Mighty dollar stumbles

Last month, we noted that the US dollar marked a “significant turning point” after the Fed communicated thru Nick Timiraos of Wall Street Journal that it would be stepping down its rate hikes (see Peak Dollar?, Oct. 31, 2022). A couple of weeks later, US headline and core CPI came in softer than expected. As a result, bond yields sharply fell and equities markets rallied strongly. The US dollar stumbled to a three-month low as investors rushed to exit their long-USD speculative positions.

Peak inflation = peak financial tightness

Some economists and strategists think that US inflation is now past its peak. They believe that the Fed’s work is finally progressing and that peak financial tightness may be behind us.

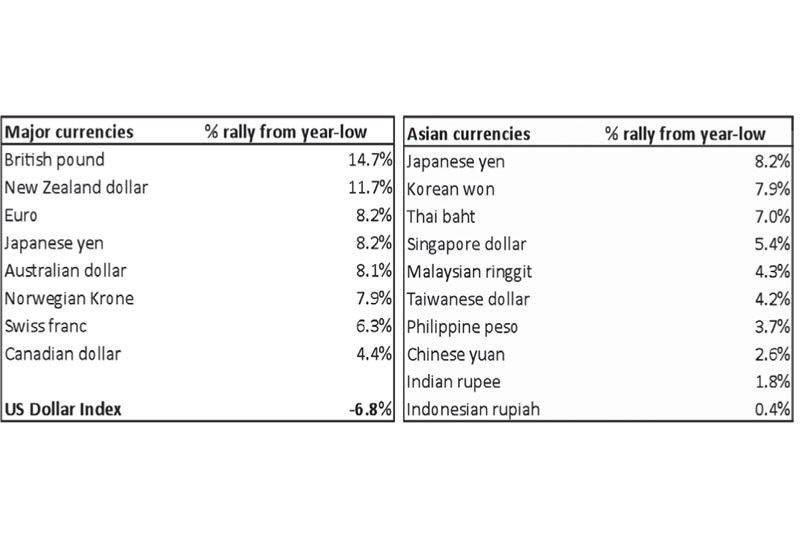

The US dollar index (DXY) has plunged 6.8 percent from its recent peak. Among major currencies, the British pound, New Zealand dollar, and the euro are the top performers, soaring by 14.7 percent, 11.7 percent, and 8.2 percent, respectively, from their year-lows.

The Japanese yen and the Australian dollar also had substantial gains of 8.2 percent and 8.1 percent. On the other hand, the Korean won and Thai baht strengthened the most in Asia after the yen, appreciating 7.9 percent and seven percent, respectively, from their year-lows. The Philippine peso appreciated by 3.7 percent from its low.

Source: Bloomberg, Wealth Securities Research

Matching the Fed

Early this year, the Fed implemented an unprecedented pace of tightening to control inflation, which has risen to 40-year highs. This has caused interest rate differentials between the US and its major trading partners to widen. The aggressive tightening of the Fed has caused the greenback to appreciate to its strongest level in 20 years.

In recent months, however, policymakers at the European Central Bank (ECB), the Reserve Bank of Australia (RBA), the Reserve Bank of New Zealand (RBNZ), and the Bank of Canada (BoC) have stepped up their monetary tightening, matching the moves of the Fed. The ECB ended its negative interest rates, raising the Euro Area’s benchmark deposit rate from -0.5 percent in July to two percent in October.

Canada delivered a 350-basis-point rise as of October, while Australia and New Zealand have hiked 275 basis points this year.

Similarly, the Bangko Sentral ng Pilipinas (BSP) matched the Fed’s recent move, raising its overnight reverse repurchase rate by 75 basis points to five percent last week.

Technicals point to consolidation

From a low of 89.2 in January 2021, the DXY surged by nearly 30 percent to a two-decade high of 114.78 in September 2022. It then traded between 110 and 114 for the next six weeks. It closed below 110 last Nov. 10 when the CPI numbers were released, breaking below the upward trend line that has supported prices since February. DXY closed at 106.97 last Friday.

Based on technical analysis, the major support now lies at the May 2022 high of 105. This former resistance and current support level also coincide with the 200-day moving average and the 38.5 percent Fibonacci retracement of the entire move from January 2021 to September 2022. Technicals now point to a consolidation in the DXY between 105 and 110.

Source: Tradingview.com, Wealth Securities Research

Dollar reversal or correction?

The US dollar is still by far the mightiest currency in the world because the US has the biggest economy and the strongest military. Moreover, US financial markets are considered the world’s deepest and most liquid markets.

The US dollar is the world’s reserve currency and is a safe haven in times of uncertainty, financial market stress, heightened global inflation, and deep worldwide recession (see Dollar smile, Sept. 12, 2022). But the recent stumble led investors to question if this is the start of a reversal in dollar strength or is it just a correction because the dollar rose too fast, too much, and too soon?

Ultimately, there are several factors that will determine the direction of the US dollar. These include the trajectory of inflation and interest rates, the fiscal, monetary, and macroeconomic policies of the US and other countries, interest rate differentials, geopolitics, and specifically, the war in Ukraine.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected]

- Latest

- Trending