Peso lowest since 2005

The first half of this year is the worst first half for the Philippine peso since 2008. With the BSP maintaining its dovish posture in contrast to an aggressively hawkish Fed, the peso plunged 7.8 percent in the first six months of this year. For the month of June alone, the peso weakened by 4.9 percent. The decline continued last Friday as the peso dropped to as much as 55.31 intraday before closing at 55.09, its lowest point against the US dollar since November 2005.

Dovish BSP guidance

The Fed raised interest rates by 75 basis-points last month, its most aggressive monetary tightening since the 1980s. It signaled another 75 and 50 basis-point hikes in the subsequent two meetings. On the other hand, the BSP had signaled a more gradual approach, hiking policy rates by 25 basis-points each in May and June. Moreover, the BSP gave dovish forward guidance of 25 basis-point hikes in August and succeeding monetary board meetings.

Many analysts believe that the BSP is lagging the Fed in raising rates. This is weighing on the peso as the hawkish Fed pushes ahead with more significant and frequent hikes. The one-year US Treasury bill yield of 2.88 percent is now greater than the one-year Philippine Treasury bill of 2.57 percent. The yield differential favors holding US Treasuries, boosting the demand for US dollars, and consequently weakening the peso.

BSP reacts to peso weakness

The swiftness of the decline in the peso caused incoming BSP Governor Felipe Medalla to react. “If we see the exchange rate is overshooting too much and that selling forex will not make the problem go away, we would consider maybe increasing policy rates more than our planned 25 basis point hike,”Medalla said in a briefing last Wednesday.

Broad dollar strength

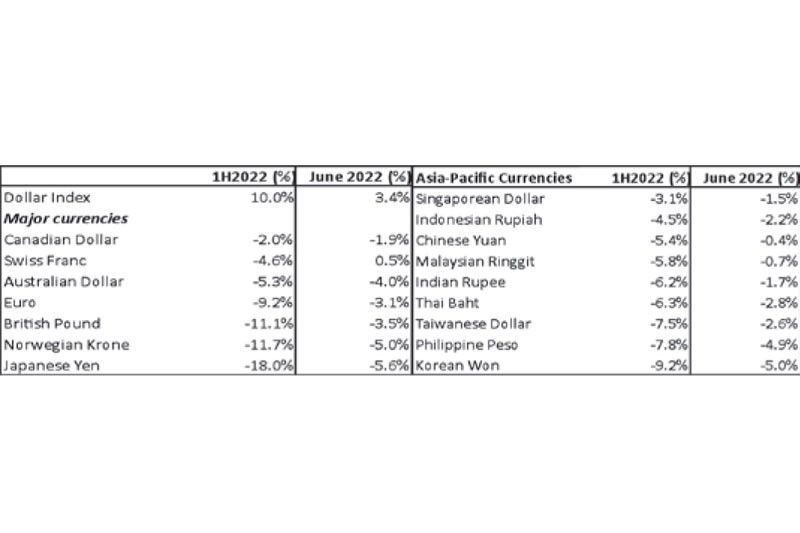

The strength of the US dollar weighed on almost all currencies, including the peso. The US dollar index (DXY) is up 10 percent in the first half of this year. Among major currencies, the Japanese yen is the worst performer, plummeting 18 percent against the greenback over a similar period. The Norwegian Krone and the British pound followed with losses of 11.7 and 11.1 percent, respectively.

In Asia, the yen is also the worst performer, followed by the Korean won, and the Philippine peso, which declined 9.2 and 7.8 percent in the first half of this year.

The table below shows that for the month of June alone, the yen, krone, won, and the peso lost 5.6, five, five, and 4.9 percent, respectively.

Massive breakout in DXY

The US dollar index closed the month of June this year at 104.739, the highest monthly close since November 2002. This move is a massive breakout for the DXY if it can stay above the previous resistance of 103.82. The next resistance for the DXY is 110.

Peso technical resistance is 56.50

The monthly chart below shows the peso breaking out of an 18-year basing pattern. Above 55, the next technical resistance is 56.50, the lowest recorded in history. 56.50 was reached in 2004 when the government announced it was in a fiscal crisis, which led to the passing of the Expanded Value Added Tax (EVAT) Act of 2005. This law marked the turn in the Philippine economy, the start of the bull run in the Philippine stock market, and a sustained appreciation of the peso.

While the technical picture shows further dollar strength, the fundamentals underpinning the dollar may change. If the Fed successfully tames inflation and achieves a soft-landing or a shallow recession, we may have a less hawkish Fed, and interest rates in the US may start declining. Consequently, we may see the dollar coming down and the peso stabilizing. As it is, the 10 year yield on US treasuries, which reached 3.5 percent in mid-June, sharply fell to 2.88 percent last Friday.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net

- Latest

- Trending