drought conditions experienced in key sugar-producing countries such as India, China, Thailand, Mexico, and the EU resulted in significant crop losses. Moreover, the surge in fertilizer prices, as a consequence of Russia’s invasion of Ukraine, weighed heavily on productivity and added to the complexities of the sugar market.

Sugar price reversal?

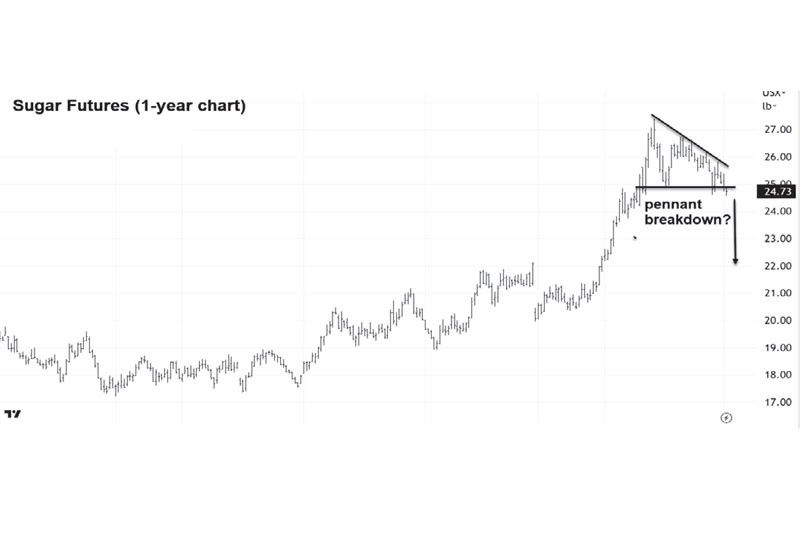

The bullish run in sugar prices experienced a shift in momentum in recent weeks. Following its peak at 27.41 cents per pound in late April, the market consolidated with prices closing at five-week lows by the end of last week. Brazil’s report of a significant increase in sugar production by mid-May contributed to this sentiment shift. The closing price of 24.73 last Friday suggests a potential breakdown of pennant formation, signaling the possibility of prices retracing back to previous support levels around 22.

Source: Tradingview.com, Wealth Securities Research

Record rice shortfall in 2023

Rice production faced significant challenges due to adverse weather conditions. Heavy rains and flooding in China and Pakistan caused a sharp decline in output leading to supply constraints. Projections for this year indicate the largest rice deficit in two decades, underscoring the magnitude of the shortfall.

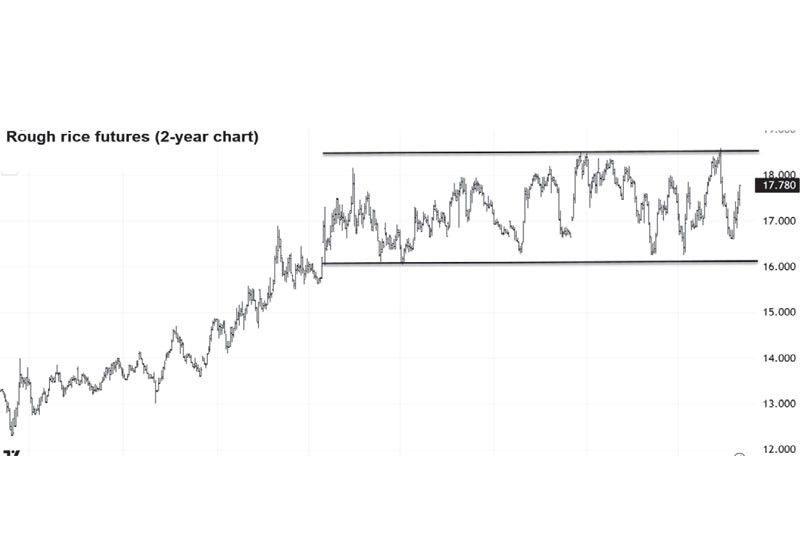

Rice prices near decade highs

Over the past year, rice prices have largely traded between $16 per hundredweight (cwt) and $18.60 per cwt. However, the current price of rice is positioned near the upper threshold of its trading range observed over the past decade. This suggests a lingering vulnerability, with the potential for an upward breakout that could propel rice prices to higher levels.

Source: Tradingview.com, Wealth Securities Research

Policymakers’ role in price stability

The volatility in sugar and rice prices, coupled with factors such as exchange rate fluctuations and import policies, significantly influence the cost of imported sugar and rice in the Philippines. These fluctuations can sway overall price levels, particularly within the food component of the consumer price index. Policymakers must remain vigilant in monitoring prices and managing their impact on food inflation as any change directly affects household budgets and exert an undeniable influence on inflationary dynamics.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending