The last hike

The Federal Open Market Committee (FOMC) is set to meet this week, and experts predict that the central bank’s year-long campaign of monetary tightening may come to an end with what could be its last hike. With inflation showing signs of cooling, major bank failures causing a credit crunch, slowing economic growth, and the possibility of recession, the central bank may be ready to pause its tightening cycle. Over the past year, the FOMC has raised interest rates nine times to bring inflation back to normal. The pace of rate hike is the fastest in 40 years and the largest in such a short time.

One more move shoul be enough

Many investors in the bond market are anticipating a final 25-basis point hike at the upcoming meeting. This would bring the Fed funds rate to five to 5.25 percent, the highest since 2006. The FOMC’s latest “dot-plot” forecast indicates only one more rate hike this year. This aligns with the bond market’s expectations after the Fed signaled its intention to end its policy of raising rates. Recently, some Fed members have hinted at what to expect from the May meeting. Atlanta Fed president Raphael Bostic said, “One more move should be enough for us” when asked about interest rates on April 18.

Furthermore, the Fed’s March meeting minutes revealed subtle changes to its language that suggest it is approaching the end of its tightening cycle. The policy statement now commits to “some additional policy firming” to combat inflation, replacing the phrase “ongoing rate increases.”

Implications on currencies

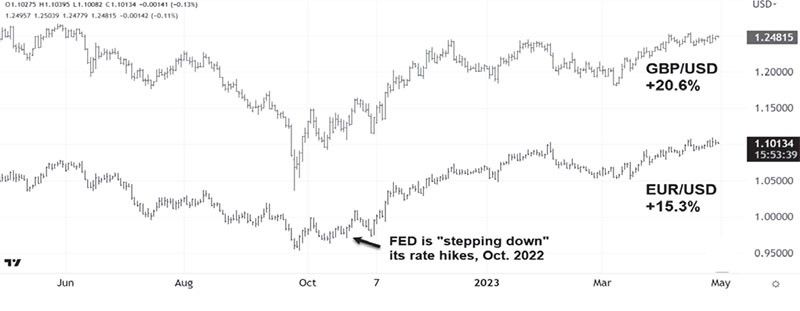

Global currencies have rallied strongly since the Fed signaled it was “stepping down” its interest rate hikes last October 2022. The British pound and euro have emerged as top performers, with an impressive increase of 20.6 percent and 15.3 percent, respectively, from their lows against the US dollar. As the Fed approaches its last hike, there is a possibility that the US dollar may remain weak, which could provide further support for the pound and euro.

EUR/USD & GBP/USD rates

Source: Tradingview.com, Wealth Securities Research

The interest rate differential between Europe and the US is expected to narrow as the European Central Bank tightens monetary policy, and growth differentials between the two regions also shrink. Additionally, higher bond yields in the Eurozone are expected to bolster the euro, while the pound will benefit from the erosion of US growth and interest rate premium.

Emerging market presents opportunities

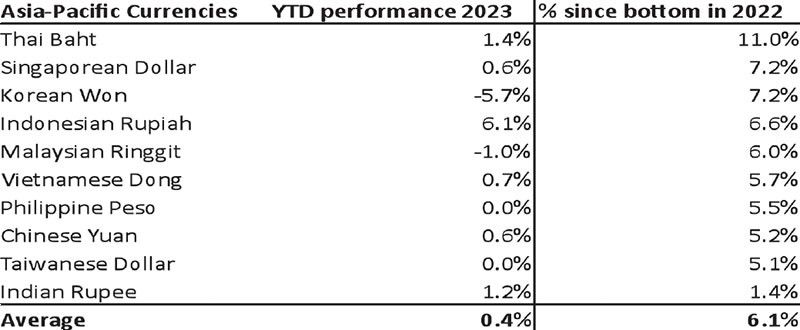

The peaking of global interest rates, combined with signs of a slowing US economy, is creating opportunities for investors to revive carry trades in emerging markets. This strategy involves borrowing lower-yielding currencies to invest in those with higher yields. Some emerging market economies are expected to perform well even if the US slows down, making this strategy more attractive. Asian EM currencies have returned an average of 6.1 percent since the US dollar peaked in September/October 2022.

The IMF projects that emerging economies will continue to grow faster than the US, allowing them to maintain their interest-rate advantage. The US economy is expected to slow down, with growth rates of 1.4 percent this year and one percent in 2024. In contrast, emerging markets are projected to accelerate with growth rates of four percent this year and 4.2 percent next year.

Very dangerous

Despite the recent slowdown in inflation and the possibility that this could be the Fed’s last rate hike, it would be risky for the Bangko Sentral ng Pilipinas (BSP) to change its monetary tightening policy ahead of the Fed. Last week, BSP Governor Felipe Medalla clarified the necessity of keeping policy rates higher than those of the Fed. Medalla emphasized that loosening policy settings faster than the Fed would be “very dangerous” and could harm the peso. He also pointed out that alternative tools are available to help the economy, such as reducing the bank reserve requirement ratio. With this clarification, the Philippine peso rebounded by one percent last week, closing at 55.38 against the US dollar after hitting a four-month low of 56.47 the previous week.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending