Dollar drop continues

Last week, the US dollar continued its historic drop from a two-decade high that was touched on Sept. 28. The dollar has now fallen 8.9 percent from its high. The US dollar index (DXY) was down 1.5 percent for the week and 6.8 percent for the month. Major currencies such as the Japanese yen, the British pound, and the euro posted weekly returns of 3.6 percent, 1.7 percent, and 1.5 percent, respectively. The monthly returns of these currencies were 10.1 percent, 7.9 percent, and 8.2 percent. The Philippine peso sustained its strength and pierced through its resistance of 56.45. It closed at a four-month high of 55.70 last Friday. This is the peso’s highest level since Aug. 12.

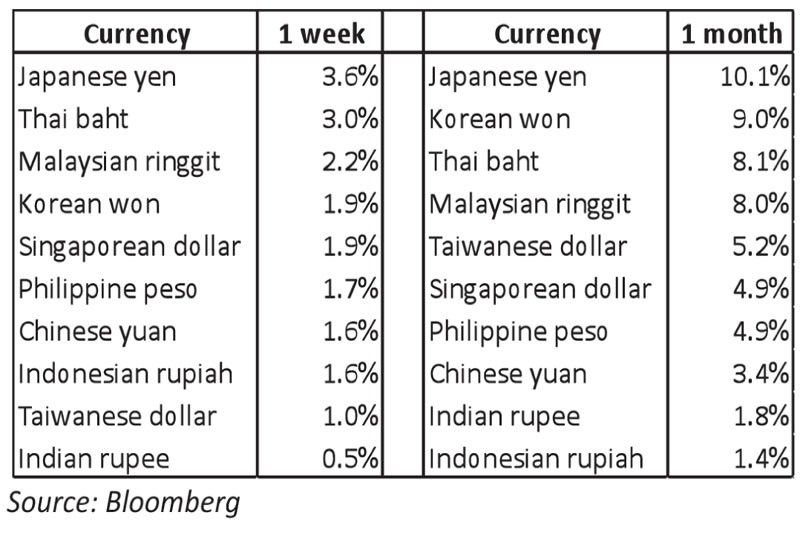

Rally in Asian currencies

The correction of the US dollar sparked a rally in Asian currencies. As we show in the table below, the move of the peso was in consonance with the strong weekly and monthly performance of Asian currencies. The Asian currency rally was led by the Japanese yen, the Thai baht, the Korean won, and the Malaysian ringgit.

Powell speech fuels dollar decline

The sustained decline of the US dollar was fueled by comments that Federal Reserve (Fed) Chair Jerome Powell made in his speech last week. The Fed chief mainly stuck to a script that was similar to what he said last month. Nonetheless, his concluding statements highlighted the need to temper rate hikes starting this month. Powell explained that monetary officials have to assess the lagged impact of their earlier policy actions and the cumulative effect of their monetary tightening. Below, we summarize key quotes from Powell’s recent speech.

1. “Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt.”

2. “Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down.”

3. “The time for moderating the pace of rate increases may come as soon as the December meeting.”

Powell emphasized that inflation is still far from the Fed’s target, the terminal rate will likely be higher than previously expected, and policy will remain restrictive for longer to bring inflation down. Despite these, Powell’s actual words that signaled potentially slower rate hikes lifted financial markets. After Powell’s speech last Wednesday, the Dow rose 737 points, the S&P 500 gained 3.1 percent, and the Nasdaq advanced 4.4 percent. More importantly, the US dollar fell 2.2 percent over the next three days following Powell’s less hawkish statements.

BSP: 25 or 50?

In an interview with Bloomberg last week, BSP Governor Felipe Medalla expressed relief that the Fed would scale back rate increases and abstain from jumbo hikes. The BSP chief expects the Fed to hike by 50 basis points in its upcoming meeting, followed by a series of 25-basis-point hikes moving forward. Considering this, Medalla stated that the BSP would likely respond with a 25 or 50-basis-point rate increase in its December policy meeting. Medalla said, “Certainly we will not do zero and I cannot speak for the rest of the board. But I think the board members will probably be split between whether doing 25 or 50.” The central bank governor said that the BSP may pause from its tightening by the first half of next year and possibly cut rates in the second half.

China further eases COVID policy

The Chinese yuan was up 1.6 percent last week and 3.4 percent last month. These gains were partly attributed to the government’s relaxation of its COVID-zero policy. Last week, China started allowing some COVID patients to isolate at home. The shift came amid a string of protests against government-imposed COVID restrictions and rising COVID cases in the country. The easing of China’s COVID policy and the reopening of the country have ensued at a gradual pace. These bode well for the economic prospects of Asia and the whole world.

Slower rate hikes usher dollar peak

Last Friday’s US jobs report showed that nonfarm payrolls and hourly wage gains were both stronger-than-expected. These would have translated to a stronger dollar and raised expectations for faster rate hikes. However, the US dollar sustained its fall and the DXY broke its key support of 105, closing at 104.51 last week. What was more significant for financial markets was Powell’s signal that Fed rates hikes would decelerate soon. This would be a marked slowdown compared to the Fed’s recent aggressive tightening of 300 basis points (consecutive 75-basis-point rate hikes in the past four meetings). Barring any unforeseen risks such as the escalation of the Russia-Ukraine war, the resurgence of inflation, or other geopolitical tensions, we believe that the recent price action reinforces the view that a peak in the US dollar has been reached (see Peak dollar?, Oct. 31, 2022).

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email ask@philequity.net.

- Latest

- Trending