Defending the peso

The Philippines is stepping up its defense of the peso, according to Finance Secretary Benjamin Diokno. He said the government is ready to dip further into its reserve buffers to prevent the peso from further weakening against the US dollar. In an interview with Bloomberg last Friday, Diokno said: “We are willing to spend some more just to defend it (peso),” he said. He believes the peso at 55 is where it should be.

Acting decisively

For months, the BSP has been fighting to bring down inflation. However, the weakening peso has made the fight harder.

In a speech during the Chamber of Thrift Banks event several days ago, BSP Governor Medalla said: “The BSP does not normally react too much to movements in the exchange rate in keeping with our market-determined exchange rate policy… But the peso depreciation, while remaining in line with regional peers, has been adding to the build-up of inflationary pressures. This strengthened the case to act – and to act decisively.”

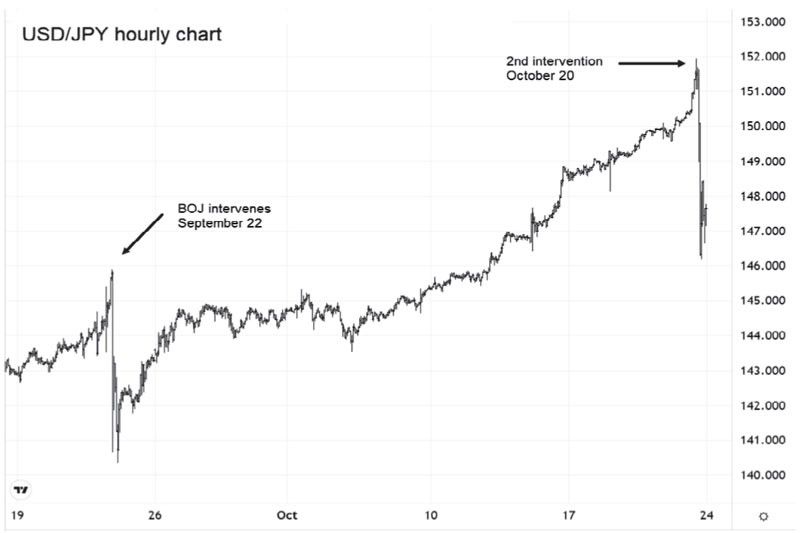

BOJ steps up intervention

The Japanese government and the Bank of Japan (BOJ) reportedly intervened to support the falling yen last Friday after it hit a fresh 32-year low of 151.95. As a result, the Japanese currency surged as much as 2.7 percent from its intraday low to close at 147.35. Last Sept. 22, the BOJ also stepped in to support the weak yen – buying yen and selling dollars. Before these instances, the last time the BOJ intervened to support the weak yen was during the 1997-98 Asian Financial Crisis.

BSP’s other tools

The BSP uses several tools in its arsenal to stabilize the wild swings in the peso. Aside from intervening directly by participating in the forex market, the BSP can raise policy rates and reduce liquidity by issuing BSP bills. The new BSP Charter now allows the BSP to borrow from the public, a more permanent form of “sterilization” than when the central bank borrows from banks. Recently, the BSP sold P120 billion worth of 28-day BSP bills, which were oversubscribed.

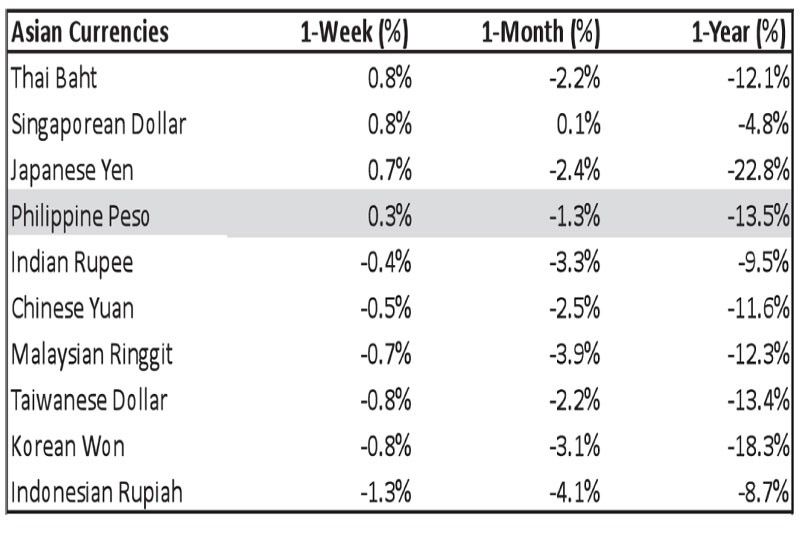

The Philippine peso has been relatively stable (vs. regional currencies) over the past several weeks.

Liquidity management measures

During a Senate meeting last Wednesday, BSP Assistant Governor Iluminada Sicat said the central bank stands ready to use liquidity management measures to curb the peso’s volatility. These are the exporters’ rediscount facility and enhanced currency rate risk protection programs. She added that the BSP has access to international financial agreements to provide insurance and has pre-deployed non-monetary measures.

Plaza Accord Part 2

During the 1980s, high US interest rates caused the US dollar to strengthen 100 percent against major currencies, with no signs of respite. The overly strong US dollar and large US trade deficits prodded the major central banks to map out a strategy during a meeting in New York, which resulted in the 1985 Plaza Accord. The accord was a joint agreement between the US, UK, Germany, France, and Japan to coordinately intervene in the forex markets by selling dollars to weaken the greenback.

In Asia, it is not only Japan and the Philippines that have recently stepped into the forex markets. China, India, South Korea, Thailand, Malaysia, and Taiwan have also reportedly intervened. But so far, interventions have been done independently. Similar to the Plaza Accord, a globally coordinated intervention (which includes the US) may again be needed to ease the pressures of a strong dollar. This may happen when inflation abates and the Fed stops raising rates. The US may also intervene once signs that the overly strong dollar may already be affecting the US economy and the profitability and competitiveness of US corporates.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending