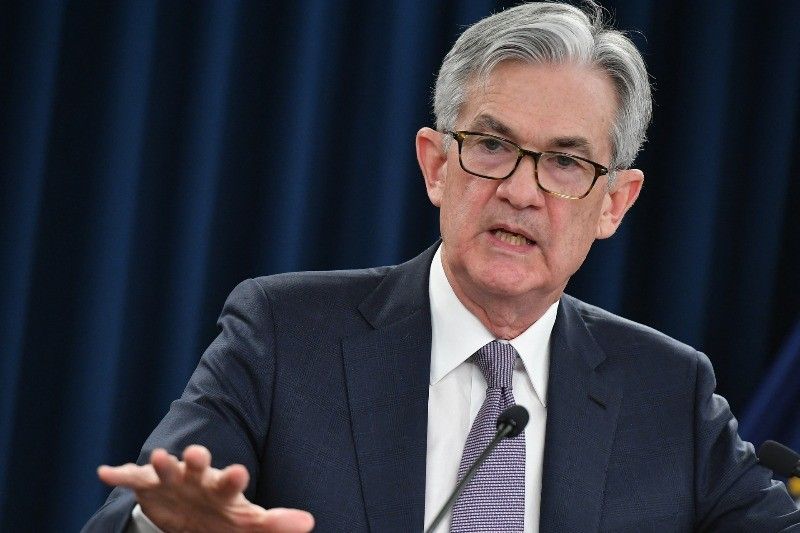

Stocks tread water after shock over Powell rate warning

NEW YORK, United States — Stock markets were mixed on Wednesday after Federal Reserve chief Jerome Powell triggered a rout a day earlier by warning that higher interest rate hikes might be needed to tame stubborn inflation.

Wall Street's main indices moved in opposite directions, with the S&P 500 and Nasdaq Composite edging higher while the Dow dipped.

In Europe, both London and Frankfurt mustered small gains, while Paris slid.

Asian indices mostly ended lower after Powell on Tuesday dealt a hammer blow to faint hopes that the US central bank could pause its rate tightening soon.

Powell told US lawmakers that the "ultimate level of interest rates is likely to be higher than previously anticipated" as economic data had come in stronger than expected.

He addressed US lawmakers again on Wednesday, saying Fed policymakers would look at all the available data before making a decision.

Analysts fretted over a US bond market indicator that has historically been a warning sign of recessions: the gap in yields between the two- and 10-year Treasuries, with the shorter-term issue higher.

This "inversion" of the norm "is adding to investors' worries," said Sam Stovall, chief investment strategist at CFRA Research. "Whenever we have a deep inversion... that has pointed to recession in the past."

Fresh data on Wednesday showed that US private hiring also picked up in February -- another indication that more effort might be needed to cool the world's biggest economy.

European Central Bank president Christine Lagarde, whose institution has been hiking rates to control inflation as well, made her own pledge on Wednesday to "do whatever it takes" to restore price stability.

The dollar was mixed after hitting multi-month highs against the euro and other major currencies.

The oil market fell again Wednesday after tumbling more than three percent in the wake of Powell's comments.

A strong US currency weighs on dollar-denominated crude prices, which become more expensive for customers purchasing in other currencies.

- Latest

- Trending