Oil slump signals recession

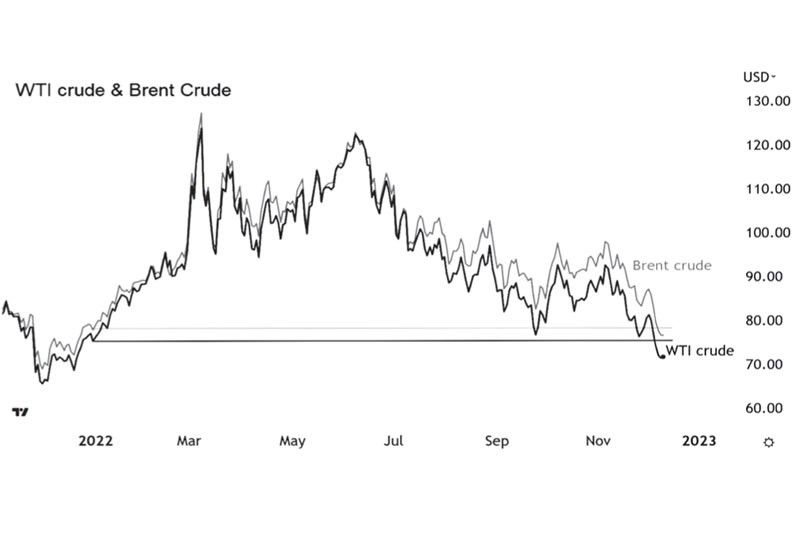

Recent price movement of financial assets and commodities is showing that investors are now more concerned about recession rather than inflation. One of the signals that is foreboding a recession is the oil price slump. Global oil prices have crashed more than 20 percent even as China loosens up its COVID restrictions and Western nations agree to a price cap on Russian crude. US West Texas Intermediate (WTI) crude tumbled to a low of $70.08 per barrel last Friday from a recent high of $93.74 just a month ago on Nov. 7. Likewise, Brent crude dropped to a low of $75.35 per barrel from a high of $99.52 per barrel over the same period.

Erasing year-to-date gains

The recent oil price decline erased crude oil’s gains for the year. At one point, WTI crude was up 74 percent when it hit a 13-year high of $130.5 per barrel last March. However, it is now down 4.8 percent for the year. Similarly, Brent crude was up 77 percent at its March highs but is now down 1.3 percent for the year.

Source: Tradingview.com, Wealth Securities Research

Demand destruction > supply destruction

Recent headlines about the oil market focused on supplies. OPEC+ pledged in early October to cut production by 1 to 2 million barrels per day from November. Meanwhile, Europe’s embargo of Russian seaborne crude took effect last week. The anticipation of these events supported oil prices throughout October and early November. But by late November, the underlying deterioration in demand has become apparent. The IEA downgraded its demand forecast for crude oil, expecting a slowdown of 1.6 million barrels per day in 2023, on top of the contraction of 240 thousand barrels per day in 4Q 2022.

Traders adjust positioning

The decline in oil prices accelerated as investors adjusted year-end positioning. According to a Bloomberg report, Brent’s open interest fell to its lowest since 2015 as hedge funds and other money managers liquidated their positions in the year’s final month. This liquidation may have exaggerated the recent decline in oil prices.

Risk appetite remains low

Risk appetite remains low as investors digest the latest economic data pointing to a US slowdown and a recession in energy-starved UK and Europe. Even the news that China is loosening its long-standing zero-COVID measures and PBOC’s promise to ease monetary conditions in the world’s second-largest economy failed to lift oil prices. Meanwhile, Saudi Arabia cuts oil prices for Asia to their lowest in 10 months, indicating that demand remains tepid.

Recession warnings are growing

In concurrence with what the oil market is saying, some CEOs of top global investment banks are already sounding the alarm bells on the economy. During an interview with CNBC’s Squawk Box last week, JP Morgan Chase’s Jamie Dimon warned of a “mild to hard recession” next year as a slowing economy and runaway inflation hurt consumer spending. At the Wall Street Journal’s CEO Council Summit, Goldman Sach’s David Solomon said that “recession is likely, with a 35 percent chance of a soft landing.” Bank of America’s Brian Moynihan and Wells Fargo’s Charlie Scharf expect a recession in 2023. Meanwhile, the world’s biggest asset manager, Blackrock, in their 2023 Global Outlook, warns of a “recession unlike any other and a new era of volatility.”

Inflation fears to recession fears

While inflation may have peaked, it is still elevated, raising the risk that the Fed will overtighten. Economists and investors are now more concerned about recession rather than inflation. The narrative has shifted from seeing “bad data is good” to “bad data is bad.” This is why the US stock market dropped considerably in the past two weeks. Oil and other commodities have also been weak. They are declining because the global economy may buckle under the Fed’s aggressive tightening.

Oil drop benefits Philippines

Declining prices of crude oil signal that a global recession may be forthcoming, which may affect Philippine exports. But on the other hand, given that our country is a net oil importer, lower oil prices also benefit the Philippines and Filipino consumers. It boosts purchasing power, lowers inflation, and reduces transportation costs. In addition, it lessens power and utility prices and helps improve the country’s trade account and current account balances. It also removes downside pressure on the peso. The oil price weakness may partly explain the recent strength of the peso, which has improved from 59 against the US dollar back in October to 55.35 last Friday.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending