Weak yen drags down peso

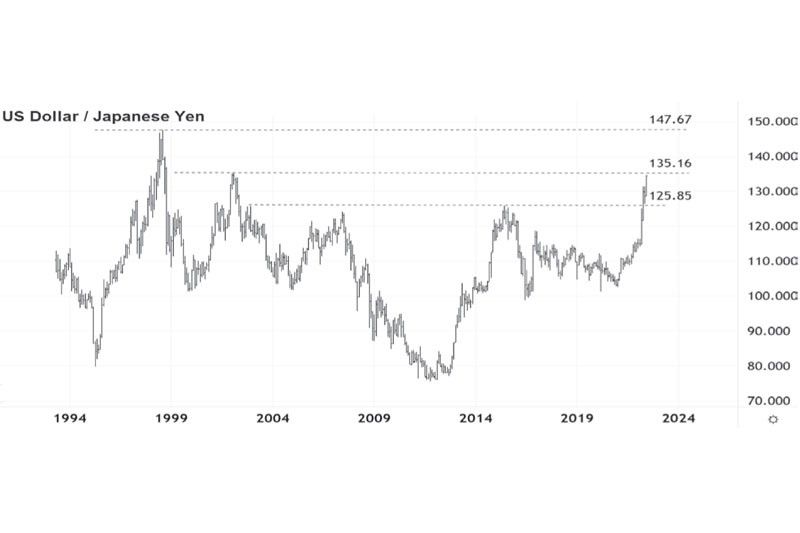

The Japanese yen plummeted to a fresh 20-year low of 134.56 against the US dollar after the Bank of Japan (BOJ) renewed its pledge to keep monetary policy loose. Money fleeing Japan has been flowing into the higher-yielding US dollar as the yen accelerated its decline. This dragged other Asian currencies including the peso lower. While the Japanese 10-year bond yield is capped at 0.25 percent, the US 10-year bond now yields 3.16 percent. Meanwhile, the 10-year German bund yield has risen to 1.50 percent, the highest since 2014.

Pace of yen decline concerning

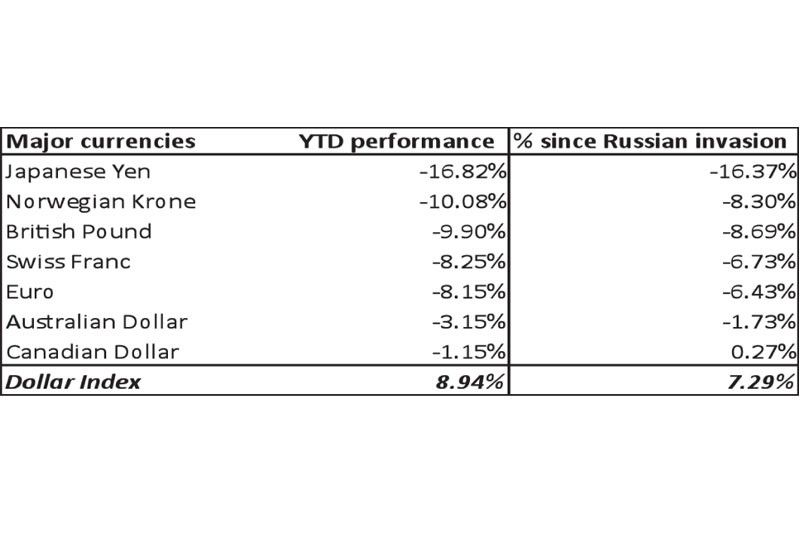

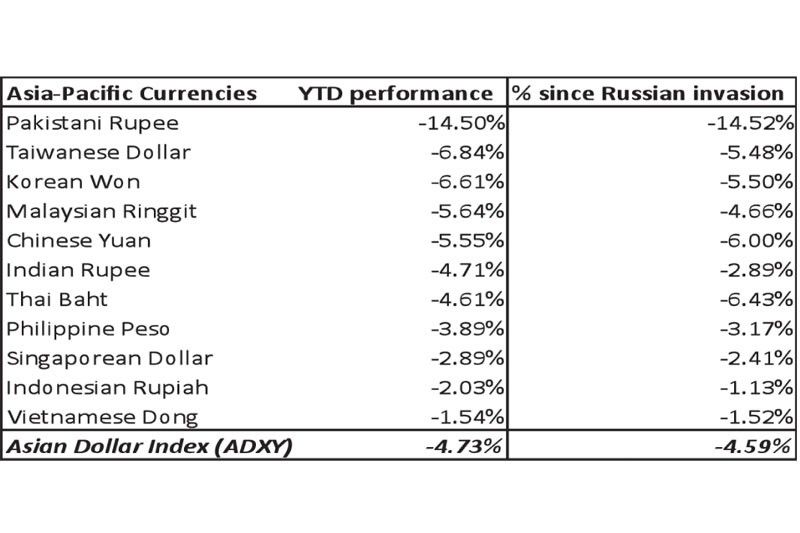

The Japanese yen has been the worst performing major currency this year, losing 16.82 percent year-to-date and 16.37 percent since the Russian invasion of Ukraine. Long considered a refuge in times of crisis, its status as a safe-haven currency has been called into question following rising energy and food prices due to the Ukrainian war and the widening global interest rate differentials.

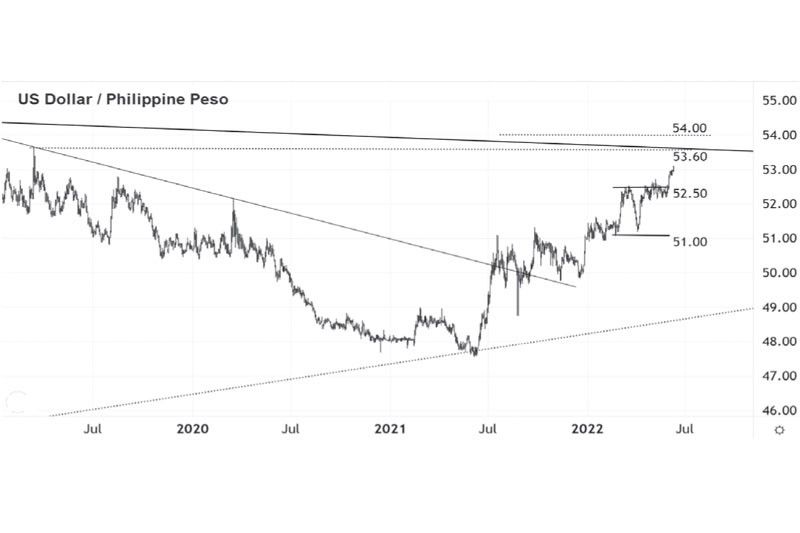

What is concerning about the yen’s decline is the level it reached and the pace at which it hit this level. The past two weeks alone, the yen dropped by 5.7 percent. The peso fell by 1.5 percent over the same period.

US inflation hits 40-year high

Last Friday’s US CPI figures came in hotter than expected after headline inflation made a 40-year high of 8.6 percent, driven mainly by energy and food. The highly elevated CPI has boosted the chances of more aggressive Fed rate hikes. At the same time, the European Central Bank confirmed its plans to raise rates by 25 basis points in July, while leaving the door open for a more aggressive hike in September. This move is a significant shift from the ECB’s long-held policy of keeping interest rates below zero. The BOJ is the only major central bank that has not joined the tightening bandwagon.

Warning for Asia?

Last week, economist Jim O’Neil warned of a crisis in Asia if the yen depreciates beyond 150 against the dollar. “If the yen keeps weakening, China will see this as an unfair competitive advantage, so the parallels to the Asian financial crisis is perfectly obvious,” said O’Neill who was a former chief strategist at Goldman Sachs and chairman of Goldman Sachs Asset Management.

The chart below shows that USDJPY broke the 2015 high of 125.85 last April. It is currently testing the 2002 high of 135.16. If USD/JPY breaks above 135.16, it will bring the exchange rate to a level not seen since the Asian financial crisis.

Peso drops to 53

Following the yen’s weakness, the peso closed at its resistance level of 53 last week. If the peso continues to decline, the next resistance is seen at 53.60, followed by 54.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email ask@philequity.net.

- Latest

- Trending