New EO on national ID to ramp up financial inclusion

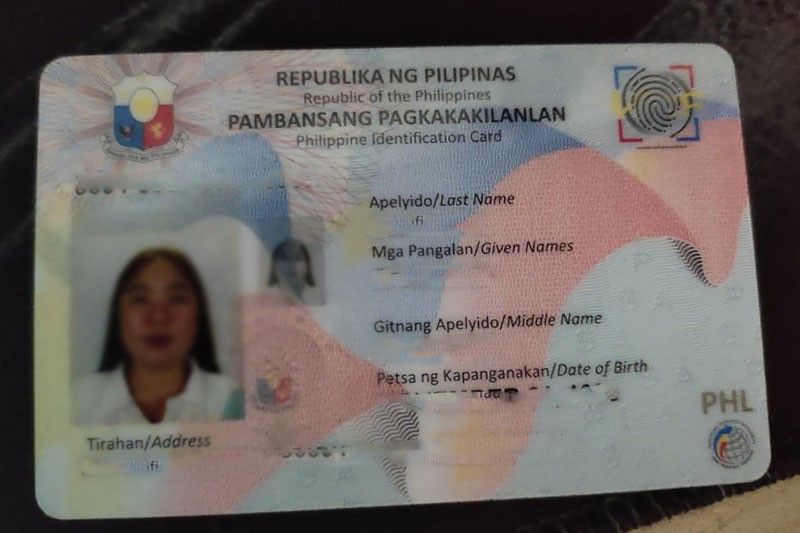

MANILA, Philippines — The executive order issued by Malacañang institutionalizing the acceptance of the national ID or the Philippine Identification System (PhilSys) number as sufficient proof in all government and private transactions would help boost financial inclusion efforts, according to the Bangko Sentral ng Pilipinas.

BSP Governor Benjamin Diokno said Executive Order 162, signed by President Duterte institutionalizing the acceptance of the national ID, would encourage Filipinos to open bank accounts.

“EO 162 is supportive of the Duterte administration’s thrust to eliminate red tape in government transactions,” he said.

The order will help include Filipinos, especially the marginalized and those from low-income households with no government-issued IDs, into the formal financial system and reduce their vulnerability to onerous lending and other practices.

According to the EO, no additional proof of identity or age shall be required upon presentation of the PhilID, PhilSys Number (PSN) or PSN derivative, as authenticated.

Furthermore, the same may be presented in lieu of a birth certificate for transactions that require individuals to establish their age, including applications for marriage licenses, as well as Land Transportation Office student permits and conductor’s licenses; enrollment for kindergarten, first grade, and Philippine Educational Placement Test passers; and Professional Regulation Commission and Bar Licensure Examinations.

The BSP issued Memorandum M-2021-057 in October 2021, reminding BSP-supervised financial institutions (BSFIs) to accept the PhilID, in both physical and mobile formats, as sufficient proof of identity.

The regulator also directed banks in the same memo to include the PhilID in their list of valid IDs displayed on their counters and at the public entrance of their establishments, as well as official websites, social media handles, and other consumer information channels.

The issuance of the memo, pursuant to Republic Act 11055 or the PhilSys Act, supports the wide scale opening of transaction accounts, particularly the basic deposit account (BDAs) that is designed to meet the needs of the unbanked and promote greater financial inclusion.

A total of 3.6 million new BDAs were opened from the fourth quarter of 2019 to the third quarter of 2021, while active electronic-money accounts increased by 16.8 million between yearend 2019 and 2020.

Furthermore, a total of 7.38 million PhilSys registrants have opened transaction accounts for free through registration sites under the co-location agreement between the Philippine Statistics Authority (PSA) and state-run Land Bank of the Philippines.

The PSA is set to launch a mobile version of the PhilID soon as a digital alternative to the physical PhilSys card and the PSA Quick Response Code Verification System, which will promote broader and seamless acceptance of the PhilID by financial institutions for various services.

Under its Digital Payments Transformation Roadmap, the BSP aims to raise the number of Filipino adults with bank accounts to 70 percent and to shift 50 percent of retail transactions to electronic channels.

With the pandemic serving as catalyst, the number of Filipino adults with banks accounts increased to about 53 percent last year from 29 percent in 2019, while the share of digital payments to retail transactions grew to 30 percent from only one percent in 2013.

- Latest

- Trending