China’s recovery boosts peso

Marking their first weekly gain in over a month, Asian currencies ended the week on a high note, The upbeat sentiment came after China’s service sector expanded at a faster-than-expected pace in February. Adding to the optimism was an earlier announcement that manufacturing activity grew at the fastest rate in over a decade. As a result, the Chinese yuan strengthened by 0.75 percent for the week, lifting the Bloomberg-JP Morgan Asian Dollar Index (ADXY) by 0.58 percent.

China’s strong economic numbers propelled Asian currencies higher, with the Indian rupee and the Thai baht surging 0.95 percent and 0.80 percent for the week. The Philippine peso gained 0.30 percent and closed the week at 54.82 against the US dollar. The ADXY’s high correlation with the peso indicates that the broader Asian currency market may have contributed to the peso’s gains.

ADXY – An alternative peso barometer

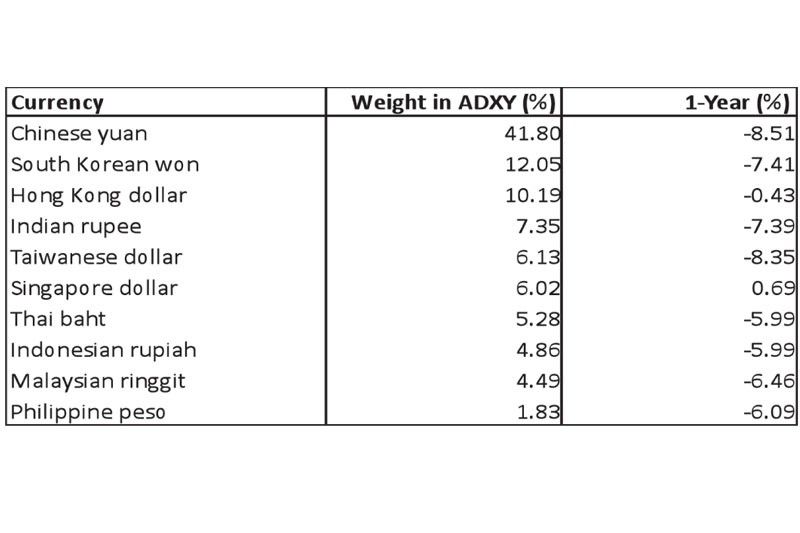

In addition to the widely used US Dollar Index (DXY), the ADXY is an alternative barometer for the Philippine peso. The ADXY comprises a basket of 10 Asian currencies, including those of prominent economies like China, Hong Kong, South Korea, India and Singapore, to which the Philippine peso is connected. The index, thus, provides a better indication of economic and political conditions in the region that directly impact the Philippine economy. While country-specific factors also play a role in the peso’s performance, its connection to regional economies make ADXY an important indicator for investors monitoring the peso. Over the past year, the currency has depreciated by 6.09 percent against the US dollar, similar to ADXY’s 6.5 percent decline.

Source: Bloomberg, Wealth Securities Research

The table above shows that the Chinese yuan holds the highest weighting in ADXY with 41.8 percent, followed by the South Korean won at 12.05 percent, the Hong Kong dollar at 10.19 percent, and the Indian rupee at 7.35 percent. The Philippine peso constitutes a 1.83 percent weighting in the ADXY basket.

China recovery bolsters Asian prospects

Asia is the region that benefits most from China’s economic reopening. A steady recovery in China could help improve the prospects of Asian economies this year. It could also provide a much-needed boost to the Philippine peso and other Asian currencies, which have been weighed down by concerns over persistent inflation, rising bond yields, and the strengthening US dollar.

Slow and steady approach

Atlanta Fed president Raphael Bostic’s remark last Thursday quelled the surging US yields and weakened the dollar. Bostic urged a moderate monetary tightening path, citing the necessity of a “slow and steady” approach, notwithstanding the recent strong US jobs market data. As a result, the 10-year US Treasury yields fell below the critical four percent level, ending a four-week slump for US equities.

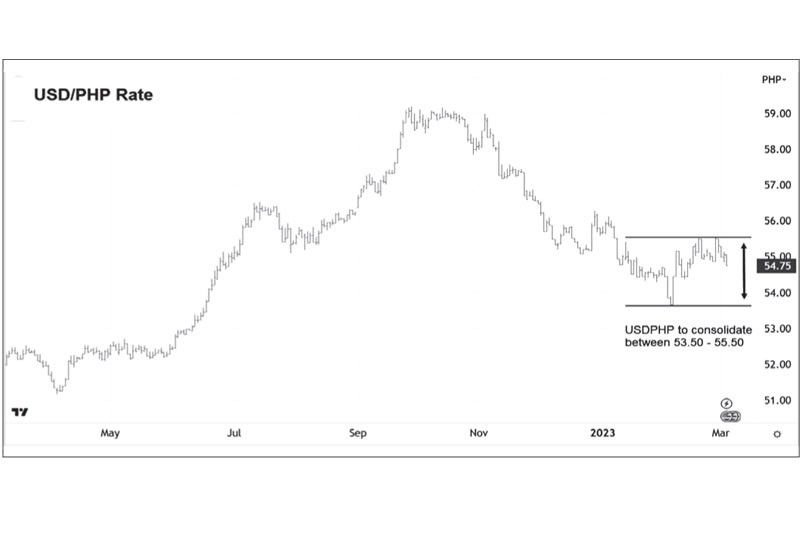

Technicals indicate peso consolidation

After reaching 55.51 last week, the Philippine peso has rallied to close at 54.82 last Friday. This rebound in the peso was largely attributed to the strong Chinese PMI numbers. Technicals suggest it is likely to experience a period of consolidation in the near term, with levels expected to range between 53.50 and 55.50. Overall, the peso’s recent performance highlights the currency’s sensitivity to external factors and underscores the need for investors to remain attuned to global economic trends.

Source: Bloomberg, Wealth Securities Research

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending