Santa came to town

Equity markets remained volatile due to concerns regarding the spread of the Omicron variant and the Fed’s hawkish statements. US stocks suffered a sharp drop and was in correction mode for most of December.

Just when hopes for a Christmas rally started to dwindle, Santa Claus came to town and lifted stocks. The US market advanced for three straight days as the S&P 500 closed at a new record high last week.

Three days down, three days up

US stocks fell due to the surge in coronavirus cases brought by the Omicron variant. The Dow dropped 995 points, while the S&P 500 fell three percent over three trading days (Dec. 16, 17, and 20). However, price action turned for the better towards the Christmas weekend. The Dow gained 1,018 points in three days and the S&P 500 advanced 3.5 percent from Dec. 21 to 23. As a result, the S&P 500 ended the week at a new closing high of 4,726.

On the other hand, Philippine stocks remained in consolidation mode. The PSEi closed at 7,182 last week. From being negative year-to-date as of Dec. 22, the PSEi has already turned positive for 2021.

Strong returns in December and January

December and January are seasonally strong months for the Philippine stock market. Equities post better returns during these months due to the jovial mood of the holidays, combined with optimism for the new year. In our book Opportunity of a Lifetime, we discussed seasonality in the stock market, specifically the Santa Claus rally and the January effect (see Chapter 10 – Investor Education, pages 192 to 199).

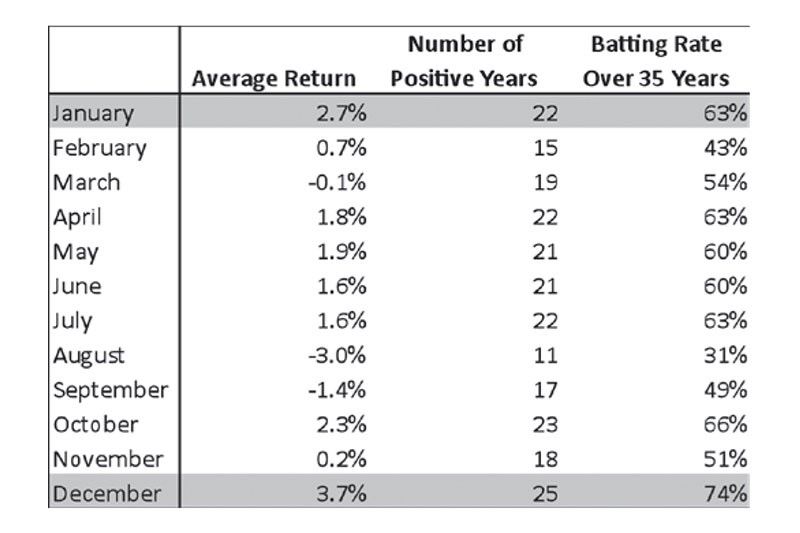

Average monthly returns of PSEi – 1987 to 2021

Source: Wealth Securities Research

Based on the table above, December is by far the strongest month of the year with an average return of 3.7 percent, and a batting rate (or probability of delivering a positive return) of 74 percent Meanwhile, January is the second strongest month, with an average return of 2.7 percent and a batting rate of 63 percent Considering these, we can see the impact of the Santa Claus rally and the January effect on the PSEi’s returns over 35 years from 1987 to 2021. However, in December 2021, the PSEi is down 0.3 percent month-to-date.

Typhoon Odette wreaks havoc

Aside from concerns on the spread of the Omicron variant, the devastation of Typhoon Odette across several regions in Visayas and Mindanao contributed to the tepid performance of the PSEi this month. The government has declared a state of calamity in six regions, including Western Visayas, Central Visayas, Eastern Visayas, Mimaropa, Northern Mindanao, and the Caraga Administrative Region. These regions include key economic and tourism centers such as Cebu, Iloilo, Bacolod, Palawan, Bohol, and Siargao. Moreover, these regions are home to business process outsourcing (BPO) companies that were reported to be severely affected. Due to the heavy damage caused by Typhoon Odette, many citizens in the affected regions still have limited access to power, internet, telecommunications, and utilities. Many people are in dire need of basic commodities, such as food, potable water, and fuel.

Closing a challenging year, hoping for a better 2022

Led by the US market, developed markets posted impressive returns this year, notwithstanding the ongoing pandemic. On the other hand, 2021 was a challenging year for Philippine stocks. The PSEi reached its 52-week low of 6,081 in May and was down 14.8 percent year-to-date at that point. While the US and developed markets performed strongly, the PSEi has rebounded from its 2021 low and is now practically flat. We, thus, hope that Santa’s arrival and the market’s strong historical returns during the months of December and January will usher in a better 2022. We believe the resilience of Filipinos will enable us to overcome the challenges posed by the pandemic and recently by Typhoon Odette.

We wish everyone a better and joyful 2022!

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending