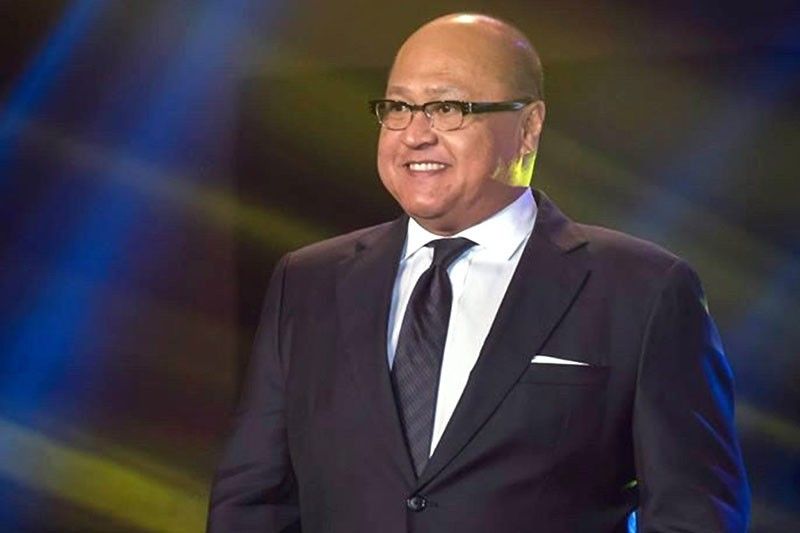

Executive profile: PNB’S Wick Veloso

The alpha male mellows

MANILA, Philippines — Jose Arnulfo “Wick” Veloso, president and chief executive officer of Philippine National Bank, has mellowed from his alpha male days as one of the top treasury traders in the 1990s to 2000s.

At 55, Wick is beginning to enjoy his “apostolic duties” even as he continues to guide PNB through the pandemic.

Wick’s nickname was inadvertently bestowed on him by his mother when he was just starting to learn how to walk. She would prod him … “quick, quick, quick,” and eventually stuck as his nickname Wick.

He enjoyed a bucolic childhood in the mid 1960s in the “boondocks of Marikina,” which was then full of talahib or tall bush grass. His father Manuel and mother Gilda were “hands on” parents to him and his younger sister in his early childhood. However, when his father retired and opted to go back to his farm in the province, Wick stayed in Marikina with his grandmother Lola Mads, as he had already started schooling in 1972 at the Franciscan-based Marist School.

Those were happy times, Wick fondly remembers, as his Lola Mads, unlike his hands-on parents, allowed him more freedom to explore his surroundings, interact and mingle with people, go on adventures, and generally learn street smarts.

Wick learned to take on responsibilities at an early age as he had to help take care of two smaller male cousins whose father was working in the province.

Lola Mads allowed the boys to play in the talahib fields and the still being developed subdivisions, with drainage culverts as their playground for typical games of hide and seek, “barilan” or mock gunfights, “patintero, tumbang preso” well into the night, but with a 9 p.m. curfew.

Those days of mock gunfights, imaginary warfare with his cousins and playmates led to Wick’s fascination with the military. He dreamt of becoming a pilot or a soldier. He was fascinated by all things military, reading military books and collecting military uniforms.

It was because of this fascination that he developed a “mission-based approach…always going to war,” which he adopted in his aggressive treasury trading days.

With the goal of joining the military, Wick was eager to finish his high school studies early so that he could enroll at the Philippine Military Academy (PMA).

Wick managed to finish high school by 16. However, the acceptance age for the PMA was 17, so Wick decided to enroll for the time being in 1982 at the De La Salle University, opting to take up marketing.

Having grown up in the relatively rural environs of Marikina at that time, Wick soon began to enjoy city life in Manila. His friends in DLSU were also able to dissuade him from pursuing his dream of a possibly dangerous and rigidly structured military career.

A professor in marketing, as well and a neighborhood salesman friend, were also instrumental in encouraging Wick’s pursuit of a marketing degree. A crucial lesson on marketing he learned from his salesman friend was that “if you want your sale to go straight to the trash, do a hard sell.”

He graduated with a bachelor of science degree in commerce, major in marketing management, from DLSU in 1986.

Wick admits that he has a knack for bonding well with people much older than him, a trait that would prove invaluable in his banking career.

He narrates,“All of my neighborhood friends were older than me…I even had a friend who was double my age and was very close to me…and my good friends were significantly older than me. It probably allowed me to be more familiar with people who are older…I know what makes them smile…what interest them…”

As he embarked on his banking career, Wick realized that his ability to connect with older people would be a big factor in gaining mentors and clients.

Mentors

After graduating from DLSU in September 1986, Wick’s first job was as a management trainee with Urban Bank. Wick explains that as he had gotten married while still an undergraduate, his needed to find a job as soon as he could and thus accepted the bank’s offer.

By November 1986, Wick was working for Urban Bank which was founded and led by Arsenio “Archit” Bartolome III, who would also become president of PNB from 1994 to 1997.

Archit was, thus, Wick’s first mentor in his banking career. Wick credits Urban Bank for their “good end-to-end banking training” that allowed him to “learn a lot” and gain experience across the board in branch operations, treasury, and credit.

He even had a stint as head of the outdoor advertising for the bank and recounts his success in securing cheap outdoor billboard advertising space utilizing vacant government property along Quezon Boulevard.

Wick thought that he would probably have a career in credit but by chance, an opening arose in the treasury department. He points out that a career in the treasury was not even part of his plans as all he knew about banking was deposit taking and lending, and nothing about treasury.

His first job in Urban Banks’s treasury department, then headed by Elmer Villegas, involved brokering bonds, but the bank also had a budget to do cross-selling of various bank products, although cross-selling at that time was not yet the trend.

Urban Bank was perhaps ahead of the trend, Wick notes, as they were already offering corporate loans, housing loans, credit cards, deposits, and a whole slew of other banking products aside from treasury brokering of government securities. In his first week with the treasury department, Wick was already able to meet his month’s target and “from there on I enjoyed doing it. “

Wick’s early beginnings with Urban Bank already showed his drive and determination to succeed. He recalls that “my shoes would literally get worn out” from the amount of walking that he did as he individually visited potential clients in Salcedo and Legaspi Village area.

He also used to take the old Love Bus to visit clients in Binondo, and again painstakingly did the rounds, visiting potential Chinese banks, financing, insurance and investment firms.

The major Chinese banks, he recalls, did not deal with him, but he patiently and persistently continued to visit them until one day, seeing his persistence, they gave him a supply of short-term Treasury bills.

At that time, Wicks explains, the longest tenor for T-bills was only one-year or 364-days, so they would sell their one-year bill when it is 30 to 60-days so they could book a capital or trading gain, and reinstate it again by buying back the one-year bill.

Wick had, thus, stumbled on a “gold mine” as it turned out that foreign banks, which had the high-networth clients, were keenly looking for the 30 to 60 day trades. The foreign banks, Wick said, were probably wondering how Urban Bank could find the supply of the one-year bills in a seemingly arid desert.

He even recalls when he and his then unit head, Alberto Emilio “Joey” Roxas (who eventually became president of China Savings Bank), would drive back from Binondo, crossing the Jones Bridge with a stack of bearer T-bill certificates rustling in the wind at the back seat of their aircon-less vehicle. He remembers asking Joey “what would happen if they flew out of the car and into the river?” And Joey’s response was, “then you jump out of the car.”

His diligence in visiting and getting to know his Chinese financial clients eventually caught the eye of Dionisio Ong of AsiaTrust, who eventually offered Wick in May 1988 a much higher salary at a time when he was already married and starting a young family.

From a junior manager or a supervisor in Urban Bank, Wick was promoted to manager of AsiaTrust’s treasury department. Ong was a task master and demanded a strong working ethic from his staff, Wick points out.

Since Wick was keen on proving his worth to earn money for the banks he adopted his mission oriented approach to achieve his goal. His continued success with his short-term government securities continued to puzzle his foreign bank counterparts and they thus worked on pirating Wick, with Citibank’s Bobby Reyes doing the scouting work.

After a short one year with AsiaTrust, Wick accepted Citibank, and he was scouted by Bobby Reyes and introduced to Citibank’s then treasury head Vic Valdepenas. Wick joined and stayed with Citibank from 1989 to 1993 as fixed income portfolio manager.

It was with Citibank that Wick honed his treasury and trading skills and really started his ascent as the alpha male in the Philippine treasury market.

It was that period in his career that he had to work long hours and study hard learning about all financial and economic trends not only locally, but globally, as Citibank conducted 24-hour trading.

Those long hours, however, Wick now admits, was a source of sadness in that he missed so many key family events. He recalls that due to his long hours of work he would even miss his own birthday party as he had to prioritize work first.

Vic Valdepenas, Wick admits is one of his mentors who helped him hone his skills, and who to this day he still keeps in touch with.

Wick was still on his upward path and former Citibanker Rafael “Paeng” Buenaventura (who would eventually become Bangko Sentral ng Pilipinas governor) returned to the Philippines to head the then Gokongwei-led PCI Bank, luring Wick away from Citibank in 1993 to become head of domestic treasury and in a concurrent capacity as treasurer of PCI Capital from 1993 to 1994.

It is was Buenaventura who introduced Wick to the perks of being a top banker… the private elevator, his own office and secretary, and a messenger and driver to boot.

Buenaventura, however, Wick admits, felt betrayed when once again, another foreign bank…this time the British banking giant Hong Kong Shanghai Bank or HSBC quickly offered Wick the post of head of interest trading at the HSBC treasury department in 1994, moving in 2000 to head its Asian local currency trading and concurrently as head of credit derivatives for Asia Pacific until 2003, and rising further to treasurer and head of global market from 2003 to 2010.

By 2010, Wick was a still red-hot property for HSBC, which promoted him to managing director of HSBC Global Market based in Hong Kong and then as head of global banking market by 2012. By the time he was ready to return to Manila, he was offered to be the first Filipino president and CEO of HSBC Philippines, which he held from 2012 to 2018.

HSBC, by that time had lost its global luster following a series of money laundering scandals that first came out in 2012 and record settlements eventually forced global banking to implement cost-cutting measure in the Philippines. It was time to part ways with HSBC.

A top government regulator, however, saw the opportunity to recommend Wick to taipan Lucio Tan, who was then looking for a new head for Philippine National Bank, a post Wick decided to accept in 2018 and heads up to this day through the pandemic crisis.

Making time for family

Looking back at his career, Wick believes that one of the most important thing in pursuing a career is achieving a work-life balance.

He admits, with some tinge of sadness, that his long days at work caused him his first marriage and to miss out on the crucial growing up days of his children. (He has four — three of whom are now all married and professionals, with only one son still studying but likewise absorbed on living his own life.)

Wick is now spending more time with his current wife, catching up with his grown-up kids, and thoroughly enjoying his weekends doing his “apostolic duties” even as he continues to lead PNB through the rough waters of the COVID-19 pandemic that has rocked the global economy.

- Latest

- Trending