Bear sighting

Investors saw a brief glimpse of the bear after the benchmark S&P 500 index hit an intraday low of 3,810.32 last May 20. The index avoided the bear market close when it ended at 3,901.55. A bear market is defined when the index falls by at least 20 percent from its former high. In this case, 3,837.25 would be the line on the sand. In contrast to the S&P 500, the tech-heavy Nasdaq Composite and the broader Russell 2000 index have long been in bear markets. Nasdaq experienced its third largest drawdown in 20 years. While not quite like 2001 or 2008, the Nasdaq was down as much as 30 percent since hitting its peak last November.

Devastation in tech, growth stocks

The market has not seen devastation like this in a long time. During the Dot Com Bust of 2000 to 2022, 1990s darling stock Cisco plummeted by 90 percent. During the Global Financial Crisis of 2008 to 2009, Apple and GE, must-hold blue chip stocks, lost 62 percent and 87 percent, respectively. Today, the premiere growth fund ARK Innovation ETF has plunged 78 percent. E-commerce giant Shopify and consumer internet company SEA Limited were down 80 percent. Even the mega-cap FAANG stocks have crashed, with Netflix declining 75 percent and Facebook losing 54 percent.

Macro headwinds

Inflation trends have accelerated since early 2022, with the war in Ukraine exacerbating the supply chain complexities and commodity price squeeze. Likewise, China’s COVID lockdowns have choked the global supply chain and slowed the global economy. With inflation hovering at 40-year highs, the Fed’s new mandate is to control inflation and tighten liquidity conditions. The market is currently pricing in a 90 percent chance of two 50 bps hikes in the next two FOMC meetings. And while end-2022 Fed rate estimates range from 2.5 percent to 2.75 percent, the minutes from the May FOMC show that the Fed is prepared to go beyond that. Beyond hiking rates, the Fed is also shrinking its balance sheet starting in June, further removing liquidity in the system. As a result, investors now fear that the aggressive Fed could put the US economy back into recession (two quarters of negative GDP growth). Note that first quarter 2022 GDP growth already fell 1.5 percent.

Bear markets with recessions

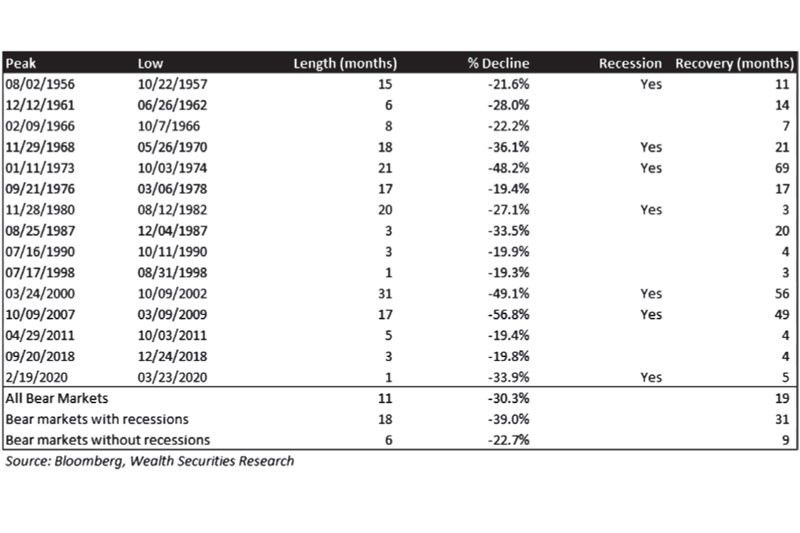

Bear markets often go hand in hand with a slowing economy. If accompanied by an economic recession, the decline will be deeper and longer. There has been 15 bear – or near bear – markets in the S&P 500 since 1956. Out of these, eight had recessions. The table below shows that bear markets coinciding with recessions had a mean loss of 39 percent and took 18 months on average to form the eventual low. Given the deep declines, it also spent an average of 31 months to recover to new highs.

Bear markets without recessions

On the other hand, seven of the 15 bear markets since 1956 did not have recessions. In these instances, the bear market had a mean loss of 22.7 percent and took six months on average to bottom out. The recovery to new highs from these bear markets was faster, averaging only nine months.

US markets staged a powerful rally

US stock markets staged a powerful rally last week, snapping their seven-week losing streak. The Nasdaq is up 10 percent off May 20’s lows, the S&P 500 and Russell +nine percent, and the Dow +eight percent. All indices except for the Nasdaq are now up for the month. Of course, the markets are by no means completely out of trouble. But there are encouraging signs that the May 20 low was at least an intermediate low.

Bottom or bear market rally?

There is some evidence that inflation could be peaking. New home sales are falling, used car prices are decreasing, and wages are stabilizing. The May FOMC minutes reveal that the Fed expects total PCE inflation to hit 4.3 percent this year, and slow to 2.5 percent in 2023 and 2.1 percent in 2024. The minutes also mentioned that the supply-demand imbalances in the economy were reduced over the first part of 2022 by “slowing aggregate demand and an anticipated easing of supply constraints.” This may well explain why Atlanta Fed president Raphael Bostic hinted last week that the Fed could pause in September.

If indeed we have seen peak inflation, odds are this current correction is a cyclical non-recessionary bear market and that the market may already be bottoming out near current levels. However, if high inflation persists and the US economy eventually falls into recession, the market may go substantially lower and prolong the duration of the bear.

Birth of a new bull?

The past five or six months have been challenging. Many investors were whipsawed and lost money. At this point, many feel discouraged with their investments. Macroeconomic numbers are bad, and the news is disparaging. The market still faces a lot of headwinds. But this is precisely the wrong time to throw in the towel. Instead, one needs to stay engaged and be diligent and patient in looking for signs of a bottoming market. Recent price actions are similar to the move of the markets in 1990 and 2018 when the S&P 500 moved from bear to bull. Perhaps, we have seen the bottom when we sighted the bear last May 20 as the S&P 500 hit an intraday low of 3,810.32. This may be the start of a bottoming out process that gives birth to a new bull market.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending