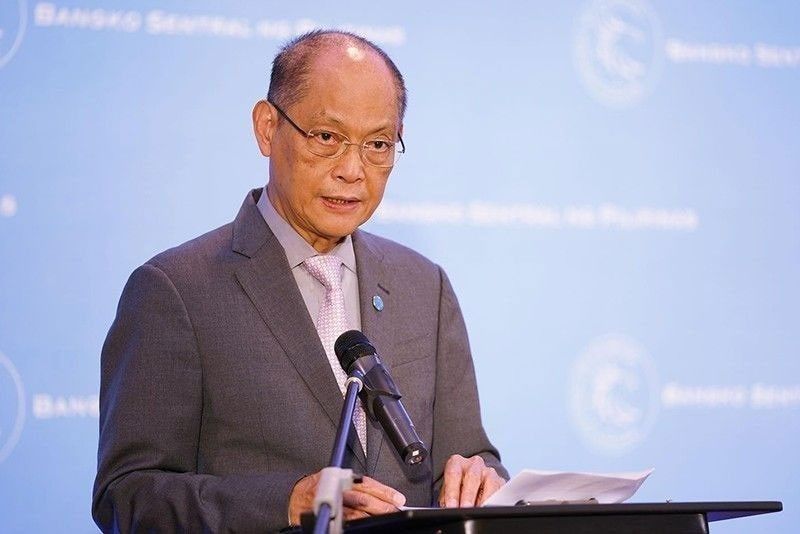

Satellite use to boost financial inclusion, digitalization, says Diokno

MANILA, Philippines — The use of satellite technology for internet connectivity in remote areas will boost the financial inclusion and digitalization efforts of the Bangko Sentral ng Pilipinas, BSP Governor Benjamin Diokno said.

He said the issuance of the implementing rules and regulations on the expanded access to satellite services by the Department of Information and Communications Technology (DICT) is expected to accelerate the rollout of internet connectivity for the unserved, underserved and geographically isolated and disadvantaged areas of the country.

“With enhanced countryside connectivity, we see previously unserved and underserved areas being reached by digital financial services, especially those designed for the lower income segments, like remittances, bills payments and the opening of transaction accounts,” Diokno said.

The DICT issued last month Department Circular 002, providing the guidelines on the expanded access to satellite services to promote the development of an inclusive and vibrant satellite industry by liberalizing access to satellite systems.

With the guidelines, banks, financial technology (fintech) companies, and other financial sector entities can tap into satellite technology for their operations, particularly toward expanding presence in underserved communities.

Internet connectivity is recognized as a critical enabler of financial and economic inclusion as financial transactions and services shift to online platforms.

With expanded internet service, banks and other financial service providers are able to better serve rural areas with more access points such as automated teller machines and cash agent services that rely on internet connectivity.

The regulator has encouraged financial services providers to seek opportunities from this policy reform for innovation and market expansion toward accelerating financial inclusion in the country.

“These developments will contribute towards the BSP’s financial inclusion targets, namely that first, 70 percent of the adult population should own a transaction account, and second, that half of all retail payments should be in digital form by 2023,” Diokno said.

Under its Digital Payments Transformation Roadmap, the BSP has committed to raise the number of Filipino adults with bank accounts to 70 percent and shift 50 percent of total retail transactions to digital channels by 2023.

- Latest

- Trending